Home » dairy exports

Articles Tagged with ''dairy exports''

Powder play

USDEC’s forecast is that long-term global dairy growth remains strong

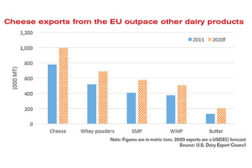

There is export potential for U.S. dairy processors, but the competition is tougher, according to the U.S. Dairy Export Council.

January 20, 2016

At home and abroad

U.S. dairy consumption helps to offset export declines in second quarter

Exports of butter to the Middle East are off; Japan, Saudi Arabia, Panama and Mexico cut back on their imports of U.S. cheeses.

August 25, 2015

Stay ahead of the curve. Unlock a dose of cutting-edge insights.

Receive our premium content directly to your inbox.

SIGN-UP TODAYCopyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing