Butter blends and creamers have areas of strength

Refrigerated butter blends and dairy creamers enjoy success

Photo courtesy of Michelle Lee Photography via www.gettyimages.com

Although inflation has begun its descent, according to U.S. Bureau of Labor Statistics data, the story remains the same for several dairy categories: dollar sales are up and unit sales are down in a majority of categories.

Overall butter blends, creams/creamers, and coffee creamers can be painted with this brush, as well as subcategories including refrigerated butter, refrigerated coffee creamers, and refrigerated half and half.

Overall butter blend dollar sales increased 25% year over year (YoY) for the 52-week period ending May 21 to $4.42 billion, but unit sales dropped slightly more than 1 percent to 921 million, reveals data compiled by Circana, a Chicago-based market research firm.

The overall creams/creamers category saw dollar sales rise 16% to nearly $6 billion, only to see unit sales drop by more than 1% to 1.4 billion. Coffee creamer data is a bit more pronounced, as dollar sales rose 19% YoY to $898 million, while unit sales dipped by 8% to 194 million.

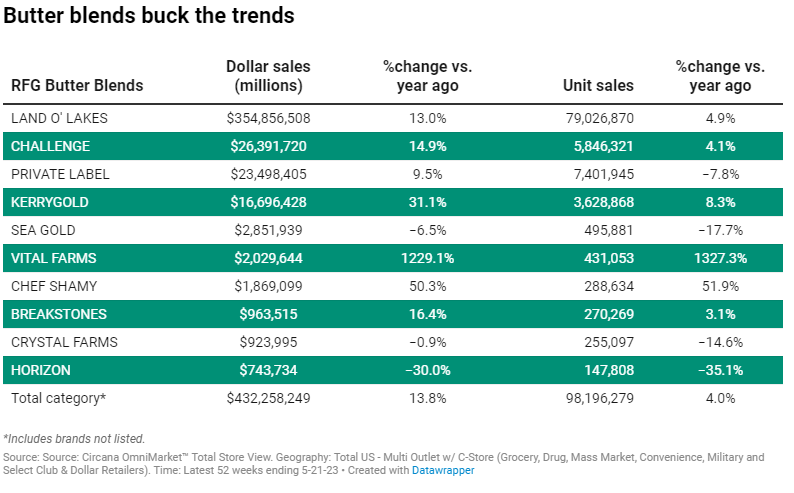

Despite this common theme, some subcategories are bucking these trends. One big winner for the year ending May 21 was refrigerated butter blends, whose dollar sales jumped 14% to $432 million, while unit sales experienced a strong 4% gain to 98 million, according to Circana data.

Leading the way in terms of sales in the refrigerated butter blends category during the recent 52-week period was Arden Hills, Minn.-based Land O’Lakes, which enjoyed a 13% gain YoY to $355 million, as well as a unit sales gain of 5% to 79 million.

Among the Top 10 sellers in this category with strong years per Circana data were: Dublin, Calif.’s, U.S. farmer-owned Challenge Butter (dollar sales up 15% to $26 million; unit sales up 4% to 5.8 million); Evanston, Ill.-based Kerrygold (dollar sales up 31% to $16.7 million; unit sales up 8% to 3.6 million); Salt Lake City-based Chef Shamy (dollar sales up 50% to $1.87 million; unit sales increasing 52% to 288,634); and Walton, N.Y.-based Breakstone’s, a division of Lactalis Heritage Group, (dollar sales up 16% to $963,515; unit sales up 3% to 270,269).

Another company to highlight in refrigerated butter blends is Vital Farms. The Austin, Texas-based company saw dollar sales in this subcategory rise a humungous 1,229% YoY to slightly more than $2 million, while its unit sales increased by an even higher 1,327% to 431,053.

Another subcategory under the creams/creamers category experiencing a standout year was refrigerated dairy cream. Dollar sales in this subcategory rose 17% to $203 million to go along with a unit sales jump of 3% to 48 million, Circana data reports. Private-label refrigerated dairy creams were tops in terms of sales reaching $79 million for the 52 weeks ending May 21, good enough for an advancement of 17%, while unit sales increased 3% to nearly 20 million.

On an individual company basis, Lynnfield, Mass.-based Hood topped the category with $37 million in sales, equal to a 14% YoY gain, but unit sales dipped by 2% to slightly more than 8 million.

Among the Top 10 in refrigerated category sales, six companies enjoyed both dollar sales and unit sales success for the year ending May 21. This list includes Monrovia, Calif.-based Cacique (dollar sales up 23% to $29 million; unit sales up 8% to 7.5 million); Newark, N.J.’s Farmland (dollar sales up 21% to $15.3 million; unit sales higher by 7% to 2.9 million); El Paso, Texas-based Tuscan Dairy Farms (dollar sales jumped 44% to $2.4 million; unit sales up 28% to 765,584); Houston-based La Vaquita (dollar sales rose 21% to $3.7 million; unit sales up 4% to 1.35 million); and Hicksville, N.Y.-based Quesos (dollar sales up 27% to $2.5 million; unit sales rose 6% to 379,947), Circana reports.

The sixth standout in this category — Hatfield, Pa.-based Rosenbergers — saw triple-digit YoY gains in terms of both dollar and unit sales. Dollar sales rocketed higher by 149% for the yearlong period ending May 21 to $3.6 million, while unit sales jumped 110% YoY to 763,330, Circana data reveals.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!