A slowdown in growth for retail cheese

Sales of natural cheese flattened, while processed cheese lost ground.

When we last covered the retail cheese segment in a Market Trends report — back in April of this year — the picture was very Gouda across the board. Dollar sales for the natural cheese category had jumped 20.8% to $16,417.6 million during the 52 weeks ending Jan. 24, 2021, according to data from Chicago-based market research firm IRI. And unit sales had risen 12.8% to 4,588.8 million.

Dollar sales for the processed cheese category, meanwhile, had climbed 17.8% to $3,329.4 million. Unit sales had increased 10.8% to 798.7 million.

Those huge COVID-19 pandemic-related increases we saw at retail could not be sustained for long, of course. As more consumers returned to their workplaces and schools, some of the sales shifted back to the foodservice side. It should come as no surprise, therefore, that IRI data show a dramatic sales growth slowdown within the cheese segment during the 52 weeks ending Oct. 3, 2021.

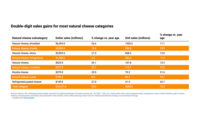

Natural cheese sales flatten

Dollar sales within the natural cheese category at retail rose slightly — 1.5% — to reach $15,968.9 million. But unit sales fell 1.0% to 4,422.8 million.

There were a few bright spots within the category. Natural crumbled cheese, for example, saw impressive gains, with dollar sales jumping 10.1% and unit sales increasing 7.0%.

Three top 10 crumbled cheese brands realized double-digit dollar and unit sales growth in that subcategory. Dollar and sales for the Athenos brand rose 16.7% and 14.4%, respectively. The La Morenita brand, meanwhile, saw 14.6% and 12.8% increases. And the Président brand’s dollar and unit sales shot up 13.5% and 10.3%.

On the flip side, the Treasure Cave brand lost the most ground among the top 10 brands. Its dollar sales decreased 16.4%, while its unit sales declined 19.3%.

The refrigerated grated cheese subcategory also significantly outperformed the total natural cheese category. Its dollar sales climbed 9.0% to $154.9 million, while its unit sales rose 5.8% to 42.2 million.

Here, two top 10 brands posted noteworthy gains. The Sartori brand saw dollar and unit sales gains of 29.7% and 31.6%, respectively. And the La Chona brand realized 20.7% and 20.5% increases.

Only one top 10 brand — Boar’s Head — saw dollar and unit sales declines. The brand’s dollar and unit sales fell 0.7% and 2.9%.

The natural cheese cube subcategory greatly outperformed the total category, too. Dollar sales rose 7.3% to $170.5 million. Unit sales jumped 13.1% to 51.1 million.

But the results were more mixed within this subcategory. Although three top 10 brands (private label, “other” Kraft and all MDS Foods brands) posted double-digit dollar and unit sales gains, three other top 10 brands (Kraft, Sargento and Wisconsin Cheese Company) posted dollar and unit sales losses.

Processed cheese sales fall

Processed cheese had a tougher time of it. The category’s dollar sales fell 1.4% to $3,187.0 million. Unit sales tumbled 3.8% to 754.2 million.

The cheese spreads/balls and processed/imitation shredded cheese subcategories, however, bucked the downward trend. Dollar sales were up 4.6% in the cheese spreads/balls segment, while unit sales climbed 3.3%. And the processed/imitation shredded cheese segment saw dollar and unit sales gains of 9.2% and 2.6%, respectively.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!