State of the Industry: Nondairy beverages had divided success

RTD coffee categories continue to speed down the freeway, but juice and tea have to avoid some areas of congestion.

Nondairy beverages mainly cruised down the sales highway this year. Ready-to-drink (RTD) coffee showed no signs of slowing down, with retail sales of RTD cold brew and cappuccinos/iced coffees staying in the passing lane. Juice and RTD tea, meanwhile, used health and immunity claims to merge successfully — though some categories struggled to avoid hazards on the road.

RTD coffee has the right-of-way

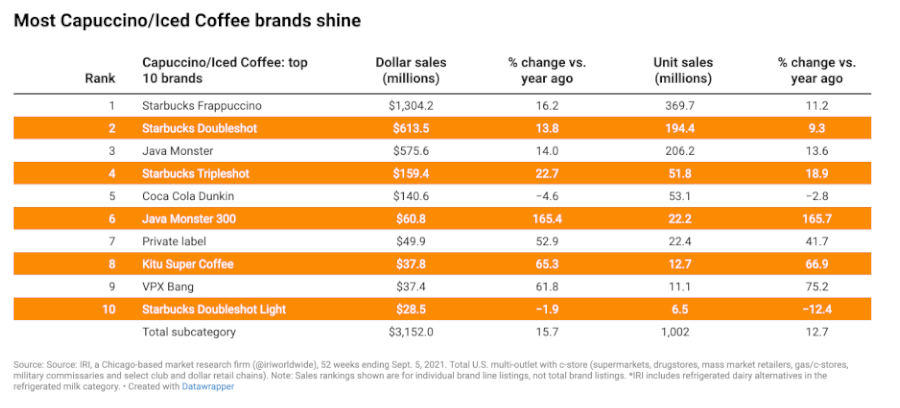

A staple of mornings, coffee is “brewing up” new drinking occasions because of the availability of exciting new flavors and convenient RTD formulations. In fact, sales of refrigerated RTD coffee increased a whopping 42.3% to $789.6 million during the 52-week period ending Sept. 5, 2021, according to data from Chicago-based market research firm IRI. Unit sales grew 37.9% to 178.8 million. The larger shelf-stable cappuccino/iced coffee subcategory also experienced substantial growth. It was up 15.7% in dollar sales (to $3,152.0 million) and 12.7% in unit sales (to 1,002.1 million).

“Ready-to-drink is the hottest coffee segment — driven by double-digit growth in 2020,” says Gary Hemphill, managing director of research for New York-based Beverage Marketing Corp (BMC). “Once primarily a category dominated by single-serve packaging, ready-to-drink coffee in chilled take-home format packaging has burst onto the scene and is driving much of the growth.”

RTD cold-brew (shelf-stable) coffee also is performing exceptionally well. According to IRI data, the subcategory’s retail sales jumped 20.3% to $324.1 million; unit sales catapulted 15.5% to $102.9 million.

And cold-brew coffee sales are forecast to reach nearly $1 billion by 2025, growing at a compound annual growth rate of 24% from the base year of 2015, reports Hamburg, Germany-based Statista. In terms of demographics, millennials looking for a healthier alternative to carbonated soft drinks — as well as older adults who appreciate the energy benefits — are typical consumers, the research firm notes.

Hybrid beverage trends are also “mixing things up” for the coffee category. Hemphill has seen more energy coffee drinks entering the market and notes that innovations such as cold brew and nitro are helping to boost coffee sales.

For its part, Riff, a Bend, Ore.-based premium coffee company, unveiled a “Let’s Riff” RTD line that fulfills the need for caffeinated cold-brew coffees that contain just two ingredients: high-quality coffee and Cascade mountain water. The varietals include Off The Cuff: an organic Peruvian cold brew with notes of dark chocolate and toffee; Arm In Arm: an Ethiopian cold brew with notes of red berry and stone fruit (also available in a concentrate); and Southpaw, which contains half the caffeine and features natural-tasting notes of cocoa nibs and nougat. The offerings come in 10.5-ounce glass bottles.

Although more consumers are working remotely, they still desire a “coffee shop experience at home,” as the pandemic dramatically drove at-home consumption, notes Sally Lyons Wyatt, executive vice president and practice leader with IRI.

“Ready-to-drink formats have exploded in popularity. Coffee concentrates, cappuccino/iced coffee, cold brew and refrigerated RTD coffee dollar and unit sales are all up double digits versus a year ago,” Wyatt says. “Cold brew and nitro cold brew are very small segments but are growing fast. Forms such as cold brew, iced coffee, nitro, etc., have given consumers the ability to have a specialized drink without the hassle and mess of making a cup at home.”

Thanks to heightened interest in functional ingredients, innovative styles and plant-based ingredients, new product development also is fueling the RTD coffee market.

Austin, Texas-based Super Coffee released an 80-calorie Blueberry Latte that is naturally sweetened with monk fruit and packed with 10 grams of the brand’s unique blend of pea protein and 200 milligrams of caffeine. The dairy-free enhanced coffee blends sweet and creamy blueberry with MCT oil for sustained energy and focus.

For its part, Philadelphia-based La Colombe Coffee Roasters released its first-ever nondairy pumpkin beverage: Pumpkin Spice “oatmilk” draft latte. The company also is jumping on the nitro cold-brew train with La Colombe Extra Bold nitro cold brew, its first single-origin nitro coffee that contains sun-dried coffee from Brazil. The coffee is dark-roasted, brewed extra bold and infused with nitrogen for a subtle texture that complements its bold taste.

And a plant-based functional beverage brand, Rebbl, Emeryville, Calif., launched Rebbl Stacked coffee: a plant-powered cold brew with additional health benefits. Available in four flavors ― Cafe Mocha, Vanilla Latte, Hazelnut Latte and Straight Black — Stacked coffee is certified organic, fair-trade, non-GMO, dairy-free, soy-free, gluten-free and vegan and is made without cane sugar or artificial flavors.

With added functionality and flavors, the coffee market is expected to remain stable and to see steady growth resulting in a 5-7% dollar growth over the next few years, Wyatt says. To keep coffee manufacturers and consumers thirsting for their daily cup of joe, she suggests finding ways to bring the coffee shop experience home.

“This might mean partnering with an additive brand or offering a line of creamers and additives to create the perfect cup at home,” Wyatt explains. “They should continue to innovate with new flavors and café-style coffees to entice people to consume more at home, keeping it as the affordable alternative to a café. In addition, manufacturers should maintain core items with new and thoughtful innovation.”

Tea on a divided highway

Tea encountered more construction on the sales highway. According to IRI data, while retail dollar sales of RTD shelf-stable canned and bottled tea were up 4.2% to $4,204.5 million, unit sales fell 2.6% to 1,931.8 million. It was a slightly sunnier picture for refrigerated tea, which had a 4.8% jump in dollar sales (to $1,840.1 million) and a 2.8% rise in unit sales (to 723.1 million). Refrigerated kombucha, on the other hand, struggled the most. The subcategory’s dollar sales fell 22.6% to $32.8 million; unit sales decreased 24.3% to 10.2 million.

Although black tea remains the No. 1 tea varietal, with about 85% of U.S. imports in 2019, green tea is surging in popularity because of its “good for the body and mind” health halo. Green teas are the least oxidized when processed, contain less caffeine and have the most flavonoids — plant-based antioxidants — which could improve fat burning andbrain function and help prevent type 2 diabetes and cardiovascular disease, experts note in the June 2021 issue of Beverage Industry.

Roger Dilworth, senior analyst at BMC, suggests that matcha could continue to grow, but likely will not evolve beyond a niche segment.

“There could be a mild upturn in tea due to yerba mate,” he notes.

Indigenous to South America, yerba mate is derived from the naturally caffeinated leaves of the holly tree, Ilex paraguariensis. Looking to capitalize on the use of its USDA certified organic yerba mate and Fair Trade Certified ingredients sourced from Brazil, Honest Tea — a brand of The Coca-Cola Co., Atlanta — launched Honest Yerba Mate in three flavors: Strawberry Pomegranate Matcha, Peach Mango Green Tea and Lemon Ginger Black Tea.

Each 15.5-ounce slim can contains real brewed yerba mate, which provides the same amount of caffeine as an 8-ounce cup of coffee, 13 grams of sugar, 1% juice and 60 calories. Honest Yerba Mate is available at select grocery retailers nationwide, including Publix, Fresh Direct, Hannaford, Dave’s and Whole Foods Market.

There’s no shortage of new product development in the flavorful functional tea market. Lipton, through the Pepsi Lipton Partnership with PepsiCo and Unilever, introduced caffeine-free, RTD Lipton herbal teas in Strawberry & Mint and Orange Blossom flavors. The 16.9-ounce bottles are packaged in 12-packs and are available at major retailers, including Walmart, Target, Publix, Food Lion, Giant Eagle and Meijer, for a suggested retail price of $5.99.

In the June 2021 issue of Beverage Industry, Kritika Mamtani, senior research analyst for chemical, materials and food at Global Market Insights, Selbyville, Del., suggests that tea manufacturers focus on developing innovative tea products to attract new and existing consumers in the market.

“The demand for tea is driven by major factors such as convenience, variety, easy availability, health benefits, and introduction of unique flavored and high-end specialty tea,” she explains. “Tea manufacturers should consider the above-mentioned factors to maintain sales and attract customers in the market over the forecast period.”

Juice avoids some potholes

Commonly viewed as breakfast beverages, juice and juice drinks saw their status change once the COVID-19 pandemic hit, as consumers sought healthful immune-supporting products, leading to a resurgence.

“Juice has been going through an identity crisis of sorts, which has put the category in a tough spot,” Madelyn Franz, cross-category research analyst for Chicago-based Mintel, explains in Beverage Industry’s January 2021 issue. “Products tend to toe the line between healthy and indulgent without committing to either position, leaving consumers confused and disengaged. While it’s been relegated to very specific consumption occasions as a result, The COVID-19 outbreak has granted brands a chance to break free from the category’s downward trajectory.

“Thanks to the pandemic and subsequent recession, consumers’ needs have actually aligned with the benefits that juice has been offering all along: comfortable, cost-effective, vitamins,” she continues. “More than that, it’s created a brief window of opportunity for the category to reset, retarget and recover in the longer term.”

Hemphill agrees that the pandemic and more people staying at home have positively impacted the category’s performance.

“After several consecutive years of soft market performance, juices and juices drinks are experiencing modest volume growth in 2020,” he says in the January 2021 Beverage Industry issue. “Fruit beverages are one of the few categories that have actually experienced improved performance due to the pandemic. More people staying at home have improved the category’s performance.”

According to data from IRI, the refrigerated juice/drinks category accounted for $7,500.0 million in sales for the 52 weeks ending Sept. 5, 2021. This represents a 5.2% increase from the prior year. Unit sales were up 4.4% to 2,492.4 million.

The largest refrigerated juice subcategory struggled, however. Dollar sales in the refrigerated orange juice segment fell 0.1%; unit sales dropped 0.8%.

The shelf-stable bottled juice category also fared well. According to IRI data, bottled juice’s dollar sales increased 4.7% to $7,794.2 million. Unit sales rose 0.2% to 3,227.4 million. The cranberry cocktail/juice drink segment was among the top performers, registering a 10.0% increase in dollar sales for a total of $1,248.0 million; unit sales jumped 7.5% to 444.0 million.

Meanwhile, the aseptic juices category was up 12.0% in dollar sales (to $1,577.6 million) and 8.2% in unit sales (to 545.6 million). Aseptic juice drinks was the strongest segment, posting a 12.2% increase in dollar sales and an 8.8% rise in unit sales.

Shelf-stable canned juices, however, took a tumble. Dollar sales within the category fell 4.2% to $1,308.3 million, while unit sales decreased 7.8% to $693.6 million.

In the juice and smoothies segment, Naked Juice, a brand of PepsiCo, added Rainbow Machine, a blend of seven fruits and veggies, to its line of juice smoothies. Rainbow Machine is a nutrient-rich juice featuring red beets, apples, mangoes, bananas, kiwis, blueberries, and blackberries, the company says.

According to Mintel’s “June 2020 Juice and Juice Drinks” report, the importance of a healthy immune system is top of mind for most consumers, renewing interest in a familiar functional ingredient: vitamin C.

“Consumers’ standing investment in wellness will make immunity claims a priority in the longer term. However, brands will need to address the pre-pandemic concerns that plagued the juice category (e.g., high sugar content, limited functional benefits) to maintain growth once hype surrounding the virus subsides,” the report states.

To compete with the growing list of niche better-for-you beverages such as still and sparkling waters and nutritional drinks, juice brands will need to deliver on consumers’ definition of “healthy,” including the addition of premium added-value claims.

Wtrmln Wtr, a brand of Alexandria, Va.-based Caribe Juice Inc., released new functional blends made with watermelon juice — a source of natural hydration — and new functional ingredients such as superfruit acerola juice, sea salt, turmeric, cayenne, hibiscus, ginger juice, and tart cherry. Available in four varieties ― Hydration, Recover, Immunity, and Antioxidant ― the functional watermelon blends contain 320 milligrams of electrolytes, 300% of the recommended daily amount of vitamin C, and six times more potassium than traditional sports drinks, the company says.

Although the juice and juice drinks categories are reinventing much of their offerings, experts still remain cautious about their performance in the long term.

“We believe once the impact of the pandemic has subsided, sales are likely to be softer and the category may see declines once again,” Hemphill says in the January 2021 issue of Beverage Industry.

Note: This article was condensed and edited from separate 2021 articles appearing in Beverage Industry, a sister publication of Dairy Foods. The authors are Sarah Graybill, Barbara Harfman, and Jessica Jacobsen.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!