Cold treats see a slight cool-off

But all segments within the retail ice cream/sherbet category still posted impressive gains.

.jpg?1626962658)

When we last covered sales within the retail ice cream/sherbet category (in our January 2021 issue), the segment was enjoying double-digit growth in both dollars and units. Eight months later — with stay-at-home dictates over and many consumers no longer indulging in as many comfort foods — retail ice cream/sherbet sales are not soaring quite as high.

That being said, sales are still pretty darn impressive. The total category saw dollar sales jump 6.5% to $7,814.1 million and unit sales rise 4.6% to 1,966.8 million, according to data from Chicago-based market research firm IRI for the 52 weeks ending May 16, 2021.

Ice milk/frozen dairy desserts take off

Within the category, the ice milk/frozen dairy dessert subcategory experienced the strongest growth. Dollar sales surged 16.7% to $287.0 million. Unit sales grew 13.7% to reach 75.8 million.

Three brands among the top 10 realized triple-digit growth. Halo Top saw 530.7% and 568.8% increases in dollar and unit sales, respectively, while Blue Bunny realized 374.6% and 398.1% gains. And Nestlé was close behind Blue Bunny with gains of 326.4% and 323.4%.

On the flip side, two top 10 brands saw double-digit declines. Dollar sales for Dreyer’s/Edy’s fell 28.2%, while unit sales tumbled 30.4%. And Friendly’s realized a 26.2% decrease in dollar sales and a 27.5% drop in unit sales.

Ice cream, sherbet post respectable gains

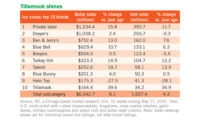

Although double-digit gains were not in the cards for the ice cream and sherbet/sorbet/ices subcategories, the segments did make notable gains. Dollar sales within the largest subcategory, ice cream, rose 6.2% to $6,964.0 million. Unit sales climbed 4.3% to 1,745.0 million.

Two brands within the top 10 stood out during the reporting period, posting double-digit dollar and unit sales gains. Dollar and unit sales for the Tillamook brand shot up 24.9% and 22.5%, respectively. And Ben & Jerry’s saw 22.2% and 22.5% increases.

Only two ice cream brands among the top 10 experienced notable declines. Dollar and unit sales for Turkey Hill were down 6.8% and 15.8%, while those for Blue Bunny were off by 6.1% and 7.8%.

As for the sherbet/sorbet/ices subcategory (the smallest subcategory), its dollar sales rose 4.2% to $208.1 million. Unit sales were up 2.5% to 65.9 million.

Three of the top 10 brands within this segment posted double-digit dollar and unit sales gains: Boardwalk/Baskin-Robbins (up 42.1% and 39.7%), Talenti (up 21.4% and 22.0%), and Prairie Farms (up 15.5% and 12.0%).

Only one top 10 brand within the segment, Häagen-Dazs, posted significant decreases in dollar and unit sales. The brand’s dollar and unit sales fell 7.2% and 7.3%, respectively.

Frozen yogurt/tofu segment shines

Meanwhile, sales within the second-largest subcategory, frozen yogurt/tofu, outperformed the total category. Dollar sales grew 7.0% to $355.0 million. Unit sales climbed 4.8% to 80.1 million.

Racking up triple-digit increases among the top 10 brands were Talenti and nondairy brand Oatly (albeit on smallish bases). Talenti’s dollar and unit sales rose 552.4% and 562.6%, respectively. Oatly’s dollar and unit sales increased 240.2% and 252.9%.

Halo Top lost the most ground among the top 10. The brand’s dollar sales fell 48.3%, and its unit sales took a 50.2% nosedive.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!