Sales Data

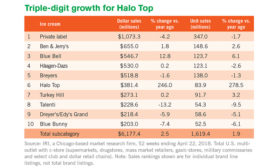

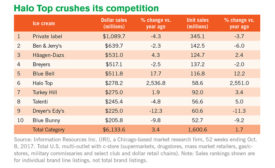

Although some brands made impressive gains, recent sales trends within the ice cream and frozen novelties categories are underwhelming

Read More

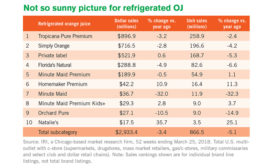

Orange juice sales continue to tumble

But sales of fruit drinks and health-boosting juices are on the rise.

June 4, 2018

Cultured dairy sales see downswing

Sales of refrigerated yogurt, cottage cheese and kefir slide. Meanwhile, cream cheese and sour cream fare better, and shelf-stable yogurt/yogurt drinks take off.

May 8, 2018

Natural cheese sales shred the rest

While processed cheese struggled, dollar and unit sales for cubed, shredded and refrigerated grated natural cheeses rose

April 3, 2018

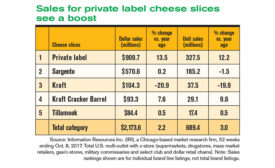

Grated and sliced natural cheeses post steady sales gains

Sales are up and down across the natural cheese category, with certain subcategories standing out from the pack.

December 12, 2017

State of the Industry 2017: Dairy exports have a positive outlook

With a ‘pretty good’ outlook for global demand, the U.S. dairy export sector could earn the title of MOST LIKELY TO TAKE OVER THE WORLD.

November 17, 2017

RTD tea and coffee post healthy dollar and unit sales

Refrigerated tea and refrigerated ready-to-drink coffee post healthy dollar and unit sales gains.

October 9, 2017

Stay ahead of the curve. Unlock a dose of cutting-edge insights.

Receive our premium content directly to your inbox.

SIGN-UP TODAYCopyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing