Sales Data

Refrigerated tea and refrigerated ready-to-drink coffee post healthy dollar and unit sales gains.

Read More

Frozen dessert sales are melting

Sales for frozen cheesecakes, frozen puddings and whipped toppings are down across the board.

September 8, 2017

Ice cream sales see a boost

Ice cream and some frozen novelty sales are climbing, though it’s a different story for sherbet and frozen dairy desserts.

August 4, 2017

Largest dairy processor Nestle tops annual Dairy 100

With Danone acquiring WhiteWave, the new dairy processing company lands at No. 4 on our 24th annual Dairy 100. This detailed dossier includes brands, products made and plant locations for the largest processors of fluid milk, ice cream, cheese, butter, cultured dairy products, dairy ingredients and other dairy-derived foods and beverages.

August 3, 2017

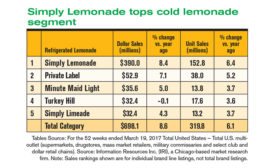

Sales are sweet for refrigerated lemonade, fruit drinks

While some refrigerated juice and drink sales are struggling, sales are up for fruit drinks, lemonade and veggie juice blends.

June 6, 2017

Functional, clean label trends drive growth of vegetable juices, juice smoothies

Consumers are looking for beverages with no added sugar, and functional and clean ingredients. This has presented challenges for some juice manufacturers.

May 11, 2017

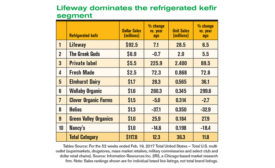

Cultured dairy beverage sales are movin’ on up

Unit sales for refrigerated kefir products and shelf-stable yogurt drinks both see double-digit increases, while other cultured dairy segments are struggling.

May 4, 2017

Sales of natural cheese shreds and slices top rest

Natural cheese is the consumer choice, with shreds, cubes and slices the preferred forms. Meanwhile, processed cheese spreads/balls are one beacon of light for that category.

April 3, 2017

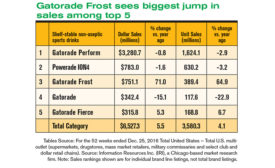

Sales for energy, sports drinks soar

Non-aseptic energy and sports drinks both saw sales increase, but sales of energy shots were not doing well

March 9, 2017

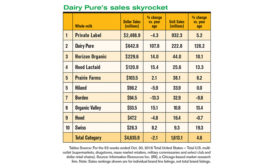

Flavored and whole-milk sales keep milk afloat

Unit sales are on the rise for the flavored milk and whole milk segments yet the overall category is down.

February 7, 2017

Stay ahead of the curve. Unlock a dose of cutting-edge insights.

Receive our premium content directly to your inbox.

SIGN-UP TODAYCopyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing