Inspection technologies key to food safety

By enhancing food safety and preventing product recalls, the use of highly effective systems can protect the reputation of dairy brands.

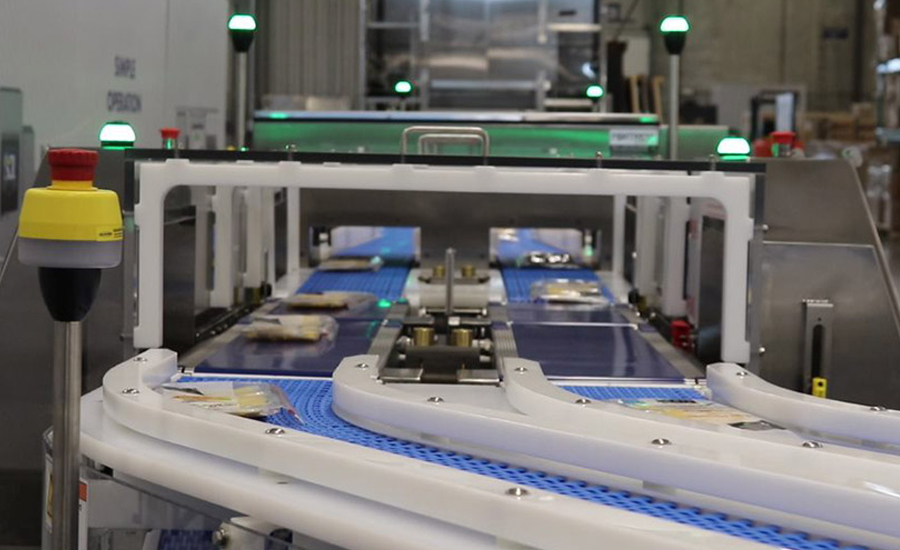

Technology upgrades are resulting in imaging improvements for X-ray devices.

Photo courtesy of Heat and Control Inc.

Highly effective metal detectors and X-ray technologies in dairy processing facilities continues to grow in importance.

By enhancing food safety and preventing product recalls, the use of highly effective systems can protect the reputation of dairy brands while guarding against the subsequent financial repercussions following an incident. Growing awareness of the necessity to accurately identify contaminants along with stringent food regulations is leading to technological improvements and greater demand for equipment, analysts say.

“The need for more accurate and efficient food inspection systems have compelled the manufacturers to develop innovative solutions with better detection capabilities, higher resolution imaging, and advanced software,” states Astute Analytica, a Noida, India-based market research firm. “The advancements are helping to address the challenge of inspecting complex food products with varying densities, shapes and sizes.”

The global food metal detector market will expand from $5.3 billion in 2023 to $8.15 billion by 2033, a 4.4% compound annual growth rate (CAGR) and up from 3.3% between 2018 and 2022, reports Newark, Del.-based Future Market Insights Inc. (FMI). Processors use metal detectors for identifying ferrous, nonferrous, and stainless metals in food products.

The global X-ray food inspection equipment sector is projected to increase from $1.44 billion in 2022 to $2.74 billion by 2031, with a 7.4% CAGR from 2023 to 2031, Astute Analytica predicts. X-ray detectors identify such contaminants as glass, stones, and bones, as well as metal.

“The current market landscape is highly competitive, characterized by constant innovations and technological enhancements,” Astute Analytica reports. “As consumers become more informed about the risks associated with food contamination and adulteration, their demand for safe and high-quality food products has surged.”

For optimal inspection system performance, it is essential that processors leverage the specific technologies that meet the unique demands of each plant, analysts say. This requires consideration of production methods and the type of contaminant that requires identification, says Robert Slauson, assistant sales manager for Advanced Detection Systems, a Milwaukee-based supplier of metal detectors.

Machine construction, degree of accuracy, and user interface design are key elements to analyze when selecting inspection systems as well, he says.

“Equipment made of high-quality materials will last longer in harsh environments and hold up to the physical demands of production longer than cheap materials,” Slauson notes. “The human machine interface [HMI] layout also needs to contain the information that an operator needs to run the equipment and it should be presented in an intuitive, easy-to-understand way.”

Well-designed HMI software will guide operators through setup and system operation; signal potential problems; and provide real-time feedback on equipment status and product settings, Slauson notes. “It doesn’t matter what kind or how good of an inspection system you have if you don’t know how to set it up and use it correctly,” he adds.

Consider the conditions

Environmental factors to consider include whether the inspection area is wet or dry and if there is temperature variance, says Todd Grube, product manager, inspection systems, for Heat and Control Inc., a Hayward, Calif.-based provider of metal detector and X-ray technologies.

“One of the most common causes of detection equipment failure is water intrusion into the electrical components,” he states. “Selecting a machine that can handle the largest product by size while still meeting the speed and/or sensitivity requirements of a smaller package is a common challenge.”

The ability to handle a wide range of products and detect minute contaminants are the primary differences between superior and average machines, Grube says. “This is critical for dairy processors that run an extensive range of products that differ in size and weight,” he notes.

Ensuring that the aperture is suitable for the product size; that equipment can effectively operate in a wet product environment; and, most importantly, that the reject device can match the line speed and is suitable for the product characteristics are key considerations as well, suggests Eric Garr, regional sales manager for Fortress Technology Inc., a Toronto-based supplier of metal detectors and X-ray systems.

The ability to calibrate equipment easily and efficiently in accordance with a particular SKU, along with having an effective range of coverage, are further elements to assess when deciding on the most appropriate system, says Kurt Westmoreland, chief commercial officer for FlexXray, an Arlington, Texas-based provider of X-ray inspection and metal detection services.

Such additional elements as line layout, software capabilities, image clarityand ease of navigation also are important variables when comparing technologies, says A.J. Miller, director of marketing for Silgan Closures, a Downers Grove, Ill.-based provider of visual inspection equipment.

“Processors should adopt a comprehensive strategy,” states John Klinge, global product manager — metal detection, for Eriez Manufacturing Co., an Erie, Pa.-based developer of metal detectors and magnetic separation equipment. This might include implementing a solution that integrates advanced metal detectors and magnetic separation technologies to intercept and eliminate contaminants before they enter the processing stream, he notes.

Do the due diligence

It also is important for operators to receive machine failure rate and replacement part cost data for each piece of equipment under consideration, Garr says. “If vendors are not prepared to divulge these, that’s a red flag,” he states. “Such factors have a huge impact on total cost of ownership and overall equipment effectiveness.”

The most reliable information and advice will come directly from a manufacturer or its authorized representative because a machine’s performance can vary widely depending on the product and the other equipment on the processing line, Grube says.

“The performance information from a vendor’s website may not be applicable due to the unique characteristics of a particular product,” he states. “A manufacturer’s authorized representative can integrate critical factors to give the most realistic expectations. If possible, performing a test using actual product and exact or a similar model is ideal.”

To help determine if new equipment is even necessary, operators should periodically send products and pallets to a third-party service to see if the service’s results align with the processor’s internal findings, Westmoreland says.

“Just because a piece of equipment is old does not mean that it is bad or that something newer will work better,” Slauson states. He adds, however, that age can be a factor when considering the need to replace difficult-to-source components. “When that obsolete part fails, will you have a backup ready, or will production be down until you can get a replacement system in?”

The day-to-day performance of existing machines is another key indicator when assessing the need to replace current technologies, Garr says. “This is why gaging overall equipment effectiveness and total cost of ownership is so imperative,” he notes.

High reject rates at the packaging stage; higher than normal rates of consumer complaints; and the incorporation of new products and/or performance standards also can help determine if it is time to replace existing equipment, Grube says.

Processors, meanwhile, should prioritize and budget for yearly equipment health checks by original equipment manufacturer service technicians, Klinge says. “These checks serve as a proactive measure, assessing the performance and reliability of existing equipment and ensure processors can timely adopt new and improved technologies when the need arises,” he states.

Cost is a concern

The expense of situating newer inspection technologies, however, can be steep, with systems often costing tens of thousands of dollars. Astute Analytica states that high upfront costs can be a substantial barrier for small- and medium-sized processors, along with such operational expenses as maintenance, energy consumption, and staff training.

“The high initial investment required for these systems also discourages food manufacturers from upgrading to newer, more advanced systems, especially during times of economic uncertainty,” Astute Analytica notes. “The lack of skilled technicians to operate and maintain the complex systems can further increase operational costs.”

Such personnel are necessary for interpreting the images, detecting contaminants, and maintaining the equipment. “A shortage of qualified technicians can lead to increased costs of having and training staff, reducing the overall return on investment of these systems,” Astute Analytica states.

Having skilled personnel who can effectively operate inspection systems will become even more crucial as vendors design newer and more effective technologies. Recent enhancements, for instance, are enabling greater sensitivity of metal detection by using simultaneous frequency to remove product effect from the most challenging items, Garr says.

“Many of today’s inspection equipment also offer fast remote and secure access,” he states. “Processors can use these reporting features to minimize physical interactions with machinery and provide production managers and auditors with access to reports and critical overall equipment effectiveness data. Some also facilitate contactless programming to boost efficiency and reduce machine downtime.”

Reductions in pixel sizes and bitrate improvements are leading to significantly better X-ray imaging as well, Westmoreland notes. Additionally, systems that offer digital traceability that enable processors to log and retrieve information effortlessly are becoming more commonplace, Klinge adds.

To effectively utilize such technologies, processors should arrange for a plant visit by an application expert, Klinge says, noting, for instance, that such individuals can help pinpoint critical control points for the strategic placement of magnets and metal detectors. Equipment suppliers also can provide data on emerging technologies during yearly validations or equipment health checks, he notes.

“Technology continues to advance, so dairy processors readily can improve their quality control programs and utilize more sophisticated inspection equipment that detects smaller foreign objects, reduces false rejects, and handles a wider range of products to assure maximum consumer safety with higher productivity,” Heat and Control’s Grube concludes.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!