2021 State of the Industry: Cheese sends greetings from the sunny side of the street

The natural cheese category hit the accelerator and saw retail dollar sales climb.

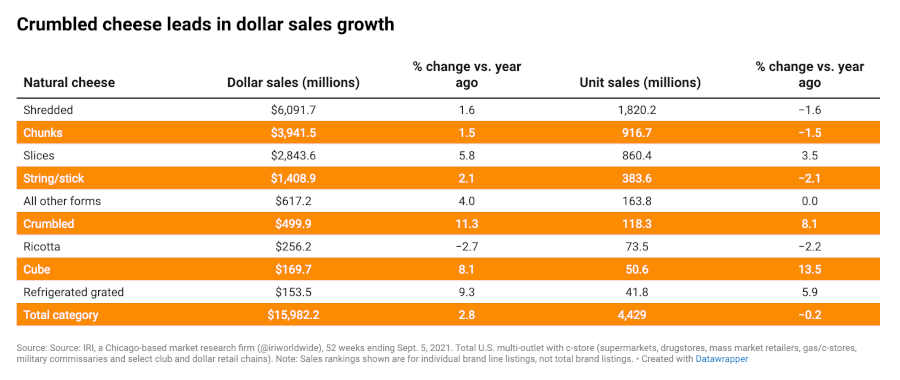

The natural cheese category managed to avoid gridlocks on the retail side in 2021, cruising at a comfortable speed with positive results. Dollar sales for the category rose 2.8% to $15,982.2 million, although unit sales fell very slightly — 0.2% — to 4,420.0 million, according to data from Chicago-based market research firm IRI for the 52 weeks ending Sept. 5, 2021.

Among the category’s subcategories, natural crumbled cheese enjoyed the smoothest ride. Its dollar sales jumped 11.3% to $499.9 million, while its unit sales climbed 8.1% to 118.3 million.

Processed cheese, on the other hand, took a slight detour from the sunny side of the street. Dollar sales within that category dropped 0.2% to $3,191.7 million; unit sales fell 3.1% to 755.8 million.

It is worth noting, however, that both categories had a tough road trip to follow. Dollar and unit sales for the natural cheese category shot up 15.8% and 9.0%, respectively, during the 52 weeks ending Sept. 6, 2020, according to IRI data. And dollar and unit sales for the processed cheese category jumped 13.5% and 6.8% during that same timeframe.

“Retail sales of cheese remain strong, varying by type, and well above sales in 2019,” notes John Umhoefer, executive director of the Madison, Wis.-based Wisconsin Cheese Makers Association. “While consumers are returning to their favorite foodservice channels, cheese types used in home cooking and sandwich applications continue to lift retail sales well above pre-pandemic levels.”

Convenient formats take the express lane

At retail, shredded cheese makes up the largest natural cheese subcategory, with dollar sales totaling $6,091.7 million for the 52 weeks ending Sept. 5, 2021, according to IRI data. That reality is a testament to the continuing popularity of convenient cheese formats.

To appeal to consumers’ desire for convenience, Andrew & Everett, a clean-label, source-verified cheese brand of Rochelle, Park, N.J.-based Panos Brands, introduced Andrew & Everett rustic thick-cut shredded cheese this spring. This line is available in white sharp cheddar, mozzarella, and Fiesta Blend varieties, the company says.

Andrew & Everett specializes in “farm-to-table” cheeses that are made from the highest-quality milk from grass-fed cows raised on third- and fourth-generation family-owned farms in America’s heartland. The cheeses are created using a process where master artisan cheesemakers — who are local to the area the cows are raised — turn milk into cheese in 48 hours. This process creates fresher, creamier and better-tasting cheese, the brand says.

Convenience within the cheese segment goes well beyond shredded cheese, of course. For example, when restaurants shut down during the height of the COVID-19 pandemic, consumers attempted to “bring the restaurant experience home” and hosted smaller gatherings to celebrate holidays and special occasions, notes Heather Engwall, vice president of marketing for Fitchburg, Wis.-headquartered Emmi Roth. As a result, sales of prepackaged fondue at retail grew 32% in 2020.

“Quick and convenient options continue to be top of mind for busy families,” notes Joe Baird, CEO of Willows, Calif.-based Rumiano Cheese. “We’re focusing on new formats that support the post-COVID lifestyle changes with home and school. … Our brand new packaging facility (in Willows, Calif.) is also enabling us to expand with new formats.”

Cheese destined for snacking occasions currently is a huge part of the ongoing convenience trend, too.

To appeal to American snackers, Sargento Foods, Plymouth, Wis., released Sargento Balanced Breaks cheese and crackers snacks early this year. The products mark a new partnership between Sargento and Chicago-based Mondelez International that combines eight Sargento natural cheese varieties with Ritz, Triscuit, and Wheat Thins snack crackers to create a snack that is easy to enjoy at home, at work, or on the go.

According to Sargento, the offerings come in four combinations, each featuring between 7 and 9 grams of protein and up to 170 calories per serving. The varieties include pepper jack and colby jack natural cheeses and Ritz Mini crackers, Gouda and sharp cheddar natural cheeses and Triscuit Mini Original crackers, Monterey Jack and mild cheddar natural cheeses and Wheat Thins Mini Original snacks, and low-moisture mozzarella and fontina natural cheeses and Wheat Thins Mini Sundried Tomato & Basil snacks. Balanced Breaks cheese and crackers come in packages of three single-serve 1.5-ounce snack trays.

Schuman Cheese also had snack occasions in mind when it added portable single-serve pairings to its Cello brand in 2021. According to the Fairfield, N.J.-based company, the addition provides consumers with a personalized portion of Cello’s award-winning Fontal and Copper Kettle cheeses in combination with dried fruit and roasted nuts.

“As the demand for healthier snack options continues to grow, Cello Snack Packs provide something new and different to enjoy while snacking at home or on the go,” shares Mike Currie, marketing director for Schuman Cheese.

On the foodservice side, Castello, a brand of Viby, Denmark-based Arla Foods, recently expanded its U.S. portfolio with new Castello burger blue cheese slices, which are conveniently sliced and made to melt to elevate any dish. Featuring the characteristics of a Danish blue cheese, the slices are said to transform burgers into a gourmet meal.

Meanwhile, cheese crisps — produced entirely from dried or baked natural cheese — represent “the hottest” emerging trend within the convenience/snacking space, notes Umhoefer.

“Line extensions into more cheese varieties and more cheese flavors could continue to fuel this category,” he says.

Before introducing any new convenient cheese format, however, cheesemakers would be wise to do their homework.

“Cheese is special in that it amplifies many of the macro trends in the U.S. and around the world,” says Kyle Jensen, vice president of sales and marketing for Hilmar, Calif.-based Hilmar Cheese Company Inc. “It’s important that cheesemakers have a pulse on what convenience means to different consumers across the world, to be proactive in offering innovative solutions that meet the wants and needs of the evolving way[s] in which people eat.”

Specialty, ethnic varieties get the green light

Specialty and ethnic-style cheeses also boast appeal. On the specialty side, cheeses that are “versatile and cooking-friendly” increased in popularity in 2020, notes Engwall.

“Varieties such as Parmesan (+49%) and Gruyere (+36%) grew significantly and are good examples of cheeses that can be enjoyed on their own or used as an ingredient when cooking at home,” she points out. “These premium cheeses were used to elevate food that was being created in the home and feel more special. We do not expect this trend to slow down in 2021.”

For its part, Emmi Roth’s Roth brand just introduced new packaging for its popular line of Grand Cru cheeses (Grand Cru, Grand Cru Reserve, and Grand Cru Surchoix). Highlighted by eye-catching labels, the update also includes a shift from wedges to more cooking-friendly blocks.

Inspired by Switzerland and rooted in Wisconsin, Roth Grand Cru tells the story of history, tradition, and commitment to cheesemaking. The newly designed Grand Cru labels feature Scherenschnitte, the traditional art of Swiss paper cutting. This folk art emerged in Switzerland in the 1800s and remains a tradition today. Emmi Roth says the inspiration of Scherenschnitte also symbolizes the art, craft, and skill that is part of the cheesemaking culture at Roth.

Also new to the specialty cheese space is Golden Gate, the first in a new line of handcrafted premium cheeses from Marin French Cheese Co., Petaluma, Calif. This washed-rind triple crème cheese is named for the golden color of the cheese, as well as the Golden Gate Bridge, the iconic gateway to Marin County where the historic creamery is located.

Golden Gate cheese undergoes four rounds of handwashing in its 14-day aging process to lock in moisture that encourages the growth of Brevibacterium linens cultures. Multiple rounds of handwashing in brine score the cheese to help develop the cultures and build an edible rind that preserves the cheese’s creamy texture and balances its earthy, rich flavor with just the right amount of salt, the company says. The striking orange rind occurs naturally without the use of added colorant. It retails in an 8-ounce package.

.png)

On the ethnic cheese side, meanwhile, Dallas-based LALA U.S. is sharing the authentic taste of Mexico with the spring 2021 introduction of three types of artisan cheese — LALA queso fresco, LALA queso panela, and LALA queso Oaxaca.

According to LALA, LALA queso fresco may be crumbled on tacos and over beans, rice, and enchiladas. LALA queso panela, also known as basket cheese, is perfect fried, grilled, or sliced for sandwiches or salads. And LALA queso Oaxaca is a fresh, semi-soft artisan cheese that is similar to mozzarella. It is authentically made into a long rope and wound into a knot following the traditional technique.

Engwall points out that both Hispanic-style and Middle Eastern varieties of cheese continue to be of growing interest to consumers. In fact, since 2019, sales of paneer are up 127%; sales of queso quesadilla are up 86%; sales of Oaxaca are up 51%, and sales of cotija are up 45%.

Flavors expertly navigate the curves

Cheeses sporting consumer-pleasing flavors — bold and adventurous flavors, in particular — are also on trend. Engwall notes that the garlic and herb combination is driving the most dollar sales growth, but spicy/hot/pepper flavors, alcohol flavors, and smoked flavors also have posted strong recent growth.

“The market is responding well to early experiments highlighting ethnic flavors and more exotic spices from global cuisines,” Baird adds.

Bel Brands USA, Chicago, recently added some flavor to the retail cheese segment with the addition of two limited-edition 9-ounce cheese balls under its Kaukauna brand. Created for the fall and holiday seasons, the cheese balls come in Cranberry & Cream Cheese and Four Cheese & Sun Dried Tomato varieties.

Kaukauna says Cranberry & Cream Cheese is its first sweet cheese ball offering. It is made with rich cream cheese and blended with cranberry juice and dried cranberries to create a sweet and tart flavor. The Four Cheese & Sun Dried Tomato cheese ball, meanwhile, features premium Romano, Asiago, Parmesan, and cheddar cheeses, which give the product a unique sharp and nutty taste.

For its part, New Holland, Pa.-based Savencia Cheese USA tapped into both the “flavor-up” trend and the snacking trend with its new Alouette Gourmet Bites. The offerings are small balls of Alouette’s signature creamy cheese filled with flavor-packed centers.

According to Savencia, the cheese balls come in two flavors: Garlic & Herb (based on Alouette's best-selling spreadable cheese) and Caramelized Onion — an elevated spin on a popular snacking flavor. Perfect for entertaining, the small morsels are fun and indulgent, with fewer than 100 calories per serving.

Inclusions represent a growing flavor trend as well.

“Inclusions continue to be of importance to both consumers cooking at home and foodservice channels,” says Jensen. “Bolder cheese flavors mean potentially needing fewer ingredients to achieve the same profile.”

Taking the health and wellness highway

Also trending within the cheese segment are better-for-you options that cater to consumers’ increasingly holistic approach to health and wellness.

“A focus on health and wellness — and thinking of food as medicine — are gaining in interest,” notes Marshall Reece, senior vice president of sales and marketing for Associated Milk Producers Inc., New Ulm, Minn. “Consumers are becoming more aware of how food can influence their wellbeing and are looking for products that can provide functional benefits.”

For cheese producers, that reality means they might want to consider how cheese could play a role in aiding sleep, managing mood, and enhancing overall health, he suggests.

During the past year, consumers’ interest in “immunity health and holistic wellness” rose sharply, adds Shannon Maher, chief marketing officer for Bel Brands USA.

“Specifically, products with probiotic and prebiotic claims saw a sales growth of 14% in 2020 versus 2019,” she says, citing retail data from IRI for the 52 weeks ending June 14, 2020. “The pandemic boosted this functional trend even further as family snack habits shifted. Indulgences were high in the early months of the stay-at-home orders, leading to an emphasis on health and wellness in 2021.”

In response, Bel Brand USA’s Babybel brand introduced a range of functional dairy snacks this past winter in two varieties: Babybel Plus+ Probiotic and Babybel Plus+ Vitamins. Bel Brands says Babybel Plus+ Probiotic contains billions of live and active cultures of the LGG probiotics strain, with evidence to suggest immune health benefits when consumed as a part of balanced diet and healthy lifestyle. Babybel Plus+ Vitamins, meanwhile, is a good source of vitamins A and B12, which are known to support eye health and metabolism, respectively.

“These varieties offer an easier way for families to get their added nutrients,” Maher says. “We are committed to delivering on consumers’ evolving expectations and demands and will continue to explore different innovations rooted in those demands.”

Steering around hazards

Despite consumers’ ever-growing love for cheese, the segment does have its challenges. For one thing, the COVID-19 pandemic resulted in a shift from food service — which traditionally uses a substantial percentage of cheese produced — to retail. The shift back to a more balanced distribution between the two channels is still in process and is being impacted by ongoing changes within the foodservice realm.

“The foodservice industry will emerge from two years of turmoil different than what it was in 2019,” Umhoefer says. “Quick-service and chain restaurants have adopted delivery and takeout options as long-term strategies, while sit-down restaurants and fine dining continue to struggle with available labor.”

Although cheese destined for pizza chains and independent pizza outlets saw a crash in the spring of 2020, it recovered and has maintained “solid momentum” during the last year or so, he adds. However, some styles of cheese have seen sales flatten as a result of fewer sit-down restaurants and reduced hours at other dining operations.

“But most cheese types, both commodity and specialty cheese, are seeing increased sales as independent restaurants, quick-service chains, and fast food icons reformulate menus and enhance ingredients to gain market share,” Umhoefer says.

Reece agrees, noting that processed cheese slices and loaves are showing gains at foodservice in comparison to 2019.

As for the labor issue, it goes well beyond food service — it is found at every step in what Reece refers to as “the farm-to-fork food chain.” To attract and retain employees, AMPI is driving home the message that “being part of the process that produces food is a noble and fulfilling profession.” It is also sharing the cooperative’s “farmer-owned, co-op crafted story.”

That type of approach is needed if companies are to succeed, Umhoefer suggests.

“Dairy manufacturing offers a stable, rewarding career in an industry that values a clean, safe work environment for its people and the products they produce,” he stresses. “Companies should invest in great human resources leadership and training and development for their management team, as well as their workforce.”

Another major pain point is tied to transportation and the overall supply chain, Baird points out.

“We have to completely rethink and redesign our supply chain to be more agile to deal with new channels and product formats, especially during the holiday season when demand frequently exceeds the truck capacity.”

The adoption of more sustainable cheesemaking practices remains a challenge, too. Maher notes that Bel Brands believes its corporate responsibility goes beyond it factory doors, so the company set concrete 2025 sustainability goals and is making progress in attaining them. It has already reduced its plants’ water consumption by 55% per metric ton of cheese (80% is the 2025 goal), expanded farmer access to social benefits through its FARM program, packaged 84% of its products in recyclable or biodegradable materials (100% is the 2025 goal) and reduced its greenhouse emissions to meet the Paris Agreement targets.

“Consumers have been increasingly conscious of their environmental footprint for many years now,” Baird adds. “We know they are more inclined to embrace brands that are in touch with sustainability and environmental impact, but we are seeing a more rapid shift in their purchasing decisions. … [They are] choosing brands that have made specific commitments to soil health, regenerative farming, and other impactful climate-friendly practices.”

Meet the alternatives

- This past spring, Chicago-based Bel Brands USA unveiled a new plant-based cheese brand — Nurishh. Guided by Bel's French cheesemaking expertise, Nurishh is said to strike the balance of genuine cheesy taste, meltability, and comfort with plant-based goodness. It comes in six varieties: cheddar-style slices, mozzarella-style slices, provolone-style slices, cheddar-style shreds, mozzarella-style shreds, and cheddar & mozzarella-style blend.

- Vevan Foods, a division of Fairfield, N.J.-based Schuman Cheese, recently added Vevan Marinated Mozza-Bites to its line of plant-based “cheeses.” Vevan Foods says the offering takes the artisan plant-based “cheese” experience to a new level, with bite-size cubes of creamy, dairy-free Mozza marinated in an aromatic blend of herbed oil and spices.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!