Retail ice cream sales tumble

But most of the category’s declines can be attributed to a few brands

The U.S. retail ice cream segment certainly has seen easier times. According to “Ice Cream and Frozen Novelties — U.S.,” a report published in May 2019 by global market research firm Mintel, the mature and diverse category is “finding growth elusive.”

Data from Chicago-based market research firm IRI certainly mesh with those findings. In fact, during the 52 weeks ending Nov. 3, 2019, the retail ice cream/sherbet category actually lost ground, with dollar sales falling 0.9% to $6,784.3 million. Unit sales took a 2.5% dive to 1,770.2 million.

Not as bad as it seems

Meanwhile, dollar sales in the very large ice cream subcategory dropped 0.5% to $6,072.1 million. Unit sales declined by 2.0%.

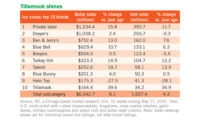

But the data are somewhat deceiving. Within the ice cream subcategory, only two top 10 brands — Halo Top (Wells Enterprises) and Breyers (Unilever) posted significant sales declines.

Better-for-you brand Halo Top saw dollar sales tumble a whopping 33.5%, and unit sales fall 32.2%. And Breyers posted 9.8% and 14.7% dollar and unit sales falloffs, respectively.

The growth story among the top 10 belonged to Talenti (Unilever). The brand’s dollar sales rose 7.4%, while its unit sales increased 6.0%.

Close behind was private label, posting 5.5% and 4.0% dollar and unit sales gains. Turkey Hill (Turkey Hill Dairy) also recorded impressive results. The brand’s dollar sales jumped 4.6%, and its unit sales went up 4.1%.

Other subsegments suffered, too

The other, much smaller subcategories under the ice cream/sherbet category also posted negative overall results. Dollar sales within the frozen yogurt/tofu subcategory, for example, fell 4.8% to $308.8 million. Unit sales declined by 7.1%.

Among the top 10 here, Halo Top and Luna & Larry’s Coconut Bliss (Bliss Unlimited) fared the worst. Halo Top posted 21.5% and 19.3% dollar and unit sales declines, respectively. Luna & Larry’s Coconut Bliss, meanwhile, saw dollar sales tumble 20.1% and unit sales drop 24.5%.

Several top 10 brands bucked the negative sales trend, with nondairy dessert brand NadaMoo (by the company of the same name) pulling off the most impressive performance. Its dollar sales jumped 65.9%, while its unit sales climbed 74.7%.

The ice milk/frozen dairy dessert subcategory also saw a significant sales decline, with dollar sales plunging 3.1% to $214.2 million and unit sales dipping 8.3%.

Although most of the top 10 brands posted declines, the biggest loser was Dreyer’s/Edy’s (Nestlé USA). The brands’ dollar sales fell 32.9%, and its unit sales dropped 34.7%.

On the flip side, Turkey Hill posted the most positive results among the top 10. Its dollar sales were up 5.2%, and its unit sales rose 4.3%.

The sherbet/sorbet/ices category suffered, too, with sales falling 2.7% to $189.2 million. Unit sales decreased 3.9%.

Among the top 10 brands, Häagen-Dazs took the greatest fall, with dollar sales dropping 17.2% and unit sales falling 17.0%.

But two smaller top 10 brands took off. All combined brands of Gourmet Sorbet Corp. saw 109.1% and 110.6% increases in dollar and unit sales, respectively. And dollar and unit sales for Baskin-Robbins (Boardwalk Frozen Treats) rose 104.7% and 94.7%, respectively.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!