Frozen dessert sales are falling

Sales of frozen puddings, whip toppings and pies are struggling.

In the frozen dessert market, ice cream typically reigns supreme among consumers who are looking to indulge in a treat. But even ice cream sales are struggling. Read “Ice cream sales cool off” in our August issue for more news on that. With this information in mind, it’s not surprising that many other frozen desserts are finding it hard to compete as well.

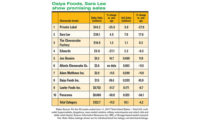

In the 52-week period ending May 20, 2018, most frozen desserts and toppings did not do well. As defined by Chicago-based market research firm IRI, the category includes frozen cheesecakes, whip toppings and frozen pudding/mousse.

The frozen desserts and toppings category saw dollar sales decrease 2.2% to $678.6 million and unit sales drop 5.4% to 259.1 million. In the related frozen pies category, dollar sales fell 4.8% to $650.1 million, and unit sales dipped 4.7% to 169.9 million.

Cheesecake sales are up and down

In the category, frozen cheesecakes is the only subcategory that saw overall positive sales, though unit sales were almost at a standstill. Frozen cheesecake dollar sales rose 1.9% to $137.7 million, but unit sales were up only 0.2% to 19.3 million.

There were a few big standouts among the top 10 brands. Atlanta Cheesecake Co. (Panarama Inc.) realized a 94.6% jump in dollar sales. Unit sales increased 21.5%. Daiya’s dollar sales climbed 60.0%, and unit sales jumped 63.5%. Suzy’s Cream Cheesecakes saw a whopping 770.4% jump in dollar sales, while unit sales improved 545.8%.

The biggest losers among the top 10 were Edwards (Schwan Food Co.) and Jon Donaire (Rich Products Corp.). Edwards saw dollar sales dip 9.8% and unit sales drop 7.9%. Jon Donaire realized a 12.3% dollar sales decrease and a 16.7% unit sales decline. Likewise, private label, the subcategory leader, saw a 5.9% and 9.2% drop in dollar and unit sales, respectively.

Frozen whip topping sales dip

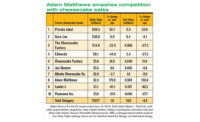

The frozen whip toppings subcategory posted a 2.5% dollar sales decline to $315.0 million. Unit sales decreased 6.0% to 187.5 million.

Among the biggest standouts in the top 10 was So Delicious (DanoneWave). Dollar sales surged 59.3%, and unit sales rose 55.7%. And dollar and unit sales for Quality Farms (Peak Foods) skyrocketed 77.9% and 153.0%, respectively (albeit on a small base).

On the flip side, Augason Farms Morning (Blue Chip Group) took the biggest hit, with dollar sales down 65.8%. Unit sales fell 64.2%. Rich’s Rich Whip (Rich Products Corp.) saw dollar and unit sales drop 14.0% and 15.4%, respectively. Subcategory leader Kraft Cool Whip (Kraft Heinz Co.) also struggled — dollar sales fell 4.8%, and unit sales dropped 10.8%.

In the frozen pies category, Edwards saw dollar sales drop 2.1%, but unit sales improved 1.8%. Dollar sales for Mrs. Smith’s (Schwan Food Co.) declined 8.8%, and unit sales dipped 11.1%. Sara Lee’s (Hillshire Brands Co.) dollar sales decreased 7.9%, and unit sales were down 5.8%.

On the flip side, private label’s dollar and unit sales were up 11.0% and 9.0%, respectively. Making the biggest jump among the top 10, however, was the Village Piemaker, which saw dollar sales increase 15.1% and unit sales improve 16.0%.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!