State of the Industry 2016: It’s a buyer’s market for dairy ingredients

U.S. dairy processors see fewer exports of their cheese and butterfat products. It’s a different story for milk powders, thanks to demand from Mexico and Asia.

17th century world map by an anonymous artist Image courtesy of Album, Art Resource, New York

Cheddar Cheese prices

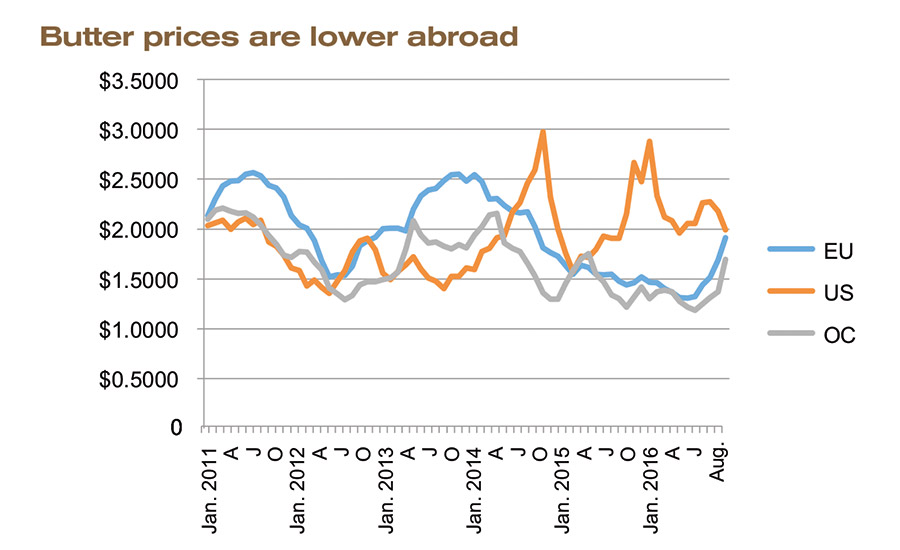

Butter prices

It was not long ago that domestic demand afforded dairy producers a premium for their milk compared to their international counterparts. Similarly, domestic end users of dairy products such as cheese and butter can no longer look to the likes of Europe and New Zealand for cheap fat and protein alternatives.

Milk | Cheese | Cultured | Ice Cream | Butter | Non-dairy Beverages | Ingredients | Exports

Instead, what has transpired is an equilibrium among milk and dairy product pricing around the globe. In the works now is how the leveling of the competitive landscape will affect not only U.S. exports but also imports of foreign dairy products.

The premium for domestic product over that of international markets has been most profound in cheese and butterfat. Unsurprisingly this imbalance has negatively affected exports of U.S. product. In 2015, the U.S. exported 223,666 metric tons of cheese from January through August, which was down 14% during the same time in 2014.

The latest export statistics have 2016 year-to-date volumes at 186,629 MT, down 17% versus the previous year and down 29% from 2014. Butterfat exports have a similar story. In 2014, U.S. export volume from January through August was 60,011 MT. Last year, volumes plummeted to 17,011 MT, and this year to 14,905 MT. Taking away export subsidies would drop YTD volume to 11,506 MT, an astonishing 81% drop-off from 2014.

Favorable prices for butter imports

A slowdown of exports due to higher domestic prices has opened the door for more foreign product to reach our shores. The unequivocal arbitrage opportunity between markets has allowed imports of butter and cheese to increase 82% and 21% from 2014 to 2015 and 47% and 9% from 2015 to 2016 YTD, respectively. The countries of origin for these products are plentiful, but do heavily favor major dairy production nationals, like Ireland.

A trip to the local supermarket conveys this increase in foreign imports, as promotions have heavily favored fats and proteins. The 82% fat imported butters are a premium product compared to our standard 80% salted variety, but market conditions allowed retailers to sell foreign product at a discount. With prices now at equilibrium, it has yet to be seen if there has been a change in consumer tastes and preferences, which can shift the demand curve.

There may be some consumers who will reach for the unsalted 82% grass-fed sweet butter made by our international counterparts. But a wide embrace is not expected because U.S. food companies and the everyday consumer are too price-sensitive to implement what is thought of a premium commoditized product.

Mexico demands dairy ingredients

Although exports have been bleak for cheese and butter, our neighbors to the south have helped propel skim milk powder (SMP) and nonfat dry milk powder (NFDM) volumes above year-ago levels. In August, Mexico imported 31% more product than the previous year, although a lot of the product going to Mexico was thought to have been aged and discounted to the market.

Additional sales to Southeast Asia, Canada, and China have brought total YTD exports of SMP/NFDM to 389,016 MT, a 5% increase compared to 2015. The spread between international and domestic pricing for powders has been significantly narrower than that of other dairy products. This is because domestic demand for powders is not great enough to absorb excess production.

Exports as a percent of total production equated to less than 10% for cheese and butterfat in 2015, whereas exports of NFDM/SMP and whey totaled 54% and 41%, respectively, from January to August 2016. The higher percent of production that goes towards exports allows for global economic conditions to have a greater impact on domestic pricing. Current data suggest that demand for U.S. product is strong.

As mentioned, YTD exports are up and near 2014 levels. Total U.S. SMP/NFDM production is down 1.3% YTD, yet domestic NFDM pricing is at the lower 30% of the 5-year average. This is largely in part because of increases in production in the EU-28, which saw a 10.5% rise in from January to July 2015 to January to July of this year; producing greater than 58% more volume than the United States this year.

Other global economic factors point to a decrease or steady consumption of powder to end the year. Economies in so called dairy deserts such as the Middle East and Africa are experiencing financial difficulties due to low crude oil prices and unfavorable monetary policy.

Mexico, which has been the largest importer of U.S.-origin NFDM has been noticeably absent after posting strong numbers in August. China, on the other hand, purchased record amounts of whey and whey protein concentrate (WPC) from the United States in August, totaling 138,523 MT. This increased the cumulative 2016 export volume to 4% more than last year. Like Mexico, the surge in buying by China is thought to be more opportunity buying/replenishing of stocks than newly found demand.

The leveling out of cheese and butter prices globally, as well as continued competitiveness of powders, tilts the scales in favor of the buyer for now. The current trend of dairy production varies from region to region, as does their economic outlooks. It is this differentiation between countries that can increase volatility across dairy markets globally. To protect import/export pricing or sales within the United States it’s clear that a strategically planned risk management strategy will mitigate this newfangled volatility.

What’s the industry talking about?

- A 17% drop in export volumes, YTD

- More imports of butter, cheese

- Demand from Mexico for U.S. dairy

- Low oil prices damper exports

- It’s a buyer’s market (for now)

Milk | Cheese | Cultured | Ice Cream | Butter | Non-dairy Beverages | Ingredients | Exports

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!