Sales of energy drinks are not so energetic

Dollar sales were up 5.4% in the energy drinks nonaseptic segment to $8.7 billion — the largest segment of the $10 billion energy drinks category. Unit sales were also up 7% in the nonaseptic segment to 3.4 billion, according to data from Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Dec. 29, 2013.

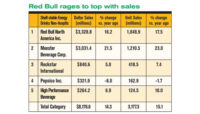

Segment leader, Red Bull had a 7.5% increase in dollar sales to $3.4 billion. In the No. 2 spot, Monster Energy (owned by Corona, Calif.-based Monster Beverage Corp.) was up 2.2% in dollar sales to $1.2 billion while the company’s Monster Energy Zero Ultra (in the No. 8 spot) saw dollar sales dramatically increase 689% to $273 million with unit sales up 749% to 128 million.

The energy drinks nonaseptic segment was, however, the only segment in the category to see gains but was enough to lift the category as a whole — dollar sales overall were up 2.9%. The energy drinks category includes the following segments (ranked in order of size, from largest to smallest): nonaseptic, shots, drink mix and aseptic.

The energy shot segment was down in both dollar and unit sales. Dollar sales dropped almost 10% to $1.2 billion while unit sales decreased almost 7% to 350.5 million. Segment leader 5 Hour Energy from Living Essentials, Farmington Hills, Mich., was down 9.3% in dollar sales to $1.2 billion.

Dollar sales in the energy drink mix were down 21.7% to $136.5 million. Unit sales decreased 16.8% to 50.8 million. The category’s smallest segment, energy drinks aseptic, also had double-digit declines in dollar sales — down 14.2% to $1.4 million. Unit sales decreased 8.9%.

Sporting news: flat sales

In the sports drinks category overall, dollar sales had a 0.2% change to $5.6 billion. The largest segment in the category, sports drinks nonaseptic, stayed pretty much flat with dollar sales up 0.1% to $5.5 billion but unit sales were down 0.2% to 3.2 billion. Gatorade Perform (owned by PepsiCo, Purchase, N.Y.), in the No. 1 spot, saw dollar sales increase 2.1% to $3.3 billion. The Coca-Cola Co.’s Powerade, in the No. 6 spot, saw a 422% increase in dollar sales to $108 million. However, Powerade Ion4 and Powerade Zero Ion4 both saw losses of roughly 10% each in dollar sales: to $860 million and $211 million respectively.

The sports drink mix segment saw the category’s largest gains: up 13.3% in dollar sales to $133 million, and an increase of 28% in unit sales to 33 million. Northfield, Ill.-based Kraft Foods’ MiO Fit sports drink — launched in early 2013 — was up more than 18,000% in dollar sales to $23 million with unit sales up more than 19,000% to 6.5 million. The sports drinks aseptic segment didn’t fare so well seeing large declines in both dollar and unit sales: a 53.6% loss in dollar sales to $10 million and unit sales dropped 50.4% to 6.8 million.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!