Dairy ingredient trends: clean labels and green business

Consumers say they want to reduce the total sugars they consume. Sweetener suppliers offer solutions and advise how the alternatives will interact with other ingredients in a product formulation.

Photo courtesy of Glanbia

A conventional glass of milk offers 8 grams of protein in 8 ounces. Dairy processors are boosting protein levels to appeal to consumers’ desire for muscle-building beverages. In flavored-milk products, the challenge is reducing sugar levels while maintaining taste and mouth feel.

Photo courtesy of Ingredioin

The neutral taste of basic dairy foods provides a great canvas for product developers, who add fiber, color, vitamins and other nutritious ingredients.

Photo courtesy of Ingredioin

As we wrap up 2013, it’s clear that the trends setting the agenda in the dairy category would strike insiders of almost any other food and beverage sector as familiar. To wit:

- Consumers across the board want clean labels and “natural” ingredients.

- They want products with less of the nutritional bugbears they’re warned against (sugar chief among them),

- And more of the macronutrients they could benefit from (like protein and fiber).

- And while they may not have a firm grasp of what sustainability means, they know it’s good, and they’re holding food and beverage brands to the task of delivering it.

Fortunately for dairy processors, these trends play to the category’s strengths. Dairy naturally resonates with notions of wellness, wholesome good health and stewardship of the land. But at the ground level, putting such trends into practice is a more complicated bet. That’s where finding the right ingredients comes in — because while it’s one thing to acknowledge the prevailing winds guiding dairy development, it’s quite another actually to address them in formulation and in production.

Read the entire Industry Outlook

A holistic solutions approach

Today’s suppliers are well aware that “natural,” “good-for-you” and “sustainable” mean little if the finished product doesn’t measure up to consumer expectations.

As Ivan Gonzales, marketing director, dairy, Ingredion Inc., Westchester, Ill., explained, “The dairy industry is being challenged to innovate at a faster pace and increase speed-to-market.”

The right supplier, he said, recognizes that “a ‘solutions’ approach encompasses activities that range from understanding consumer needs and how they affect product design to understanding and suggesting ideas for how to manufacture and position a product in the market.”

This deeper dive into ingredient “solutions” is especially critical when tackling substantive reformulations — as manufacturers so often do these days.

“This may be a reformulation for sodium, fat, sugar, calorie or cost reduction,” noted Carol Rainford, senior food scientist, Tate & Lyle, Decatur, Ill. “Sometimes the change can be an added ingredient, such as a protein or fiber to provide nutrition or health benefits.”

But a true solution doesn’t just sub out yesterday’s ingredient for a more au courant one.

“Providing ingredient solutions means providing a total formulation solution,” Rainford said.

Cleaning up their acts

Dairy processors are navigating this landscape as they move their formulations toward more natural territory. According to the Dairy Foods 2013 Ingredient Study of dairy processors, fully 52% of respondents expected to spend more on natural and/or organic ingredients in 2013 than in 2012. That commitment belies the notion that natural is just a buzzword, either among consumers or the dairy manufacturers who cater to them.

Senior Marketing Manager Todd L. Sitkowsk of DSM Nutritional Products, Parsippany, N.J., would agree.

“A macro trend that really stands out and is applicable with nearly all dairy-based products are naturalness and clean label,” he said. “Many dairy companies are looking to simplify their product labels and are interested in natural or naturally sourced products.”

And they’re increasingly pressured to do so. Consider that GMO Inside, a nationwide coalition of opponents of genetically modified organisms (GMOs) led by Green America, has instigated a petition campaign to force Chobani, America’s leading Greek-style yogurt brand, to use milk only from cows not fed GMO-containing feed. Whether you support their initiative or not, the perception that it’s time to clean up our acts isn’t going away.

But while natural ingredients are on the upswing as consumer awareness rises, manufacturers must still “boost the sensory appeal of their dairy products while delivering on the natural element,” said Loren Ward, the director of R&D for Glanbia Nutritionals, Twin Falls, Idaho. In other words, natural is nice, but taste, appearance and texture still win.

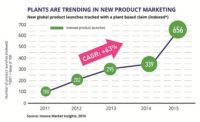

One sector where we see the convergence of natural sourcing and sensory appeal is in the color arena, where natural is the “new normal” for today’s dairy industry. A combined study by Mintel and U.K.-based Leatherhead Food Research found that the global value of natural colors finally overtook that of their synthetic counterparts this year, and that the use of natural colors in new food and beverage launches now beats out synthetics by two to one worldwide.

“Natural colors are used more frequently, and customers want to see continued improvement in stability, range and availability in natural colors,” said Mike Geraghty, president, color group, Sensient Technologies Corporation, St. Louis, Mo.

Experts agree that today’s natural options deliver more shades — and deliver them more stably — than in the past, even under stressful processing and product environments, such as acidic drinks and yogurts.

This past summer, in fact, the company launched what it claims is the first titianium-free opacity agent in the industry, giving manufacturers a unique clean-label alternative to titanium dioxide. The powder falls outside the realm of California’s Proposition 65 labeling requirements, while also being GMO-, allergen- and off-note free, and stable across pH levels. As an added bonus, a company press release notes that its coating properties make it an excellent zero-calorie replacement for dusting sugar — helping manufacturers address another contemporary formulation demand.

The lowdown on sugar reduction

Indeed, consumers are increasingly uneasy with the amount of sugar in their diets — and they’re displaying a concomitant zeal to scrub it from the products they purchase. It’s a complicated issue that sorts sweeteners into “good” and “bad” camps that, though real in consumers’ minds, may not be all that credible from a nutrition science standpoint.

Nevertheless, the public is warming up to the argument that calories do count, and that we’re getting too many of them from simple carbohydrates. No wonder a recent consumer attitudes and behavior study from Mintel found that total sugars more than any particular sweetener are what consumers aim to avoid, with anywhere from 17% to 26% of soda, yogurt and bread purchasers claiming to want fewer sugars overall.

Sweetener suppliers are paying heed. As Steviva Ingredients President Thom King said, “We believe that replacing sugar in yogurt, ice cream and flavored milk with all-natural sugar substitutes will be a trend in the coming years.”

The head of the Portland, Ore.-based firm said he has heard from several dairy processors “asking for a solution to reduce calorie counts in prepared fruit concentrates for flavored yogurt, as well as in flavored milk. Yet while they’re concerned with sugar content, the second-greatest concern is being able to deliver a clean label to consumers.”

And there’s the rub. Replacing sugar with a “chemical-sounding” high-intensity sweetener might solve one problem even while creating another. Then there’s the effect that removing sugar has on the underlying formulation and processing dynamics.

As Gonzales said, “Reducing sugar in dairy not only impacts the sweetness profile, but also has an impact on the taste and texture of the final product.”

Add to that the unintended consequences on mouthfeel, lost bulk, shelf stability and freezing-point depression and you understand: Any sugar-reduction solution needs to answer the top-level trend, while also contending with the unintended consequences of the substitution.

So what options are out there? Natural, stevia-based alternatives have been getting most of the attention, as successive generations improve upon the initially objectionable taste of some steviol glycosides.

In guiding customers to the optimum option, whether stevia or otherwise, King described his approach as “collaborating with manufacturers on finding the exact natural sugar substitute for their particular application.”

So if mouthfeel and flavor are top priority in a dairy beverage, he’d point the formulator not to a pure stevia option that only replicates sugar’s sweetness, but to a blend that might also include non-GMO crystalline fructose as a carrier and bulking agent, or to a stevia-fortified agave nectar that also adds needed bulk.

In addition to building back some of sugar’s texture, “Both deliver a lower calorie count, clean label, brilliant mouthfeel and a flavor profile identical to HFCS or sucrose,” King said.

One dairy category that has consistently complicated sugar-reduction efforts is frozen dairy. As Rainford said, “The loss of solids is not only important from texture, mouthfeel and flavor standpoints, but also in terms of the freezing point. Rebalancing the hydrocolloids and bulking agents is crucial to achieving the desired freezing point and texture of the product.”

Bulking agents like polydextrose, maltodextrin and polyols are go-to solutions for reduced-sugar ice creams and frozen yogurts. Processors can also use a soluble corn fiber to partially replace solids in reduced-sugar formulations, Rainford said. And depending on the use level, it might also “deliver the added benefit of a dietary fiber claim,” she noted.

Speaking of which, soluble oat fiber, which used to be limited mainly to baked goods and cereals, is now practical for use in dairy beverages thanks to extra-fine forms of oat beta-glucan from companies like DSM.

“Drinkable yogurt is a primary target for heart-healthy fortification, as are dairy smoothies,” said Marlena Hidlay, marketing manager at DSM. “Dairy-based oat beverages are gaining popularity as consumers look for convenient, yet nutritious, on-the-go meals and snacks.”

Protein positive

Introducing good-for-you ingredients like oat and corn fiber is the flipside of the cut-the-sugar imperative that colors so much of today’s dairy development. The recent Dairy Foods 2013 Ingredient Study found 36% of respondents planning to increase their 2013 spending on functional ingredients like amino acids, antioxidants, vitamins and minerals over the previous year’s levels. And if industry observers are right, a healthy chunk of that spending will go to protein ingredients.

What makes dairy proteins so appealing to consumers are their high levels of essential amino acids, not to mention their widely acknowledged quality as a protein source. For product developers, they’re exceptionally functional and have a reputation for operational friendliness.

“We predict a continued rise in the popularity of dairy proteins as more consumers become aware of their nutritional benefits,” said Ward. “As a result, manufacturers are looking to combine nutrition and functionality, and ingredient solutions are following suit.”

Today’s dairy proteins are worlds better than their predecessors thanks to this melding of health with practicality.

“We are reaching a level of complexity that allows for the tailoring of whey protein and milk protein ingredients for specific nutritional and functional characteristics,” Ward said.

For example, functional whey protein concentrates can stabilize emulsions in salad dressings and sauces while also allowing for fat reductions of as much as 25% without compromising taste or texture, he said. Functional whey proteins increase yield, improve mouthfeel in yogurts and dairy drinks and can mimic the water-binding and gelling properties of pricier ingredients like gums, phosphates and hydrocolloids.

Dairy protein’s nutrition story deserves the attention it’s getting. For example, we start losing 1% to 2% of our muscle mass per year once we hit age 40 to 50, Ward said.

“Research shows that many can decrease this rate of muscle loss by exercising and consuming proteins that are quickly absorbed, have a high level of the amino acid leucine and also contain significant levels of branched-chain amino acids,” he said.

Sustainable strategies

So where does sustainability fit into this picture — and what, for consumers, manufacturers and their suppliers, does the term mean? The industry is still figuring that out, but it’s implementing across-the-board sustainability strategies in the process. Indeed, if you’re not dedicating some effort to sustainability, you’re falling behind.

Ward notes that his company’s heritage “is rooted in sustainability,” dating back to its inception as a cooperative of Irish dairy farmers. Even now, with personnel numbering roughly 1,000 and locations in the Western United States, Glanbia “has retained its sustainable strategy,” he declared.

The company has collaborated with the Innovation Center for U.S. Dairy in “precompetitive, multi-stakeholder initiatives to achieve the breakthrough goal of reducing all dairy greenhouse gas emissions by 25% by 2020,” he said.

For its part, Steviva “believes there is no responsible alternative to doing business other than through environmentally sustainable practices,” King said. That’s why the company’s packaging comes from 100% recycled plastic, it operates its own internal recycling program, its fleet vehicles run on alternative fuel, renewable sources power its manufacturing and office facilities and the company maintains a commitment to zero-carbon output while also donating a portion of net profits to nonprofit environmental organizations.

Sensient Colors’ line of palm-free natural colors addresses both the natural trend and concerns surrounding deforestation and wildlife habitat preservation raised by the skyrocketing growth in palm production. The new colors are free of palm-derived components and fare well in stability testing and against degradation, according to a company press release.

Some suppliers are even helping dairy processors buff their own sustainability profiles with ingredients that can clean up some aspect of formulation or production. For example, Ingredion offers a texturizing system that Gonzales said addresses the Greek yogurt trend and its by-product: acid whey. Acid whey harms aquatic life and confounds easy disposal. The value of the texturizing system is that it lets manufacturers avoid both the upfront costs of traditional Greek-style straining equipment and the acid whey that straining generates.

Alternatively, manufacturers could take advantage of a newly developed process that turns all that acid whey into nutritious, high-margin dairy products like fermented protein beverages, whey smoothies and fermented desserts. Dairy processors can trade storage, transportation and disposal costs for potential profits from value-added products, according to an Arla Food Ingredients press release. It sounds like a fair trade.

As Gonzales said, the key to making sustainability stick is “making operations and improvements cost efficient, so they do not impact product profitability.”

In fact, you could say the same for all the other trends that have swept dairy in the past year — and will likely keep the wind in its sails for 2014. With “clean, lean, green and full of protein” an unofficial rallying cry, it’s a relief to know that the state of the ingredient sector is strong.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!