Sales of energy drinks surge, sports drinks fumble

Energy drink sales get a jolt, while sports drinks aren’t quite hitting it out of the park.

Energy drinks are showing significant increases in dollar and unit sales, despite warnings from health officials mentioned in news reports recently. On the flip side, some sports drink companies are struggling, showing decreases in dollar and unit sales.

In the 52 weeks ended Dec. 30, 2012 the energy drink category saw dollar sales jump 13.7% to $9.6 billion, and units rose 14.8% to 3.6 billion, according to data from SymphonyIRI Group, Chicago. In the same period, dollar sales for the sports drink category went up 4.9% to $5.6 billion, with unit sales also up 4% to 3.2 billion.

As defined by SymphonyIRI, the energy and sports drink categories consist of the following segments:

Energy drinks

• Shelf-stable Energy Drinks Non-Aseptic ($8.1 billion sales, units up 15.1%)

• Shelf-stable Energy Drinks Aseptic ($1.6 million sales, units up 188.3%)

• Shelf-stable Energy Shot ($1.3 billion sales, units up 1.5%)

• Shelf-stable Energy Drink Mix ($183.4 million sales, units up 204.5%)

Sports drinks

• Shelf-stable Sports Drinks Non-Aseptic ($5.5 billion sales, units up 4.4%)

• Shelf-stable Sports Drink Mix ($102.3 million sales, units down 25.8%)

• Shelf-stable Sports Drinks Aseptic ($21.7 million sales, units down 23.7%)

The Shelf-stable Energy Drink Mix segment saw the biggest jump with dollar sales up 235.7% to $183.4 million, the units were up 204.5% to 63.6 million. Among the top five, Kraft Food’senergy drink mix led in overall dollar sales at $116.4 million. It also saw the biggest increases with dollar sales up 319.7% and units up 203.4%.

Leading the energy drink category in dollar sales was the Shelf-stable Energy Drinks Non-Aseptic segment with $8.1 billion sales. It saw an increase in dollar sales, up 14.3%, with units up 15.1%. Red Bull North Americaled this segment in dollar sales with a 16.2% increase to $3.3 billion. The unit sales were up 17.5%. Following close behind was Monster Beverage Corp.with $3 billion sales, up 21.5%, and units up 23%.

Within the energy drink category, the Shelf-stable Energy Shot segment saw only a small dollar increase of 1% and units up 1.5%. Among its top brands, Living Essentialsdominated the segment with $1.1 billion sales. Its dollar sales were up minimally by 1.3%, but the units were down 0.8%. Private label had the best success with dollar sales jumping 30.2% and units up 65.7%.

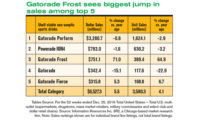

In the sports drinks category the Shelf-stable Sports Drinks Non-Aseptic segment dominated in dollar sales at $5.5 billion. The dollar sales increased 5.6% and units were also up 4.4%. Though it had a smaller piece of the pie, Starbucks Coffeesaw a significant increase in dollar sales, up 12,060.2% to $42.8 million, with units jumping 12,868.3%. Quaker Oats Co.led the segment in dollar sales at $4.2 billion, with sales up only slightly at 3.6% and units up 2.7%.

Also in the sports drinks category, the Shelf-stable Sports Drink Mix segment struggled with both dollar and unit sales. Dollar sales saw a 14.4% drop and unit sales a 25.8% drop.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!