Home » clean ingredients

Articles Tagged with ''clean ingredients''

Opposites attract in the frozen dessert market

Frozen dairy desserts embrace good-for-you indulgence.

December 5, 2018

Bring the goodness of juice into focus

Premium juices, lower-sugar options offer path to success.

February 16, 2018

The marriage of dairy foods and clean labels

The key to achieving on-trend dairy products is the use of simple ingredients that have a purpose.

October 3, 2017

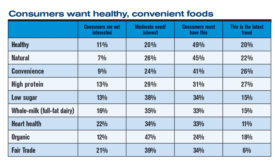

Exclusive survey: Buyers of ingredients are leaning clean, natural

With new products under development, dairy processors are lining up ingredients and suppliers. Here’s an exclusive look at how they buy and their sourcing strategies.

May 8, 2017

State of the Industry 2016: Ingredients will come clean in 2017

Clean-label formulation can’t come at the expense of functionality. Those in the R&D lab need to consider the ramifications of swapping out traditional ingredients for alternatives.

November 21, 2016

Stay ahead of the curve. Unlock a dose of cutting-edge insights.

Receive our premium content directly to your inbox.

SIGN-UP TODAYCopyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing