Home » sales data

Articles Tagged with ''sales data''

Only modest growth for natural cheese

But refrigerated grated cheese, cheese cubes and cheese slices are outperforming the total category.

December 5, 2018

RTD tea and coffee post healthy dollar and unit sales

Refrigerated tea and refrigerated ready-to-drink coffee post healthy dollar and unit sales gains.

October 9, 2017

Frozen dessert sales are melting

Sales for frozen cheesecakes, frozen puddings and whipped toppings are down across the board.

September 8, 2017

Ice cream sales see a boost

Ice cream and some frozen novelty sales are climbing, though it’s a different story for sherbet and frozen dairy desserts.

August 4, 2017

Flavored and whole-milk sales keep milk afloat

Unit sales are on the rise for the flavored milk and whole milk segments yet the overall category is down.

February 7, 2017

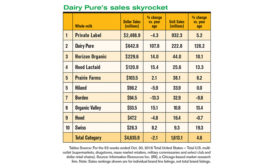

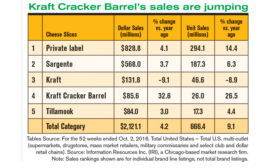

Natural cheese slices its way to the top

Sales look good for slices, shreds and sticks in the natural cheese category, while processed cheese holds onto hope with its spreadable cheeses.

December 8, 2016

RTD coffee and tea sales are energized

Unit sales and dollar sales of both refrigerated ready-to-drink coffee and refrigerated teas increase.

October 10, 2016

Frozen dessert sales make producers frown and say ‘cheesecake’

The picture for cheesecakes, whip toppings and frozen puddings is not pretty. Sales dropped in all those segments. Sales of frozen sweet goods show some promise.

September 5, 2016

Sales of veggie juices, lemonade sales are all juiced up

Sales are promising for vegetable juices, juice drinks, smoothies and lemonade. Orange juice sales struggle.

June 8, 2016

Stay ahead of the curve. Unlock a dose of cutting-edge insights.

Receive our premium content directly to your inbox.

SIGN-UP TODAYCopyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing