Chobani tops $100M in refrigerated oat milk sales

Entire subcategory rises, along with coconut milk and kefir.

Photo courtesy of a_namenko via www.gettyimages.com

At first glance, oats and coconuts have little in common. But they certainly share one thing: as milk alternative products, both products are flying off the shelves.

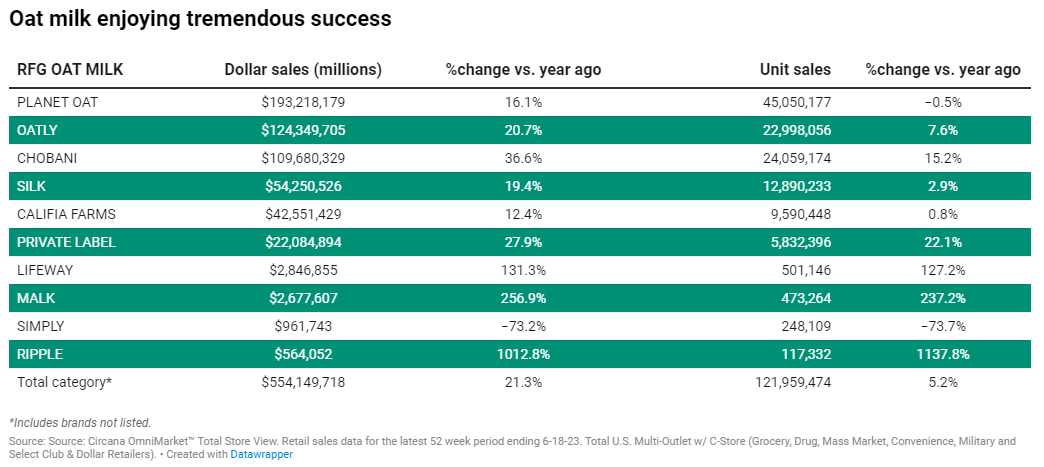

According to Circana, a Chicago-based market research firm, for the 52 weeks ending June 18, overall refrigerated oat milk dollar sales rose 21% to $554 million, while unit sales rose by 5% to 122 million. Leading this category in dollar sales for the recent 52-week period was Planet Oat. The HP Hood Inc. brand saw its dollar sales increase 16% year over year (YoY) to $193 million. However, its unit sales, at –0.5%, dipped slightly to 45 million.

Joining Planet Oat in the $100 million dollar sales club within the refrigerated oat milk category are Oatly Inc. and Chobani Inc. Malmö, Switzerland-based Oatly’s dollar sales increased by 21% to $124 million, while its unit sales grew 8% YoY to 23 million. As the result of a strong year, Norwich, N.Y-based Chobani topped $100 million in oat milk sales for the first time. Its dollar sales increased by 37% YoY to $110 million, while unit sales climbed 15% to 24 million, Circana data reports.

Lifeway Foods also had a strong year, seeing triple-digit gains in both dollar sales and unit sales. Its dollar sales skyrocketed 131% to nearly $3 million, while the Morton Grove, Ill.-based company’s unit sales grew by a nearly equal 127% to 501 million.

One to watch in the refrigerated oat milk subcategory is Ripple Foods. According to Circana, the Emeryville, Calif.-based company’s dollar sales skyrocketed to $504,062, a increase of 1,013%, while unit sales gained 1,138% to 117,332.

The overall refrigerated coconut milk subcategory grew its dollar sales by 23% YoY to nearly $89 million, to go along with a unit sales increase of 4% to 21.8 million. Topping this category and nearly tripling sales of competitors was Danone US LLC’s Silk, whose dollar sales grew 36% to $51.2 million, joined by a healthy 8% advancement in unit sales to 12.4 million for the period ending June 18.

Among the other brands to exhibit both dollar and unit sales growth in the refrigerated oat milk category were Bergenfield, N.J.-based Remedy Organics, Los Angeles-based Califia Farms and Miami-based De Mi Pais. Remedy’s dollar sales rose 44% to $5.4 million and unit sales increased 42% to 1.3 million; Califia Farms’ dollar sales lifted 39% to $3.7 million along with a unit sales jump of 33% to 881,029; and from a much smaller base, De Mi Pais’ dollar sales jumped 54% to $213,661, while its unit sales rose 41% to 61,557, per Circana data.

Another standout subcategory for the period ending June 18 was refrigerated kefir, whose dollar sales increased 20% to $129 million, to go along with an 8% rise in unit sales to 32.6 million. No. 1 in terms of sales in refrigerated kefir is Lifeway Foods. Its dollar sales rose 22% YoY to nearly $113 million, while its unit sales rose 11% to 29 million.

Both Lifeway Foods’ dollar sales and unit sales results are 20 times that of any of its competitors. However, some competitors did experience solid YoY increases, including Indio, Calif.’s Forager Project, whose dollar sales increased by 42% to $2.8 million, along with a unit sales advancement of 29% to 379,787; and Kinderhook, N.Y.’s Maple Hill, whose refrigerated kefir dollar sales skyrocketed by 164% to $1.28 million, with unit sales jumping 156% to 191,500, according to Circana.

In the more “mature” refrigerated soy milk subcategory, dollar sales rose by a strong 13% YoY to $171 million, but unit sales dropped 4% to 45 million. Silk led the way in this subcategory with $144 million in dollar sales, a 15% gain YoY, but unit sales dipped 4% to 35.4 million.

Mixed results also could be found in refrigerated almond milk, whose dollar sales increased 3% YoY to $1.57 billion, but unit sales suffered a nearly 9% decline to 419 million. Approximately 40% of dollar sales in the refrigerated almond milk subcategory belong to Blue Diamond. The Sacramento, Calif.-based cooperative’s dollar sales increased by 9% YoY to $611 million, while its unit sales dropped by 5% to 147 million, Circana data demonstrates.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!