2020 State of the Industry: Ice cream is a category on fire

The COVID-19 pandemic created a hot spot for ice cream/frozen novelty purchases.

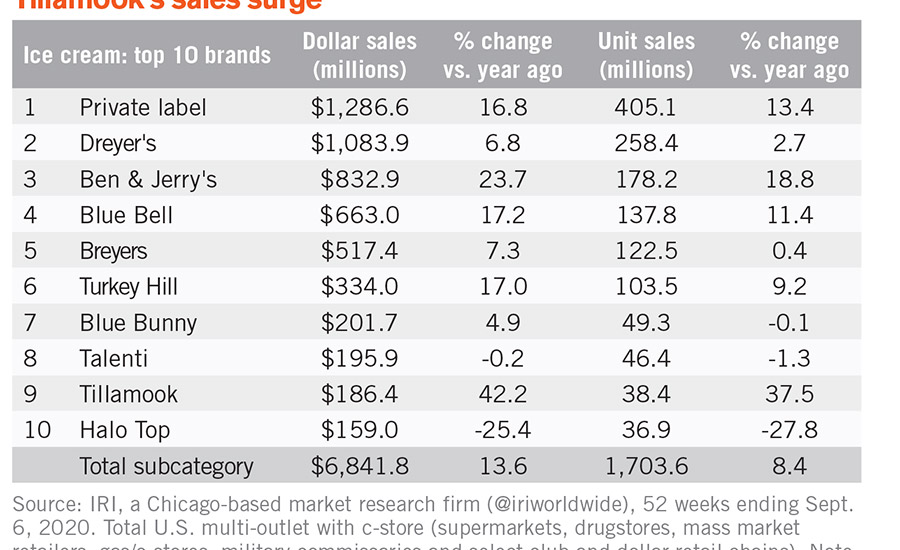

Retail ice cream sales might not have being eating fire this year, but they certainly have been on fire. Over the 52 weeks ending Sept. 6, 2020, dollar sales in the ice cream subcategory of the larger ice cream/sherbet category were up 13.4% (to $6,841.8 million), while unit sales increased by 8.4% (to 1,703.6 million), according to data from Chicago-based market research firm IRI.

The frozen novelties subcategory also has been heating up, with dollar sales soaring 16.0% (to $5,784.1 million) and unit sales jumping 9.1% (to 1,650.6 million).

Milk | Cheese | Cultured | Ice Cream | Butter | Non-dairy Beverages | Ingredients | Exports

The coronavirus shutdowns certainly helped stoke the flames, with more consumers reaching for the familiar comfort of ice cream while at home. But will this growth streak last as the United States continues into a recession?

According to global market research firm Mintel, yes — at least in the near future.

“Looking back at past recessions indicates that in these types of circumstances people tend to nest (indulge at home) and reach for accessible indulgences (like ice cream), prolonging a residual yet tempered growth for the category,” the company notes in its “Ice Cream and Frozen Novelties: Incl Impact of COVID-19 US April 2020” report.

Dena Wimette, senior innovation manager for Ben & Jerry’s, Burlington, Vt., notes that in March, the products that were flying off the shelves were toilet paper, beer and ice cream.

“So it's an interesting time to be in ice cream,” she adds. “It's interesting to be in the world, period, but in ice cream, definitely.”

A comfort food blowout

When grappling with the uncertainty of the COVID-19 pandemic, many consumers turned to familiar and comforting indulgences, Mintel notes.

“Fifty-one percent of consumers associate ice cream with comfort,” the company adds. “Furthermore, 45% report that ice cream is their favorite indulgence, pointing to a well-positioned opportunity for brands in the category to forge bonds with consumers.”

According to George Denman, vice president of Cincinnati-based Graeter’s Ice Cream, indulgence-minded brands have seen more of a retail sales uptick than brands with healthfulness in mind such as Halo Top.

“Another big winner was the turnaround in large-size brands like Breyers, Edy’s, Friendly’s and Turkey Hill,” he adds. “With kids at home and not in school, mom stocked up on these 48-ounce containers, which prior to the pandemic were anemic [in sales] at best.”

Lindsey Meuser, assistant category manager, ice cream for Tillamook County Creamery Association, Tillamook, Ore., predicts that premiumization will continue in the category.

“Coronavirus has led to significantly increased ice cream consumption, and we’re finding that consumers are choosing to splurge on premium offerings as they seek out more opportunities to treat themselves with an extra-special dessert during such uncertain and emotionally exhausting times,” she adds.

Sal Pesce, president and chief operating officer of Serendipity Brands, New York, notes that retail sales of superpremium brands and pints, in particular, have seen “double-digit increases” month over month. He also observed that the shortage of certain products on retail shelves led to consumers trying out lesser-known brands.

“Unfortunately, it's not the way you want to grow the category with this devastation that happened to our country, but it's absolutely had a positive effect on sales in retail,” he notes.

To build on the positive attributes associated with ice cream, Ben & Jerry’s has aimed for a fun brand presence while people are stuck at home, notes Rebecca Robinson, head of operations. The company pulled together an “Operation Joy” team to create “fun for our fans in a time where there's a lot of stuff going on that's really serious.”

And Cleveland-based Pierre’s Ice Cream Co. created a new ice cream line to honor “everyone who has adapted, struggled, sacrificed and persevered during this challenging time,” says Laura Hindulak, vice president of marketing.

According to Pierre’s, the Heroes ice cream pint line comes in three flavors: Hearts for Heroes, which is black raspberry ice cream with raspberry-filled chocolaty hearts; Super Stars, which is vanilla ice cream with peanut butter-filled chocolaty stars and peanut butter swirl; and Virtual Hugs, which is caramel ice cream with sea salt caramel truffles.

The company will donate $1 of every sale to local food banks through the assistance of the Cleveland Food Bank, explains Hindulak.

Indulgent flavors swallow the competition

While at home, many consumers have craved the adventurous flavors of their local scoop shops, notes Meuser. This has inspired ice cream companies to create extra-indulgent and adventurous flavors.

“With consumers spending more time at home in 2020 and likely into 2021, we see a lot of opportunity to recreate the scoop shop experience at home with more unique or funky flavors that they might ordinarily seek out from an ice cream shop,” she adds.

For example, ChurnBaby Ice Cream, a newly launched brand of Richmond, Utah-based Casper’s Ice Cream Inc., promises to deliver a hip, boutique ice cream experience from the comfort of home. Made with ultrapremium ingredients, ChurnBaby’s products bring an elevated twist on classic ice cream flavors, the company notes.

ChurnBaby Cookie Cups come topped with a full cookie and a spoon on the inside of the lid for convenient snacking, Casper’s says. The newly launched treats come in four flavors: Choco Chip Cookie Dough, Peanut Butta Brownie Luvva, Cool Mint Chocolate Chip and Choco Chip Vanilla Fudge Brownie. Also available are ChurnBaby ice cream sandwiches. The offerings come in Caramel Cashew and Caramel Cookies ‘n’ Cream flavors.

The indulgence trend already was well established before the COVID-19 pandemic. Some of the overarching trends Denman says he’s seen in the category include texture (with more decadent inclusions), the deconstruction of desserts into ice cream flavors and alcohol/spirits-based varieties.

“We are also seeing a number of birthday cake-flavored ice creams,” he says. “Graeter’s launched their version of an indulgent birthday cake to celebrate its 150th anniversary in July. It quickly became the No. 2 Graeter’s flavor at both Kroger and Giant Eagle in July 2020.”

And The Cheesecake Factory, Calabasas Hills, Calif., expanded its The Cheesecake Factory At Home line by introducing a collection of premium cheesecake ice creams that feature a signature cream cheese blend and sour cream. The collection, which is a collaboration with Le Mars, Iowa-based Wells Enterprises Inc., comes in seven flavors: Birthday Cake, Chocolate, Cookies & Cream, Key Lime, Original, Salted Caramel and Strawberry. The line is available nationwide and has a suggested retail price of $4.99 for a 14-ounce carton, the companies say.

Pesce explains that flavor exploration is important to today’s consumers, and limited-edition flavors are one way to add more adventurous flavors into the category.

According to Bret Buhler, commercial group leader, KanPak LLC, Arkansas City, Kan., “seasonal, decadent or creative flavors” are important to today’s consumers. He notes the popularity of flavors such as salted caramel, brown sugar s’mores and Nutella.

For its part, Serendipity is working with Selena Gomez to introduce one new limited-edition flavor per year, Pesce notes. The first one, Cookies and Cream Remix, “is one of the most demanded pints in the country.” The flavor is a twist on cookies and cream, with pink vanilla ice cream, thick fudge swirl and loads of cream-filled cookies.

“I think people, if they're going to indulge, they want it to be worth it,” says Pesce. “And they want it to be an experience.”

Indulgence is tied into comfort, and some companies have further built on ice cream’s comfort food association by offering up flavors associated with childhood nostalgia. According to Mintel, “71% of U.S. consumers enjoy things that remind them of their past and childhood.”

Serendipity is leaning into this trend. Pesce says that the company is collaborating with Warner Brothers to launch a series of limited-edition flavors based on popular movies or television shows. The first one, Serendipity Central Perk Coffee Almond Fudge, is inspired by the TV show “Friends.”

And Denman notes that kid-friendly breakfast- and cereal-flavored varieties are becoming popular.

“Lucky Charms and Cinnamon Toast Crunch ice cream are two examples of transforming popular cereal flavors into ice cream treats,” he says. “And then there is Good Humor’s Brown Sugar Pop-Tart bars leveraging the breakfast trend.”

Healthy offerings extinguish consumer concerns

On the flip side, many consumers are still looking for “better-for-you” ice cream flavors that can offer indulgence with a bit less of the guilt. However, the meaning of “better-for-you” is changing, notes Mintel.

“Consumers are less motivated by claims like low-calorie, low-fat and low-sugar,” the company reports. “Instead, consumers are prioritizing softer, holistic benefits like simple ingredients and functional benefits.”

Wilmette concurs.

“I think there's still that emphasis on knowing what's in your product and wanting real ingredients. I think that is a sort of macro trend across most foods,” she says. “And so looking for real dairy or real plant-based ingredients, real sugars, things like that.”

To provide more transparency about its products, Ben & Jerry’s launched gluten-free ice cream certification in 10 of its SKUs in October 2020. The flavors already were gluten-free, explains Robinson, but the company wanted to ensure consumers had a certification to reference on-pack.

According to Buhler, the better-for-you trend isn’t necessarily about losing indulgence, but rather about offering “health benefits that are important to consumers.”

“For example, this may include products that are free of preservatives and low in fat, as well as products that include premium-quality and fresh ingredients such as fruit puree and chocolate or vanilla extract,” he explains.

Los Angeles-based Real Good Foods Co. built on this trend by launching a better-for-you superpremium ice cream made from simple ingredients. Real Good Foods ice cream has a fraction of the carbs of traditional ice cream and is sweetened with allulose, a naturally occurring sugar, the company says.

According to Real Good Foods, other healthier ice creams are classified as “light” ice cream, while its offering is superpremium. The ice cream is made with 16% butterfat and fits the standard of identity for real superpremium ice cream without the calories and carbs. It comes in seven flavors: Vanilla, Chocolate, Mint Chip, Peanut Butter, Salted Caramel, Mocha Java Chip and Cake Batter.

Luconda Dager, president of Velvet Ice Cream Company Inc., Utica, Ohio, notes that consumers also are requesting ice cream to serve multiple functions and include ingredients such as probiotics and cannabidiol.

Another major trend in this space is ice cream that fits into the ketogenic diet. Halo Top, a brand of Le Mars, Iowa-based Wells Enterprises Inc., says it introduced the Keto Series — seven flavors of ice cream designed for people following the diet.

The Keto Series incorporates creamy, ultrafiltered skim milk, which provides fewer calories than regular milk and is a good source of protein. With net carbs ranging from 5 to 10 grams and calories from 410 to 630 per pint, the line is lower in calories than regular ice cream without sacrificing flavor, says Halo Top. Flavors include Peanut Butter Chocolate, Caramel Butter Pecan, Chocolate Cheesecake, Jelly Donut, Berry Swirl, Banana Cream Pie and White Chocolaty Macadamia Nut. The line is available in 16-ounce pints and has a suggested retail price of $5.99.

Another way to offer indulgence without the guilt is to create opportunities for portion-controlled snacking, explains Wimette.

“I think one of the things that I've paid attention to and seen a lot more of is this increase in bite-sized and snacking, and more portion-controlled offerings where people are really getting a chance to make more choices on their own and customize how much they're eating and when they're eating it,” she says.

A lot of the portion-controlled innovation has been on the novelty side, Wimette adds. For its part, Ben & Jerry’s introduced Cookie Dough Chunks in 2019, which are half-pound bags of the dough found in the company’s iconic Cookie Dough ice cream flavors. The frozen chunks come in Chocolate Chip Cookie Dough, Peanut Butter Chocolate Chip Cookie Dough and Vegan Chocolate Chip Cookie Dough varieties.

Coronavirus snuffs out traditional retail

While the past year has been a sweet time for ice cream, the category has also experienced its fair share of challenges, says Meuser. A big one has been dealing with supply chain interruptions due to the COVID-19 pandemic.

“Coronavirus has really challenged supply chains across, making it difficult to keep up with increased consumer demand that isn’t showing signs of slowing down,” she explains. “True to our challenger mindset, Tillamook has worked hard across the organization as one team to ensure we’re addressing this increased consumer demand in an agile way.”

According to Robinson, it’s also been difficult for many companies to keep up with the increased consumer demand. Ice cream is one of the grocery store aisles where there has been a lot of out of out-of-stock products.

“We've seen a lot of brands that are struggling to keep up with the demand,” she says. “There's also logistics in manufacturing, so a lot of companies trying to handle extra stress, workloads on their teams from a logistics standpoint, like even the amount of truck drivers available.”

Another challenge brought on by the pandemic is that consumers are changing how they shop and are using more online delivery services. According to Mintel, Generation Z and millennials, in particular, are looking beyond traditional grocery stores to e-commerce. This trend is likely to accelerate as the COVID-19 pandemic continues.

“The residual adoption of e-commerce as a food and drink purveyor is already evident and is likely to accelerate,” the company reports. “Value and product integrity may be a concern for more pragmatic consumers who may be hesitant to make the leap to buying ice cream online. Brands will need to partner with online retailers and third-party delivery services to address those concerns, or develop programs of their own.”

According to Meuser, while ice cream faces an additional challenge in the direct-to-consumer space, as it needs to be shipped frozen, this area also represents a huge opportunity.

“With consumers spending less time shopping the aisles, having robust, easy-to-navigate and functional direct-to-consumer models will be a big unlock in the category,” she says.

Milk | Cheese | Cultured | Ice Cream | Butter | Non-dairy Beverages | Ingredients | Exports

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!