Retail sales of refrigerated juices rebound

But shelf-stable juice categories continue to struggle.

Consumers are shunning sugar, and there’s no shortage of beverage innovation reflecting this reality. So it’s no wonder that the U.S. retail juice segment has had a tough time of it in recent years.

But if recent sales within the refrigerated juices/drinks category — the largest retail juice segment — are any indication, the tide could be turning. Data from Chicago-based market research firm IRI show that dollar sales within this category actually rose 2.0% to reach $6,537.1 million during the 52 weeks ending March 22, 2020. Unit sales were up 2.4% to 2,246.4 million.

Orange juice rebounds

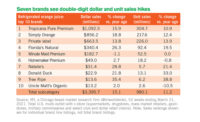

The largest refrigerated juice category, orange juice, saw a turnaround, too. Dollar sales increased by 1.6% to $2,906.5 million, while unit sales climbed 1.9% to 867.2 million.

The Uncle Matt’s Organic brand (at press time, Dean Foods Co. was in the process of selling the brand to Harmoni Inc.) racked up the biggest sales increases among the top 10. Dollar sales climbed 28.7%, and unit sales jumped 41.4%.

Close behind was Donald Duck (Citrus World Inc.), which realized dollar and unit sales gains of 21.1% and 37.1%, respectively. The Natalie’s brand (Natalie’s Orchid Island Juice Co.) also fared well, with dollar sales rising 21.1% and unit sales swelling 18.7%.

Performing the worst among the top 10, meanwhile, was the Orchard Pure brand (Dean Foods Co., at press time). Dollar and unit sales were down 16.3% and 17.3%, respectively.

But some other, smaller refrigerated juice categories outperformed the refrigerated orange juice subcategory. Refrigerated pineapple juice saw dollar sales rise 23.8% and unit sales grow 26.5%. Refrigerated cranberry juice/cranberry juice blends posted 13.3% and 17.4% dollar and unit sales increases, meanwhile, while refrigerated grape juice realized 12.1% and 10.9% dollar and unit sales gains.

The biggest loser within the refrigerated juices/drinks category is also one of the smallest subcategories: refrigerated lemon/lime juice. Dollar sales fell 53.9%, while unit sales took a 50.8% nosedive.

Mixed results for shelf-stable juices

It was a good news/bad news situation on the shelf-stable side. The good news? Dollar sales in the shelf-stable canned juices category were up 2.8% to $1,374.7 million. Unit sales didn’t fare as well, however, declining by 3.2% to 770.9 million.

Within the largest shelf-stable canned juice subcategory — canned juice drinks — Mtn Dew Amp Game Fuel (PepsiCo Inc.), was the growth leader among the top 10 brands. Dollar sales skyrocketed 295.3%, and unit sales jumped 286.0%. On the flip side, Mtn Dew Kickstart lost the most ground, with dollar and unit sales declining by 25.0% and 22.7%.

The bad news could be found in the bottled and aseptic juice segments. The shelf-stable bottled juice category saw dollar sales fall 0.2% to $6,990.6, and unit sales tumbled 2.0% to 3,100.4 million.

Dollar sales within the largest shelf-stable bottled juice subcategory — bottled fruit drinks — also posted sales declines. Dollar sales fell 1.2%, and unit sales decreased 3.0%.

The best performer among the top 10 brands was Arizona (Arizona Beverage Co.). Its dollar and unit sales jumped 18.4% and 19.6%. The worst performer was Minute Maid (The Coca-Cola Co.), which saw dollar sales tumble 9.0% and unit sales slide 17.1%.

The aseptic juices category lost ground, too. Dollar sales dropped 1.1%, while unit sales took a 2.3% fall.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!