Natural cheese continue to climb

In the ongoing battle for sales, natural cheese continues to outshine processed cheese

The good news continues on the cheese front. According to Portland, Ore.-based Allied Market Research, the U.S. cheese market was valued at $32.3 billion in 2017, and is projected to reach $40.5 billion by 2025, growing at a compound annual growth rate of 2.8%.

Although its share of those sales is much lower than those overall values, the U.S. retail channel also has much to celebrate — at least on the natural cheese side. Data from Chicago-based market research firm IRI for the 52 weeks ending Oct. 6, 2019, show that dollar sales of natural cheese rose 1.6% to $13,165.8 million. Unit sales increased 1.9% to 3,990.1 million.

Continuing its multi-year downward trend, the processed cheese category posted less-than-positive results, however. Dollar sales fell 2.7% to $2,793.6 million, while unit sales tumbled 2.9% to 723.2 million.

Cheese cubes shine

In the largest natural cheese subcategory — shredded cheese, with 2.1% and 3.1% dollar and unit sales gains, respectively — a couple top 10 brands shined more brightly than others. One of those is Tillamook (Tillamook County Creamery Association), which saw dollar sales jump 35.4% and unit sales take off 38.6%. Cabot (Agri-Mark) is another. Its dollar sales rose 34.5%, and its unit sales increased by 34.6%.

A couple other top 10 brands posted less-positive results. Philadelphia (Kraft Heinz Co.) saw sales fall 22.7% and unit sales decrease by 20.6%. And Sargento (Sargento Foods) posted 11.1% and 11.8% dollar and unit sales declines, respectively.

But one of the smallest natural cheese subcategories made the biggest gains overall. Dollar sales in the cheese cube subcategory were up 13.9% to $139.7 million, and unit sales rose 23.6% to 37.2 million.

Taking the lead here among the top 10 is the Wisconsin Cheese Company brand from the company with the same name. Dollar sales skyrocketed 79.8%, while unit sales shot up 78.3%.

On the flip side, the Shullsburg brand (Shullsburg Creamery) fared the worst. Dollar sales took a 25.8% dive, while unit sales were down 24.9%.

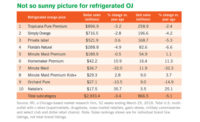

Another natural cheese bright spot is refrigerated grated cheese. Dollar sales in the subcategory climbed 4.4% to $111.4 million, while unit sales rose 5.7%.

Liuzzi (Luizzi Cheese) led the way in growth among the top 10 here. The brand’s dollar sales jumped 41.3%, while its unit sales increased by 40.4%.

The only brand to lose ground among the top 10 was Stella (Saputo Cheese USA). Dollar sales fell 20.0%, and unit sales dropped 20.8%.

Plant-based offerings make gains

Within the processed cheese category, the processed cheese slices subcategory continues to lose ground. Still, four top 10 brands managed to buck the downward sales trend (see the table). Most notable among those are two plant-based brands that actually contain no dairy ingredients: Daiya (Daiya Foods) and Follow Your Heart (Follow Your Heart/Earth Island).

Daiya posted an impressive 45.6% increase in dollar sales and a 49.4% gain in unit sales. And Follow Your Heart saw dollar and unit sales rise 17.6% and 14.7%, respectively.

Taking the biggest fall was Borden (Dairy Farmers of America). Dollar sales for the brand fell 16.9%, while unit sales declined 16.6%. Land O Lakes (Land O’Lakes) also posted disappointing results. Dollar and unit sales dropped 14.6% and 10.9%, respectively.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!