Cultured dairy sales plunge

Most cultured dairy categories saw year-over-year dollar sales declines

There’s been little reason for cultured dairy processors to celebrate in recent months. During the 52 weeks ending Feb. 24, 2019, most major cultured dairy categories/subcategories saw retail dollar sales fall, according to data from Chicago-based market research firm IRI.

Yogurt, kefir post steep declines

The largest cultured dairy segment, the spoonable yogurt category, suffered the most. Retail dollar sales were down 3.6% to $7,145.7 million, while unit sales fell 6.0% to 4,216.3 million. (IRI does not break out individual brand data for the yogurt category, and the figures do not include yogurt drinks).

Sales of drinkable yogurt have been growing, but have not yet offset the decline of spoonable yogurt, noted global market research firm Mintel in its October 2018 “Yogurt and Yogurt Drinks — US” report.

“Moreover, drinkable yogurts are likely cannibalizing sales of spoonable,” said Caleb Bryant, senior beverage analyst with Mintel, at the time of the report’s release. “High-protein/low-sugar yogurt styles represent a growth area within the stagnant yogurt market, and there is a strong growth potential for nondairy yogurts.”

Kefir lost even more ground, however. Dollar sales within the refrigerated kefir category tumbled 12.9% to $93.2 million. Unit sales fell 17.1% to 28.9 million.

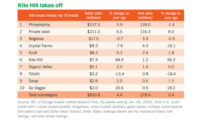

Sour cream, cottage cheese sales flatten

In the sour cream and cottage cheese categories, meanwhile, there was little movement in terms of sales.

The sour cream category’s dollar sales shrank by 0.1% to $1,247.0 million, while unit sales rose by the same percentage, reaching 626.2 million. The standouts among the top 10 brands were Cacique (Cacique Inc.) and Mid-America Farms (Dairy Farmers of America), both of which posted double-digit gains (albeit on small bases). Cacique’s dollar and unit sales jumped 16.4% and 14.6%, respectively. Mid-America Farms saw an 11.2% increase in dollar sales and a 13.5% improvement in unit sales.

Faring the worst among the top 10 was Dean’s (Dean Foods). Dollar sales for the brand took an 8.6% dive, while unit sales dropped 8.8%.

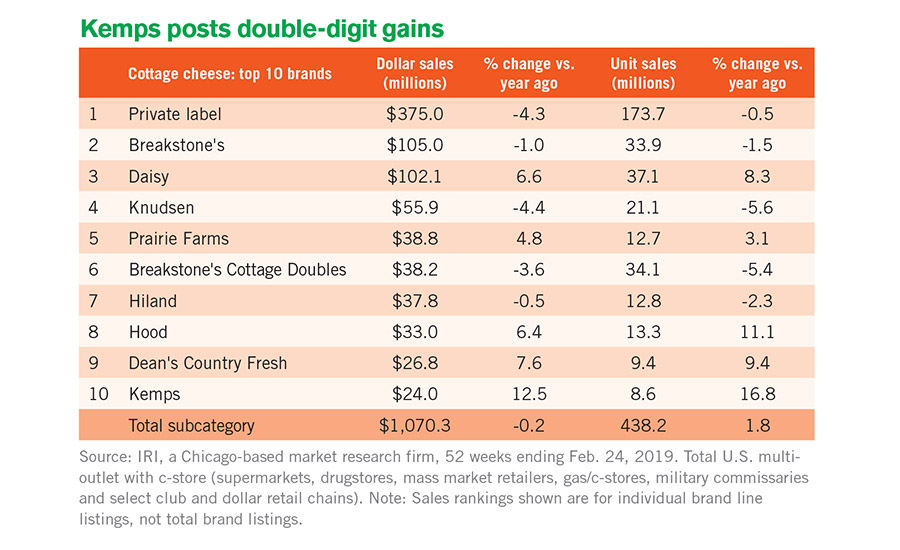

As for cottage cheese, the category saw dollar sales drop 0.2% to $1,070.3 million. Unit sales rose slightly — 1.8% — to 438.2 million.

The star among cottage cheese’s top 10 brands was Kemps (Kemps LLC), which saw a 12.5% increase in dollar sales and a 16.8% rise in unit sales. Dean’s Country Fresh also posted impressive gains: 7.6% and 9.4% increases in dollar and unit sales, respectively.

Cream cheese sales improve slightly

The overall cream cheese/cream cheese spread category posted respectable dollar sales growth — 2.1% — to reach $1,723.4 million. Unit sales jumped 1.6% to 672.9 million.

Within the large brick cream cheese subcategory (up 1.9% in dollar sales and 4.4% in unit sales), several brands among the top 10 performed well. For example, Cabot (Cabot Creamery) saw 8.3% and 9.2% dollar and unit sales gains, respectively. And dollar sales for the Philadelphia brand (Kraft Heinz Co.) rose 6.7%, while unit sales climbed 9.1%.

But six brands among the top 10 posted dollar and unit declines. Faring the worst here was Organic Valley; it saw a 27.5% decrease in both dollar sales and unit sales.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!