Ice cream sales try to stay afloat

Some brands showed decent gains, while others struggled.

The competition among ice cream brands remains fierce, as some scramble to answer the call for “healthy indulgence” and others seek to grab attention with unique flavors and premiumization. What do the numbers tell us? It’s a mixed bag for ice cream right now, with some brands showing strong sales gains, and some other brands posting notable sales declines. Meanwhile, the data show a comeback for frozen novelties.

Dollar sales in the ice cream/sherbet category were up just 0.2% during the 52 weeks ending Nov. 4, 2018, to $6.8 billion, according to data from Chicago-based market research firm IRI. Unit sales fared slightly better — up 1.1% to 1.8 billion. On the flip side, the frozen novelties category saw dollar sales increase 4.2% to $5.2 billion, and unit sales improved 2.3% to 1.6 billion.

It’s a mixed bag for ice cream

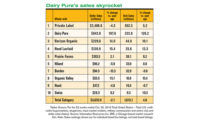

In the ice cream subcategory, dollar sales dropped 0.4% to $6.1 billion, while unit sales increased 0.6% to 1.6 billion. Private label led the subcategory: Here, dollar sales dipped 2.1%, yet unit sales improved 0.8%.

Among the top 10 brands, only a few posted positive sales gains. Ben

& Jerry’s (Unilever) dollar sales improved 3.1%, and unit sales increased 4.6%. Blue Bell (Blue Bell Creameries) saw dollar sales jump 7.1% and unit sales rise 6.1%. Likewise, dollar and unit sales ticked up 4.4% and 4.0%, respectively, for Häagen-Dazs (Nestlé USA). Meanwhile, Halo Top (Eden Creamery), which had been kicking its competition to the curb this past year, saw mixed results. Dollar sales dropped 6.7%, while unit sales rose 4.2%.

But many of the top 10 ice cream brands struggled. Dreyer’s/Edy’s Grand (Nestlé USA) posted dollar and unit sales declines — 2.8% and 3.0%, respectively. Talenti (Unilever) fared the worst — dollar sales dropped 11.9%, and unit sales fell 9.3%. Dollar and unit sales were down 2.2% and 2.3%, respectively, for Breyers (Unilever). Blue Bunny (Wells Enterprises) also struggled; it saw dollar sales fall 5.5% and unit sales dip 4.7%. Outside of the top 10, Dreyer’s/Edy’s Slow Churned was the biggest loser. The brand realized a 12.0% decline in dollar sales and a 13.4% drop in unit sales.

Frozen novelty sales see a boost

Sales looked pretty good in the frozen novelties subcategory, as most of the top 10 brands enjoyed positive numbers. Once again, private label led the way in total sales; its dollar sales rose 4.0%, and unit sales were up 5.1%. Dollar sales increased 4.0% and unit sales were up 3.7% for Nestlé. And Nestlé Drumstick’s dollar and unit sales improved 3.0% and 1.5%, respectively. Blue Bunny impressed the most, however, with dollar sales jumping 16.2% and unit sales getting a 16.0% boost. Häagen-Dazs also did well — dollar sales climbed 8.9%, and unit sales increased 7.4%.

On the downside, a few companies struggled. Dollar sales decreased 2.3% and unit sales dipped 3.3% for Klondike (Unilever). Magnum (Unilever) saw mixed results — dollar sales were up 1.5%, but unit sales fell 1.2%. Good Humor (Unilever) also posted dollar and unit sales declines of 5.5% and 10.3%, respectively.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!