Frozen dessert sales are melting

Sales for frozen cheesecakes, frozen puddings and whipped toppings are down across the board.

Cheesecake sales

Competing in the frozen dessert market can be tough, even more so during a time when so many consumers are paying close attention to labels and their food choices. Consumers are cutting back on desserts, choosing healthier options or reaching for ice cream when they want to indulge. (See related article)

In the latest 52-week period, sales for frozen desserts and toppings struggled. As defined by Information Resources Inc. (IRI), Chicago, the category includes cheesecakes and frozen pudding/mousse.

The frozen desserts/toppings category saw dollar sales drop 3.2% to $671.5 million, and unit sales decline 3.9% to 268.6 million, for the 52 weeks ended June 11, 2017, according to IRI.

The frozen desserts/toppings category consists of these segments:

- Frozen whip toppings ($319.7 million; units down 4.3%)

- Frozen sweet goods - no cheesecakes ($228.9 million; units down 2%)

- Frozen cheesecakes ($122.7 million; units down 4.2% )

- Frozen pudding/mousse ($0.105 million; units down 72.3%)

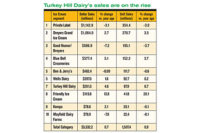

Cheesecake sales are declining

In the frozen cheesecakes segment, dollar sales decreased 11.3% to $122.7 million and unit sales dropped 4.2% to 18.1 million. Private label led the segment with $44.2 million, but dollar sales fell 25.5% and unit sales were down 27.8%. Sara Lee (Hillshire Brand), one of only four brands in the top 10 to see sales increase, saw dollar and unit sales grow 4.5% and 17.6%, respectively. Sales for The Cheesecake Factory (The Cheesecake Factory Bakery) rose 1.2%, but unit sales declined 0.2%. Edwards (Schwan Food Co.) saw dollar sales drop 27.1% and unit sales were down 8.3%.

Dollar sales for Jon Donaire (Rich Products Corp.) jumped 14.7% and unit sales improved 11.9%. Daiya Foods showed some promise with dollar sales climbing 49.4% and unit sales increasing 45.9%. Panarama sales struggled, as dollar sales declined 36.9% and unit sales dropped 34.1%.

In the frozen sweet goods (no cheesecakes) segment, dollar sales fell 1% to $228.9 million and unit sales dipped 2% to 53.4 million. Segment leader Pepperidge Farm’s dollar sales increased 1.6% and unit sales were up 1.2%. Also among the top 10, Sara Lee saw dollar and unit sales go up 0.5% and 0.1%, respectively. Sales struggled for Marie Callender’s (Conagra Foods) — dollar sales decreased 28.5% and unit sales dropped 40.1%. Dollar sales were up 8.4% for Mrs. Smith’s (Schwan Food Co.), and unit sales increased 6.8%. Outside of the top 10, J&J Snack Foods’ dollar sales improved 100.8% to $5.8 million and unit sales jumped 75%.

Frozen whip topping sales get pounded

Dollar sales in the frozen whip toppings segment fell 1.3% to $319.7 million, and unit sales were down 4.3% to 196.9 million. Kraft Cool Whip led the segment with $228.6 million. Dollar sales decreased 3.8% and unit sales dropped 8.9%. Private label came in second in the top 10, with $85.4 million — dollar sales climbed 5% and unit sales increased 6.3%. Dollar sales ($2.4 million) for Peak Foods dropped 16.1% and unit sales also fell 18.2%. So Delicious (Whitewave Foods) saw dollar sales increase 59.1% to $1.8 million and unit sales jump 49.9%. Rich’s also saw impressive sales — dollar sales increased 70.2% to $1.2 million and unit sales rose 76%.

In the smallest segment in the category, frozen pudding/mousse sales plunged. Total dollar sales were down 76.8% to $105,028, and unit sales dropped 72.3% to 21,363. The French Patisserie led the segment with $94,359, but dollar and unit sales dropped 78.8% and 76.8%, respectively.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!