Functional, clean label trends drive growth of vegetable juices, juice smoothies

Consumers are looking for beverages with no added sugar, and functional and clean ingredients. This has presented challenges for some juice manufacturers.

Ocean Spray Pact Fruit Infusions

As consumers demand more better-for-you products, experts note that the juice and juice drinks category has been challenged in a unique way and struggled to maintain its share of the beverage market.

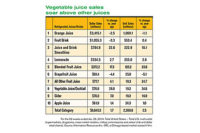

“The juice/juice drinks sector has struggled during the past year,” said Susan Viamari, vice president of Thought Leadership at Chicago-based Information Resources Inc. (IRI). “Volume declined 1.8%, while dollar sales inched up just 0.8%. Juice drink concentrates saw the largest slide (volume down 49.8%; dollars down 24.1%), while performance was strongest in bottled juices (volume down 0.5%; dollars up 2.2%).”

These numbers reflect growing consumer trends of better-for-you, fresh products, among many other factors. Chicago-based Euromonitor International also pointed to the decline in its March 2016 report titled “Juice in the U.S.,” and explained that it’s largely a result of consumer aversion to sugar and artificial ingredients. “The high sugar content of many juices has turned health-conscious consumers away from these beverages. This trend is having a particularly damaging effect on juices which are not 100% juice, as these are more likely to have added sugar in their ingredient lists.”

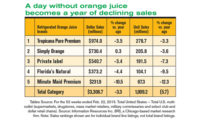

Orange juice represented roughly 37% of off-trade volume sales in 2015, making it the most popular option in the United States, according to Euromonitor’s same juice report. But, due to reduced yields of Florida’s oranges as a result of citrus greening, unit prices have increased, which has caused consumers to shift to non-citrus juices as a substitute for carbonated soft drinks, the report stated.

Additionally, consumers have begun to favor premium products, which call for higher unit prices. Euromonitor noted that smoothies, coconut waters and exotic fruit juices have gained traction as a result of a more premium positioning.

According to Chicago-based Mintel, growing competition from energy drinks and other functional beverages also has challenged the category.

“One of the largest non-alcoholic beverage markets, the category has stalled at the $20 billion mark,” the market research firm stated in its October 2016 “Juice and Juice Drinks” report. “Like other non-alcoholic beverage leaders (carbonated soft drinks and dairy milk), the category is losing share to other beverage types that offer flavor and function innovation, some with lower sugar/calorie levels.”

Additionally, the Mintel report indicated that the category struggles due to limited drinking occasions. Although 100% juice leads with 66% consumption, occasions for consuming 100% juice drop off after the morning drinking occasion, it noted. However, juice drinks and smoothies are able to maintain an audience throughout the day.

“Producers that are able to take advantage of the smoothie and juice bar trends are expected to have fared [the] best in the past five years. PepsiCo’s Naked Juice brand is an example of this,” the IBISWorld report stated.

Keep it simple

Consumers are just as concerned about what is not in the products that they consume as they are about what is in them. Sixty-eight percent of North American consumers surveyed in Nielsen’s 2016 Global Ingredients Study said that they would pay more for products that are free of undesirable ingredients, said Andrew Mandzy, director of strategic insights at New York-based Nielsen. Furthermore, 61% say that the shorter the ingredient list, the healthier the product.

“This trend shows up fairly clearly in the data, as sales of natural and organic juices are up 7% and 23%, respectively. In addition, GMO-free sales in shelf-stable juices are up over 30% compared to a year ago,” he explained.

Many juice manufacturers have begun launching juice and smoothie products that are organic and feature clean, easy-to-read labels. For example, Bolthouse Farm’s 1915 brand recently introduced a line of cold-pressed smoothies that are made with organic pureed fruits and vegetables. The line boasts an ingredient panel featuring no more than six ingredients and nutrient-rich fruits and vegetables.

Additionally, PepsiCo’s Naked Juice brand introduced Naked Cold-Pressed juices in June 2016, which contain no added sugars or preservatives, the company said. The line is made with ready-to-eat, high-quality fruits and vegetables and is Non-GMO Project Verified, it added.

As processing has become a concern, BMC’s report noted an influx of juice manufacturers utilizing high-pressure processing (HPP) for their products.

“HPP reportedly gives raw foods a longer shelf life and preserves more of their vitamin, mineral and enzyme content,” the report stated. “… Among the HPP segment’s attractive features, besides high shelf price, are users’ penchant to ingest drinks as regimen, garnering major repeat business, and ability to support significant mail order/Internet business,” the report stated.

According to the report, Oceanside, Calif.-based Suja Juice Co. dominated the HPP juice segment. The company offers several lines of organic, HPP juices and juice drinks, including fruit-infused waters, drinking vinegars and juice blends.

Although the juice and juice drinks category has offered an alternative to consumers looking to avoid carbonated soft drinks, it has experienced some attrition for its own sugar content.

“The trend toward healthy alternatives to carbonated soft drinks has led consumers to substitute those products with this industry’s offerings,” the IBISWorld report stated. “… However, such health awareness has also detracted from fruit juice sales, a traditional industry staple. The growing consumer focus on fruit juice’s high sugar content has wounded its previously healthy reputation.”

Although not all segments have been equally impacted by this concern, market research experts note that the U.S. Food and Drug Administration’s new Nutrition Facts label, which updates the serving sizes to reflect the amount that consumers typically will consume and adds an Added Sugar section under the Total Sugars section, also could have an impact on the category, most notably due to the Added Sugars section, analysts note.

Nielsen’s Mandzy noted that 22% of North American consumers are conscious about their sugar intake and actively control the amount they consume.

“The additional metrics of added sugars will create yet another data point for consumers to consider as they make decisions about their health and wellness,” he said. “As of today, only 12% of sales in the category have a claim that says ‘No Added Sugars.’”

Make it functional

At the same time that consumers are looking for simple, clean labels, they’re also demanding products that provide functional and/or nutritional benefits.

“Consumers want more — more healthful ingredients, an extra serving of vitamins/minerals/fruits/veggies, and they are looking for beverages that help them advance their nutritional goals in these areas,” IRI’s Viamari said.

In its report, BMC noted that juices still are viewed as a healthier option compared with other beverage categories.

“Juices are viewed as more nutritious than fruit drinks, and super-premium juices promote themselves as even more healthful, while sparkling juice is viewed as a healthier option than carbonated soft drinks,” the report stated. “The addition of nutraceutical enhancements such as vitamins, minerals (like calcium) or herbs is seen as restoring nutrients lost in processing and, in some cases, adding benefits not normally found in fruit.”

In response, juice and juice drink manufacturers have begun to offer fortified juice options. For example, PepsiCo’s Tropicana brand launched Tropicana Essentials Probiotics. The line contains 100% juice with 1 billion live, active cultures in each serving. The line boasts no added sugars and more than the daily recommended value of vitamin C.

“Fortification has become an important influencer of trends,” IRI’s Viamari said. “Consumers are looking for beverages that provide benefits beyond simple thirst quenching and innovators are delivering against sought-after benefits, such as nutritional enhancement, workout recovery and energy enhancement through fortification/integration of new/unexpected/better-for-you ingredients.”

Sales of refrigerated juices with fortified claims have increased 7.5% year-over-year, while sales of shelf-stable fortified juices increased 17.7% year-over-year, according to Nielsen’s Mandzy.

“Younger consumers — primarily the millennial generation — want more than just traditional juice,” the report stated. “They want an innovative blend of flavors that is both nutritious and delicious. Nevertheless, the industry has been fighting back, offering its own variety of new products. Tropical flavors like mango and pineapple have been on the rise as consumers look for exotic and creative healthy alternatives.”

Noting the desire for unique flavors combined with health benefits, Austin, Texas-based Daily Greens introduced Green Ade, a line of cold-pressed green juices. The line features innovative lemonade flavors like Watermelon-Hibiscus Ade. Each flavor highlights nutrient-dense, algae-based superfoods, such as chlorella and Blue Majik spirulina, which each contains 65 individual nutrients, the company said.

Moving forward, juice and juice drink manufacturers will face some challenges, but new product innovation likely will be the key to success.

“The battle for share of the stomach is fierce — crossing over between CPG and [quick-service restaurants] (QSR), and even beyond,” Viamari said. “Juices/juice drinks marketers are facing this same competitive pressure. To compete, marketers need to stay in lockstep with the evolving needs, wants and behaviors of their consumers.”

She continued, “The category will continue to grow and evolve, finding momentum in healthier for you and functionality. Juices provide a quick and inexpensive opportunity to satisfy a taste craving, fuel up without slowing down, round out nutritional intake, etc. Marketers must play on all of these benefits in a highly targeted way.”

This is an edited version of an article that first appeared in the January 2017 issue of Beverage Industry, a BNP Media publication (like Dairy Foods). It was reported and written by BI Associate Editor Amanda Del Buono and edited by Dairy Foods Managing Editor Sarah Kennedy.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!