Though sales are down for the overall milk category, there is still promise thanks to flavored milks and whole milk — both of these segments saw unit-sale increases. The whole milk trend continues to make its way across dairy aisles, even yogurt and cottage cheese companies are releasing full-fat versions. But on the flipside, low-fat and skim milk are seeing a drop in sales.

The milk category’s dollar sales decreased 6.8% to $15.9 billion, and unit sales also fell 0.7% to 5.7 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Oct. 30, 2016. The greater drop in dollars compared to units suggests that retailers have been unable to raise prices.

The category includes these segments:

- Refrigerated skim/low-fat milk ($8.2 billion, units down 5.6%)

- Refrigerated whole-milk ($4.6 billion, units up 4.6%)

- Refrigerated flavored milk/eggnog/buttermilk ($1.4 billion, units up 4.5%)

Low-fat milk sales drop

The refrigerated skim/low-fat milk segment saw dollar sales drop 12.6% to $8.2 billion, and unit sales drop 5.6% to 2.9 billion. Private label dominated in overall sales with $4.7 billion, but dollar and unit sales were down — 15.4% and 5.9%, respectively. Among the top 10, there were a couple significant stand outs. Dean Foods’ Dairy Pure, which came in second in the segment with $923.5 million, saw dollar sales climb 87.3% and unit sales jump 98.9%. Fairlife’s dollar and unit sales skyrocketed 141.5% and 131.6%, respectively. Hood Lactaid (HP Hood) also saw an increase, dollar sales were up 5.3% and unit sales increased 4%. But the rest of the segment struggled. Prairie Farms’ dollar and unit sales fell 8.6% and 2.2%, respectively. Hiland Dairy’s dollar sales were down 16.6% and unit sales dipped 9.8%. Dollar sales for Borden dropped 20.7% and unit sales fell 18.5%.

Whole-milk resurgence

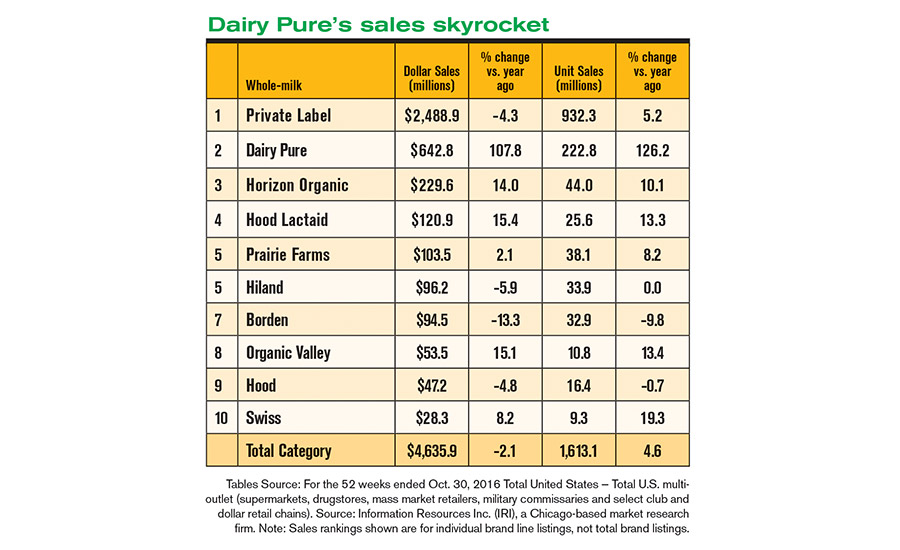

Dollar sales in the refrigerated whole-milk segment were down 2.1% to $4.6 billion, but unit sales increased 4.6% to 1.6 billion. Coming in second for this segment, Dean Foods’ Dairy Pure saw impressive numbers. Dollar sales increased 107.8% to $642.8 million, and unit sales jumped 126.2%. Also among the top 10, Horizon Organic’s dollar sales climbed 14% and unit sales were up 10.1%. HP Hood’s Lactaid saw dollar sales increase 15.4% and unit sales rose 13.3%. Dollar and unit sales were up for Prairie Farms, 2.1% and 8.2%, respectively. Organic Valley’s sales also got a boost — dollar sales jumped 15.1% and unit sales increased 13.4%. Swiss Dairy’s dollar sales rose 8.2%, while unit sales jumped 19.3%.

Flavored milk wins

The flavored milk/eggnog buttermilk segment saw dollar sales tick up 2.9% to $1.4 billion, and unit sales rose 4.5% to 685.4 million. Private label led the segment at $319.3 million, with dollar sales up 0.5%, while unit sales increased 6.9%. Dean Foods’ TruMoo came up second in the segment at $166.3 million, with dollar sales up 2.5% and unit sales climbing 6.6%. Prairie Farms’ dollar and unit sales saw a 10.2% and 13% boost, respectively. Dollar sales were down 4.6% for Borden, with unit sales dropping 3.6%. Fairlife once again saw impressive sales numbers — dollar sales jumped 80% and unit sales climbed 77%. Darigold’s dollar sales rose 9.7% and unit sales were up 8.8%. Creamland TruMoo (Dean Foods) had an 11.1% increase in dollar sales, with unit sales up 9.5%.