RTD coffee and tea sales are energized

Unit sales and dollar sales of both refrigerated ready-to-drink coffee and refrigerated teas increase.

Sales of refrigerated ready-to-drink (RTD) coffee are jumping, and refrigerated tea is seeing a boost, too.

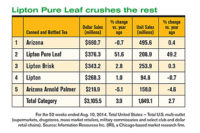

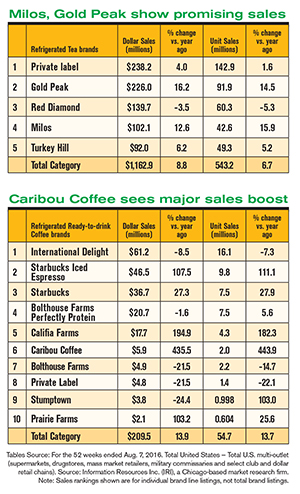

The refrigerated teas/coffee category saw dollar sales increase 10% to $1.3 billion and unit sales rise 7.5% to 599.4 million, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Aug. 7, 2016.

The refrigerated teas and coffee category consists of the following segments:

- Refrigerated teas ($1.1 billion, units up 6.7%)

- Refrigerated ready-to-drink coffee ($209.5 million, units up 13.7%)

Refrigerated coffee sales get a jolt

Refrigerated coffee sales get a jolt

In the RTD coffee segment, dollar sales jumped 13.9% to $209.5 million, and unit sales increased 13.7% to 54.7 million. Among the top 10, Starbucks Iced Espresso Classics saw dollar sales jump 107.5% and unit sales climbed 111.1% (see table). Starbucks, another line from the Seattle-based coffee brand, also saw promising numbers — dollar sales were up 27.3% and unit sales rose 27.9%. Caribou Coffee’s dollar and unit sales skyrocketed 435.5% and 443.9%, respectively. Dollar sales for Califia Farms rose 194.9% and unit sales improved 182.3%.

On the flip side, some brand lines struggled. Segment leader International Delight (Whitewave Foods Co.) saw dollar sales drop 8.5% to $61.2 million, and unit sales decreased 7.3%. Though dollar sales were down 1.6% for Bolthouse Farms Perfectly Protein (Campbell Soup Co.), unit sales increased 5.6%. Another Bolthouse Farms brand saw dollar sales drop 21.5% and unit sales decreased 14.7%.

Refrigerated teas are invigorated

The refrigerated teas segment leads the category in overall sales with $1.1 billion — dollar sales climbed 8.8% and unit sales increased 6.7% to 543.2 million. Among the top 10, private label brands led the segment (238.2 million units) with dollar sales up 4% and unit sales improving 1.6%. Coming up close behind it was Gold Peak (Coca Cola Co.), which saw dollar sales increase 16.2% to $226 million, and unit sales jumped 14.5%. Milos Tea Co.’s dollar and unit sales jumped 12.6% and 15.9%, respectively. Turkey Hill (from Kroger’s Turkey Hill Dairy) saw dollar sales go up 6.2% and unit sales increased 5.2%.

GTS Kombucha Synergy (Millennium Products Inc.) showed dollar sales improve 18.6% and unit sales were up 16.1%. Dollar sales improved 26.8% for Lipton Pure Leaf (Pepsi Lipton Tea Partnership), and unit sales jumped 31.3%. Meanwhile, Swiss Premium Dairy’s dollar sales dropped 23.2% and unit sales decreased 16.3%. GTS Organic Raw Kombucha showed some of the biggest sales increases among the top 10 — dollar sales were up 37.1% to $20.2 million and unit sales jumped 28.7% to 5.6 million.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!