Frozen dessert sales make producers frown and say ‘cheesecake’

The picture for cheesecakes, whip toppings and frozen puddings is not pretty. Sales dropped in all those segments. Sales of frozen sweet goods show some promise.

Ice cream sales may be climbing (see our August issue), but sales for most frozen dessert segments took a beating. Unit sales of frozen cheesecakes, pudding/mousse and whip toppings all decreased. Meanwhile, frozen sweet goods sales ticked up. Read about innovation in the frozen dessert category and new frozen dessert products.

The frozen desserts/toppings category saw dollar sales up only 0.7% to $692.4 million, while unit sales dropped 3.1% to 278.7 million, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended June 12, 2016.

The frozen desserts/toppings category consists of these segments:

- Frozen cheesecakes ($137.7 million, units down 4.5%)

- Frozen whip toppings ($324 million, units down 4.1%)

- Frozen sweet goods - no cheesecakes ($230.1 million, units up 1.1%)

- Frozen pudding/mousse ($0.452 million, units down 37.1%)

Cheesecake sales are falling

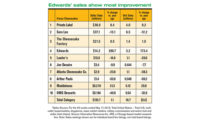

In the frozen cheesecakes segment, dollar sales increased 1% to $137.7 million, but unit sales dropped 4.5% to 18.6 million (see table). Private label dominated the segment with sales of $59.3 million. Dollar sales jumped 52.1% and unit sales increased 33%. Another standout in the segment was Adam Matthews— dollar sales skyrocketed 175.9% and unit sales jumped 155.9%. Cheesecake Factory (The Cheesecake Factory) also saw a boost, as dollar sales improved 34.5% and unit sales were up 31.9%.

The rest of the top 10 in the segment struggled. Dollar sales for Edwards (Schwan Food Co.) fell 44.9%, and unit sales were down 27.8%. Lawler’s dollar sales decreased 91.1% and unit sales dropped 82.2%. Sales of No. 2 brand Sara Lee (Hillshire Brand) were almost at a standstill — dollar sales were up 0.9% and unit sales fell 0.1%.

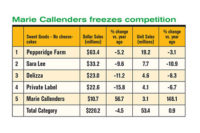

On the flip side, some brands in the frozen sweet goods (no cheesecakes) segment experienced positive sales. Dollar sales in the segment improved 3.7% to 230.1% and unit sales were up 1.1% to 54.2 million. Pepperidge Farm led the segment with $61.5 million — dollar sales rose 5.5% and unit sales improved 4.9%. Private label saw promising numbers — dollar sales jumped 34.6% and unit sales increased 16.6%. Kinnikinnick Foods’ dollar sales were up 21.1%, while unit sales jumped 24.9%. Mrs. Smith’s (Schwan Food Co.) struggled with dollar and unit sales down 21.6% and 23.6%, respectively. Dollar sales for Marie Callender’s (Conagra Foods Inc.) were up 0.7%, but unit sales dropped 9.6%.

Puddings, mousse sales get whipped

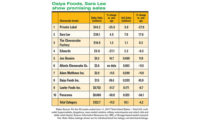

In the small frozen pudding/mousse segment, dollar sales took a hit, down 29.4% to $452,392 as unit sales dropped 37.1% to 77,001. One standout in the segment was Stevenson’s (Lone Star Bakery Inc.) — dollar sales improved 29.7%, while unit sales jumped 78.9%. Rich’s (Rich Products Corp.) struggled, with dollar sales down 96.1% and unit sales dropping 91.2%.

Things didn’t fare well for the frozen whip toppings segment either: dollar sales were down 1.4% to $324 million, and unit sales fell 4.1% to 205.8 million. Kraft Cool Whip (Kraft Heinz Co.) dominated the segment with $237 million in sales, though dollar sales were up only 0.5%. And unit sales took a hit, down 3.5%. Truwhip (Peak Foods LLC) was a standout in the segment (likely thanks to its clean-label claims, like no high-fructose corn syrup). Dollar sales jumped 54.6% and unit sales increased 39.9%. Rich’s dollar sales took a beating, down 50.6%, and unit sales fell 9.5%.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!