Ice cream sales are climbing

Sales for ice cream and frozen novelties see a boost, while frozen yogurt and ice pops show sales melting.

Ice cream sales continue to show promise as dollar and unit sales both see a boost. Frozen novelty sales also went up, thanks to price increases, because unit sales were almost at a standstill. The news didn’t fare so well for manufacturers of frozen yogurt or sherbet. Both experienced sales declines.

The ice cream/sherbet category saw dollar sales increase 2.8% to $6.4 billion and unit sales were up 2.5% to 1.7 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended June 20, 2016. In the frozen novelties category, dollar sales improved 3.3% to $4.8 billion, while unit sales were up only 0.2% to 1.5 billion.

IRI’s ice cream/sherbet category consists of:

- Ice cream ($5.7 billion; units up 4%)

- Frozen yogurt/Tofu ($285.1 million, units down 12.2%)

- Sherbet/Sorbet/Ices ($192.4 million; units down 1.9%)

The frozen novelties category segments consist of:

- Frozen novelties ($4.4 billion, units up 0.4%)

- Frozen ice cream/Ice milk desserts ($223.8 million, units up 2.5%)

- Ice pop novelties ($146 million, units down 5.3%)

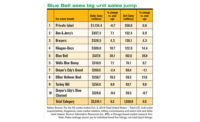

Ice cream freezes out competition

In the ice cream segment, dollar sales increased 3.9% to $5.7 billion, and unit sales jumped 4% to 1.5 billion. Among the top 10, sales were promising for most. Unilever’s Ben & Jerry’s saw impressive numbers — dollar sales jumped 14.3% and unit sales increased 13.7%. Dollar sale for Breyers (Good Humor, another Unilever brand) saw a rise of 12.1% and units improved 10.8%. Nestle’s Häagen-Dazs showed dollar sales up 10.3%, while unit sales climbed 11.3%. There were impressive numbers for Unilever Best Foods as well; dollar sales jumped 24.4% and units increased 24.8%. Blue Bell struggled through a 2015 product recall. Its dollar sales dropped 47.9% and unit sales decreased 50.7%.

Meanwhile, the frozen yogurt segment’s dollar sales dropped 8% to $285.1 million, and unit sales decreased 12.2% 73.4 million. The sherbet segment also struggled with dollar sales down 2.2% to $192.4 billion, and unit sales dropped 1.9% to 65.2 million. In the top 10, Unilever’s dollar sales jumped 34.8% and unit sales increased 38.3%. Dean’s Country Fresh also saw numbers climb — dollar sales rose 20.8% and unit sales were up 20.2%. Ciao Bella’s dollar sales rose 6.5% and unit sales jumped 12.9%. Though coming up second in overall sales with $23.7 million, Häagen-Dazs (Nestle) struggled with dollar sales down 12.9% and unit sales decreasing 13.3%. Nestle’s Dreyer’s Edy’s also saw dollar sales drop 11.2% and unit sales fell 9.9%.

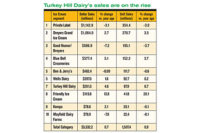

Frozen novelty sales hold steady

The $4.4 billion frozen novelty segment saw dollar sales increase 3.5%, while the unit sales ticked up only 0.4% to 1.4 billion. Among the top 10, most saw sales increases. Nestle Drumstick’s dollar sales improved 8.9% and unit sales increased 5.6%. Wells Blue Bunny saw a 9.4% boost in dollar sales and unit sales were up 7.3%. Nestle’s dollar sales jumped 40.9% and unit sales rose 21.6%. Unilever’s Magnum also saw dollar sales increase 12.3% and unit sales improved 9.2%. Another Nestle brand, Skinny Cow did not fare as well — dollar sales dropped 6% and unit sales decreased 6.7%.

The ice pop novelties segment struggled with several brands seeing a sales drop. Dollar sales were down 2.4% to $146 million, while unit sales dropped 5.3% to 68.5 million. Fun Pops (Alamance Foods) led the segment with $46 million — dollar sales were up 3.6% and unit sales improved 3.2%. Pop Ice (The Jel Sert Co.) saw dollar and unit sales decrease 8.6% and 12.2%, respectively. The Jel Sert Co.’s dollar sales and unit sales also fell — down 21.5% and 23.9%, respectively.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!