Dairy exports will grow, but so will competition

The length and breadth of the current down cycle in global dairy trade has some wondering whether we are undergoing a structural change in long-standing market fundamentals that would bode poorly for U.S. dairy exports in the years ahead.

While trade in 2016 will remain soft, those looking for growth can take solace in a couple facts:

1) We’ve been in a similar position before. The U.S. share of world dairy trade deteriorated with the global financial crisis in 2009, but rebounded stronger than ever because the fundamentals driving dairy demand remained sound.

2) Recent U.S. Dairy Export Council (USDEC) research concludes that those same fundamental factors continue to hold true and today’s downturn will similarly succumb to them over the next few years.

USDEC’s mid-term market analysis, “U.S. Dairy Export Prospects: Looking out to 2020,” found that population growth, economic expansion and the subsequent enlargement of the world’s middle class will drive global dairy trade from 9.4 million tons of finished product in 2014 to 11.7 million tons in 2020. Trade in each major product category — whole milk powder (WMP), nonfat dry milk/skim milk powder, cheese, whey protein and butterfat — will rise at compound annual growth rates (CAGR) of 3-5%, depending on the product.

Growth in disposable income and population will continue to fuel global dairy consumption at a far faster rate in emerging economies than in developed countries, creating opportunities for nations with the capacity and competitive wherewithal to serve their needs.

At the same time, USDEC’s research acknowledges a market shift: We are facing a significantly altered competitive landscape. Over the midterm, we continue to see attractive dairy export growth opportunities, but growth will be slower than recent years, and fiercer competition means U.S. exporters cannot expect to succeed by default.

Globalization then and now

From 2007-2013, global dairy trade volume rose at a CAGR of about 6.5%. The pace was even more rapid than the Innovation Center for U.S. Dairy’s forecast in its groundbreaking 2009 “Globalization Report,” which helped to establish the strategic plan for the American suppliers to capitalize on overseas dairy demand growth. That report, researched by management consulting firm Bain & Co., predicted a 2.8% CAGR, with trade volume nearly reaching 7 million tons of finished product by 2013.

At the time, that seemed like significant growth. But overall world dairy exports actually grew 30% more than Bain forecasted, and U.S. dairy exports grew 50% more than forecast.

The Innovation Center’s decision to pursue a position as a consistent supplier to best capitalize on global opportunity — and the industry’s positive but ongoing response to that recommendation — were major reasons behind the significant growth in U.S. share of global dairy trade over that period.

Moving forward, instead of 6.5% growth, USDEC research suggests a 2014-2020 CAGR of 3.7%. In pure volume terms, that translates on average to an additional 380,000 tons of finished product crossing borders annually rather than the 546,000 tons per year the industry saw from 2007-2013.

In other words, dairy exports will still grow, but not as quickly as before.

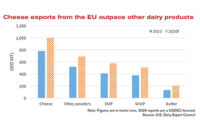

At the same time, New Zealand and, in particular, the European Union (EU) have invested heavily in capitalizing on global dairy demand growth projections. Free from the limits of milk production quotas in 2015 (for the first time in 30 years), key producers in the EU have moved aggressively to expand dairy exports. With a half-percentage-point gain in EU milk production equal to 5.5 million additional tons of milk — equivalent to 713,000 tons of WMP or 592,000 tons of cheese — the bloc has the scale to turn a favorable dairy export market into a harsh one.

The way forward

The bottom-line message is that the United States needs to step up its game and compete harder to take advantage of continued gains in emerging-market dairy demand.

U.S. suppliers responded when the Innovation Center laid out a strategy to become more consistent global suppliers and the industry will need to step up again to heightened competition in the years ahead. There is no secret formula for doing so — it revolves around good business practices: Continuing to produce consistently high-quality products, understanding and manufacturing to the specifications of overseas end-users, upgrading customer service, investing in relationships with overseas buyers, seeking out better supply chain efficiencies. In addition, improvements in outdated governmental regulations would facilitate necessary innovation.

As part of the dairy check-off’s strategic planning process, USDEC is working with the Innovation Center to further develop strategies to assist U.S. industry, address the competition and drive resumed growth in export sales.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!