Sales of cultured dairy foods are slipping

Unit sales are struggling for cottage cheese, cream cheese, sour cream and even yogurt. Meanwhile the whipped cream cheese and refrigerated dip segments outperformed the others.

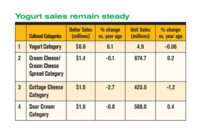

The cream cheese category’s dollar sales improved 5% to $1.5 billion, but units decreased 2.2% to 661.9 million, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Jan. 25, 2015. The yogurt category (the largest of the cultured categories) saw dollars sales up 3.2% to $7.3 billion, but unit sales dropped 0.1% to 5.1 billion.

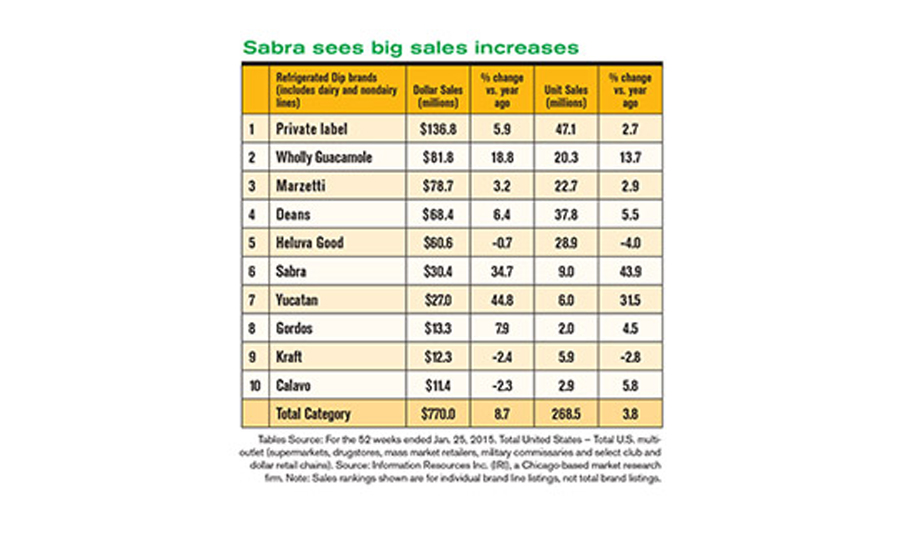

The sour cream category barely moved, with dollar sales up 4.5% to $1.1 million and unit sales up 0.08% to 596.3 million. Sales of cottage cheese increased 1.1% to $1.1 billion, but units dropped 5.1% to 403 million. Meanwhile, the refrigerated dips category dollar sales rose 8.7% to $770 million and units were up 3.8% to 268.5 million. The refrigerated dips category includes both dairy and nondairy dip brands lines.

Cultured dairy consists of these categories:

- Yogurt ($7.3 billion; units down 0.3%)

- Cream cheese/Cream cheese spread ($1.5 billion; units down 2.2%)

- Sour cream ($1.1 billion; units up 0.08%)

- Cottage cheese ($1.1 billion; units down 5.1%)

- Refrigerated dips ($770 million; units up 3.8%)

- The cream cheese category includes these segments:

- Brick ($732.2 million; units down 1.3%)

- Soft ($660.6 million; units down 3.6%)

- Whipped ($154.5 million; units up 2%)

The whipped cream cheese segment performed the best among the category, dollar sales improved 8% to $154.5 million, and units rose 2%. Among the top 10, several companies saw promising sales increases. Green Mountain Farms (Franklin Foods) saw dollar and unit sales jump 59.7% and 59.3%, respectively. Challenge’s dollar and unit sales skyrocketed 348.7% and 312.5%, respectively. J&J Dairy’s dollar sales increased 13.1% and unit sales rose 12.1%. Weight Watchers didn’t fare as well, dollar sales dropped 24.1% and units were down 27%.

In the brick cream cheese segment dollar sales increased 7.8% to $732.2 million, but units dropped 1.3% to 354.5 million. Kraft Philadelphia led the segment with $461.9 million and dollar sales were up 7.7%, but units dropped 3.2%. Crystal Farms also saw dollar sales go up and units drop, 2.2% and 8.6%, respectively. Challenge outperformed the rest, with dollar and unit sales skyrocketing, 241.2% and 214.2%, respectively. Organic Valley’s dollars sales increased 17.9% and units were up 13.8%.

Sabra was the superstar among the top 10 in the refrigerated dips segment. The company’s dollar sales jumped 34.7% and unit sales increased 43.9%. Private label led the way in overall sales for the segment with $136.8 million; sales increased 5.9%, with units up 2.7%. Kraft and Heluva Good (H.P. Hood) both struggled, dollar sales dropped 2.4% and 0.7%, respectively. Units fell 2.8% and 4%, respectively. (See the table.)

Among the top 10 in the sour cream segment Daisy Brand led the segment with $499.3 million, dollar sales increased 8.7% and units rose 5.4%. Breakstone’s saw dollar sales drop 0.3% to $85.8 million, units down slightly as well, 0.3%. Kraft Simply struggled, dollar and unit sales decreased 15% and 11.3%, respectively. Dollar sales were up 9.6% for Hood (HP Hood), units also increased 10.3%.

Private label dominated the cottage cheese segment with $437.1 million. Dollar and unit sales increased 7.2% and 2.1%, respectively. The majority of the other brands struggled. Breakstone’s dollar sales dropped 4.1% and units fell 7.6%. Breakstone’s Cottage Doubles’ sales and units also dropped 16.8% and 25.7%, respectively. Daisy’s dollar sales were up 2.8%, but units decreased 6%. Dean’s (Dean Foods) dollar sales slipped 20.4%, units fell 22.2%. Hiland (Hiland Dairy Foods) showed promise. Dollar and unit sales increased 22.3% and 7.9%, respectively.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!