No matter how you slice it, natural cheese rules

Slices, chunks and sticks are the preferred style of cheese among consumers, based on year-end sales. Convenience rules and on-the-go is key. On the processed side, it doesn’t matter how you slice it, sales are down.

Natural cheese accounts for 78% of the cheese category, based on a retail sales report from Dairy Management Inc. using data from Information Resources Inc. (IRI), Chicago.

The natural cheese category includes these segments:

- Shredded cheese ($4.6 billion; units up 0.3%)

- Chunks ($3.6 billion; units up 1.9%)

- Slices ($1.8 billion; units up 6%)

- String/stick cheese ($1.2 billion; units up 1.8%)

- The processed cheese category includes these segments:

- Processed/imitation cheese-slices ($2 billion; units down 5.8%)

- Cheese spreads/balls ($457.6 million; units down 2.2%)

- Processed/imitation cheese-loaf ($344.3 million; units down 14.9%)

The total natural cheese category showed dollar sales rising 7.6% to $12.8 billion, while units increased 1.8% to 3.6 billion, according to IRI for the 52 weeks ended Dec. 28, 2014. Though the processed cheese category dollar sales increased 1.4% to $3.1 billion, unit sales dropped 5.6% to 862.1 million.

Natural cheese is a winner

Natural shredded cheese, the largest segment in the category, showed dollar sales up 8.6% to $4.6 billion, but unit sales barely moved 0.3% to 1.4 billion. Among the top 10, American Heritage (Schreiber Foods) saw sales jump 515% and units skyrocket 551%. Belgioioso’s sales increased 14.8% and units rose 13.6%. Sales for Borden (Dairy Farmers of America) improved 14.1%, with units up 6%. Crystal Farms saw dollar sales up 3.4%, but units dropped 6.4%.

Natural shredded cheese, the largest segment in the category, showed dollar sales up 8.6% to $4.6 billion, but unit sales barely moved 0.3% to 1.4 billion. Among the top 10, American Heritage (Schreiber Foods) saw sales jump 515% and units skyrocket 551%. Belgioioso’s sales increased 14.8% and units rose 13.6%. Sales for Borden (Dairy Farmers of America) improved 14.1%, with units up 6%. Crystal Farms saw dollar sales up 3.4%, but units dropped 6.4%.

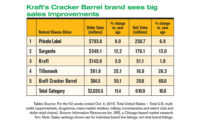

The natural slices segment saw dollar sales jump 12% to $1.8 billion and units improve 6% to 557.7 million. Kraft Foods products in the top 10 did well. Kraft’s dollar and unit sales increased 21.9% and 19.8%, respectively, while Kraft Cracker Barrel’s dollar and unit sales jumped 61.9% and 59.9%, respectively. Crystal Farm’s dollar sales improved 30.2% and units increased 28.3%. Sargento Natural Blends did not fare as well: dollar sales dropped 7.4% and units fell 13.6%.

The natural string/stick cheese segment’s sales rose 6% to $1.2 billion, while units improved 1.8% to 402.8 million. Sargento did well in this segment, with dollar sales up 11.9% and units up 12.3%. Polly-O’s (Kraft Foods) dollar sales increased 6.6% and units rose 8.4%. Frigo Cheese Heads (Saputo Cheese USA) struggled, unit sales were down 15.1%, while dollar sales rose 1.3%. The price went up 64 cents from last year to an average price per unit of $3.96. Horizon Organic (WhiteWave Foods), though not in the top 10, saw dollar and unit sales jump 45.7% and 45.6%, respectively.

The processed cheese category has work to do

Though dollar sales for the processed/imitation cheese slice segment improved 2.7% to $2 billion, unit sales fell 5.8% to 593.9 million. Kraft Velveeta was the only company among the top five to show units improve — sales were up 15.2% and dollar sales increased 26.3%. Sales of Kraft Singles (the segment leader) improved 3% but units dropped 4.5%. Private label sales fell a slight 0.08%, but units tumbled 10.3%.

Though dollar sales for the processed/imitation cheese slice segment improved 2.7% to $2 billion, unit sales fell 5.8% to 593.9 million. Kraft Velveeta was the only company among the top five to show units improve — sales were up 15.2% and dollar sales increased 26.3%. Sales of Kraft Singles (the segment leader) improved 3% but units dropped 4.5%. Private label sales fell a slight 0.08%, but units tumbled 10.3%.

The cheese spreads/balls segment showed dollar sales drop 0.6% to $457.6 million, while units decreased 2.2% to 116.6 million. Though The Laughing Cow (Bel Brands USA) led the segment ($98.5 million), dollar sales dropped 12.3% and units fell 9.2%. On the flip side, The Laughing Cow Mini Babybel dollar sales jumped 114.9% to $4.4 million, and units increased 116.7%. Kaukauna (also Bel Brands USA) showed promise, with dollar sales up 5.4% to $50.8 million and units up 3.3%.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!