Move over blueberry, Make way for parsnip yogurt

Many consumers today are used to having choices when it comes to product selection and food is no exception. In large part this is being driven by the millennial generation (the group born between 1980 and 2000).

There are about 80 million millennials in the United States (or about 25% of the U.S. population). They exceed the baby boomer generation by approximately 3 million people. Millennials are now between the ages of 14 and 34 years old and more importantly, as a group they have purchasing power estimated to be about $170 billion. So like the boomers before them, what millennials say with their wallets will likely have major impact on product offerings moving forward.

To understand this group is to understand their lifestyles and their life experiences. For example, this consumer group is ethnically diverse, and their food tastes reflect this diversity. Additionally, this group travels more and tends to be more open to trying different and new global taste experiences. So while traditional flavors like strawberry, blueberry, vanilla, peach, and raspberry will remain popular flavors of yogurt and cultured dairy beverages for some consumers, the emerging millennial population will seek out a wide variety of new experiences.

Millennials also are more “foodie-oriented” and tend to shop in specialty food stores (e.g. Trader Joe’s or Whole Foods) and less likely to shop in big box stores to satisfy their desire for the wider variety of different food experiences. And they are willing to pay for it.

So what can yogurt and cultured dairy beverage manufacturers do if they want to cater to millennial consumers?

One option would be nothing. Some would say, “We cannot afford to try to capture new market opportunities. If we keep our current consumers, we will be okay.”

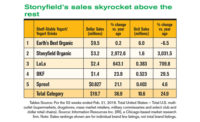

These are likely the same organizations that stood on the sidelines of the high-protein (Greek yogurt) revolution and are now scrambling to hold on to their “pre-Greek” market share. Alternatively, you could say the risk is too high to not recognize what motivates millennials’ food choices.

My guess is the successful companies will manage their risk well and be rewarded with growing market share and profitability if they truly understand the product preferences of millennials and meet their wants.

But is it really that risky? First, cultured product manufacturers need to know that they are not the only ones trying to capture this market. In other words, suppliers of new flavoring systems are more than ready to provide ingredients they believe can satisfy the millennial. These include pomegranate, lychee, guava, mango, acai berry, fig, tayberry (a cross of blackberry and red raspberry) and coconut.

Additionally, some manufacturers are simply taking a page from their friends in the frozen dessert category and formulating new taste experiences into these products by the addition of chocolate chips, premium coffee extracts and other pieces to create a more indulgent yogurt treat (experience).

Parsnips and beets

Most recently, vegetable-flavored yogurts have been developed and introduced to pique the curiosity and interest of consumers looking for something really different in their cultured dairy products. Tomato, carrot, beet, butternut squash, sweet potato and parsnip yogurts are being touted as savory yogurt flavors. Purees of these vegetables add sweetness and fiber along with unique savory flavor profiles. In addition ginger, green tea, plum, cinnamon, curry, chipotle, and other new flavor introductions inspired by Hispanic and Asian cuisines will likely appeal to millennials. Will smoky, cabernet, salmon, balsamic, salty, brown sugar or other new exotic flavored yogurts be next?

All about that base

In order to match (or be complementary to) these new creative flavors, the yogurt base or other cultured milk base may also require some innovation. The textural properties of the base can impact flavor release and flavor perception. The sweetener level and type can also enhance or detract from the overall flavor. Color and color intensity have also been shown to influence consumer perception of flavor. Finally, the acid profile contributed by the fermentation (e.g. cultures used) and degree of acidification can also contribute to the perceived flavor experience.

So, in order to fully capture your share of the millennial wallet, don’t wait to be a “me too.” Study what millennials are seeking, test what dairy system changes make the best fit, and work with flavor experts to deliver a winning cultured dairy product line for this emerging generation of sophisticated consumers.

Once you have the right product, then devise effective ways to let millennials know you have what they want, in the right package, with the right message and delivered to them in the right place.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!