The whole truth: whole-milk sales are rising

It’s not a secret that total fluid milk sales are declining. Many milk processors are scrambling to find ways to revitalize interest in the category.

We discuss this in a series of articles. MilkPEP CEO Julia Kadison reviews her group’s efforts in the last year. Madlyn Daley of Dairy Management Inc. reviews consumption statistics and brand packager Mike Wencel tells how to use a packaging redesign to help drive sales .

Recent data show a picture not quite as bleak, as whole-milk unit sales actually increased slightly. Could this signal some hope on the horizon?

In the milk category, dollar sales were up 3.7% to $18.1 billion, but units dropped 1.9% to 5.8 billion, in the 52 weeks ended Nov. 30, 2014, according to Information Resources Inc. (IRI), Chicago.

IRI tracks the following segments in the fluid milk category:

- Refrigerated skim/low-fat milk ($10.5 billion, units down 5.2%)

- Refrigerated whole milk ($4.8 billion, units up 1.3%)

- Refrigerated flavored milk/eggnog/buttermilk ($1.3 billion; units down 0.9%)

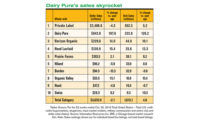

The whole-milk segment showed promise with dollar sales up 7.3% to $4.8 billion and units increased 1.3% to 1.4 billion. Private label more than dominated this segment with $2.6 billion sales. Dollar sales were up 8.7% and units improved 2.3% to 835.8 million. Three companies among the top 10 stood out with significant unit increases: Oak Farms Dairy saw dollar sales rise 23% and units jump 19.3%; Sales went up 18.1% and units increased 14% for Horizon Organic (Whitewave Foods Co.); and Prairie Farms Dairy’s sales improved 19.9%, while units jumped 13.1%. Others struggled — Borden Dairy’s sales decreased 10.6% and units dropped 15.4%; Deans’ Land O’ Lakes saw dollar sales down 4% and units fell 11.6%.

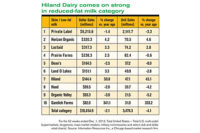

The skinny on low-fat milk

In the skim/low-fat milk segment, sales were not as hopeful. Dollar sales were nearly frozen, up 0.6% to $10.5 billion, and units fell 5.2% to 3.3 billion. Two companies among the top 10 saw sales up — Hiland Dairy’s sales improved 21.9% and units were up 14.4%; and sales and units increased for Oak Farms Dairy, 18% and 14.2%, respectively. Dean’s regular and Land O’ Lakes brand took a hit in sales — both dropped, 3.5% and 7.2%, respectively, and units fell, 9.2% and 13.7%, respectively. Also seeing numbers tumble was HP Hood; its sales fell 2.4% and units dropped 5.7%. Organic Valley’s sales improved slightly, 4.3%, while units barely moved, up 0.07%.

Despite recent innovation with flavors and seasonal offerings, the flavored milk/eggnog/buttermilk segment showed little improvement. Dollar sales did go up 3.4% to $1.3 billion, but units barely moved, down 0.9% to 624.3 million.

A few standouts did see significant increases. Dollar sales for Country Fresh TruMoo (Dean Foods) skyrocketed 108.6%, and units increased 98.8%. Dean’s Country Fresh also saw sales up 42.3% and units jumped 35.7%. Hiland Dairy’s sales improved 25.5%, and units were up 20.2%. Coming in just after private label ($315.9 million) in overall sales was TruMoo (Dean Foods) with $150.5 million — dollar sales increased 14.3% and units were up 8.9%. Sales and units dropped for Borden, 5.8% and 13.2%, respectively.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!