Frozen pudding, cheesecake sales not so sweet

The saturated frozen dessert market (including ice cream, frozen yogurt, cheesecakes, pies and pudding) shows processors struggling to keep sales up. As we noted last month, ice cream sales are nearly frozen (see August, page 22). And the struggles for frozen treats don’t end there; it has seeped over into other areas of the frozen dessert case, with sales and units down for cheesecakes, puddings and other frozen sweet goods.

The frozen desserts/toppings category saw dollar sales down 3.6% to $694.7 million, with units down 2.5% to 295.8 million, in the 52 weeks ended June 15, 2014, according to Information Resources Inc. (IRI), Chicago. The two hardest-hit segments were frozen cheesecakes and frozen pudding/mousse. Cheesecake sales dropped 5.9% to $129.3 million, with units down 3.5% to 18.3 million. The much smaller frozen pudding/mousse segment had the most trouble, with dollar sales down 35.8% to $252,445 and units down 31.7%.

IRI’s frozen dessert category consists of these segments:

- Frozen whip toppings ($344.8 million, units down 3.2%)

- Frozen sweet goods, not cheesecakes ($220.2 million, units up 0.9%)

- Frozen cheesecakes ($129.3 million, units down 3.5%)

- Frozen pudding/mousse ($252,445, units down 31.7%)

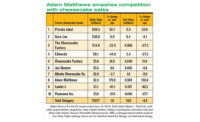

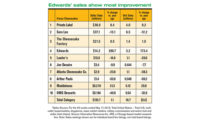

In the frozen cheesecakes segment Edwards (Schwan Food Co.) soared above the rest in the top five. Its dollar sales were up 105.1% and units jumped 73.9%. Private label saw success with dollar sales up 32.4% and units up 34.5%. The rest of the companies struggled, including Sara Lee (Hillshire Brands). Though Sara Lee dominated in overall sales with $42.2 million, its dollar sales were down 6.7% and units fell 9.7%.

In the struggling frozen pudding/mousse segment, the only company with numbers up among the top five was Stevenson’s (Lone Star Bakery Inc.). Its dollar sales jumped 30.8% and units were up 28%. The rest of the companies were all in the negative, including Sticky Toffee Pudding (The English Pudding Co.) and New Orleans (New Orleans Ice Cream Co.), with dollar sales down 63.3% and 50.1%, and units down 66.6% and 51.8%, respectively.

The largest segment among the frozen desserts category is frozen whip toppings with $344.8 million. Dollar sales were down 2.2% and units fell 3.2%. Among the top five, a couple companies actually saw significant increases. Rich Products’ dollar sales skyrocketed 414% and units went up 51.2%. Also up was Truwhip (Peak Foods LLC); its sales jumped 58.6% and units were up 74.7%. Dominating the segment in overall sales was Kraft’s Cool Whip with $238.9 million, but dollar sales were down 1% and units fell 1.1% to 150.3 million.

In the frozen sweet goods (no cheesecakes) segment, dollar sales were down 4.5% to $220.2 million, with units just slightly up 0.9% to 53.4 million. Once again, the top five companies all saw numbers fall with the exception of one, Marie Callender’s (ConAgra Foods). The frozen pie maker saw dollar sales jump 56.7%, while units skyrocketed 148.1%. The overall sales leaders in the segment, Pepperidge Farm ($63.4 million) and Sara Lee ($33.2 million), each saw sales drop. Dollar sales were down 5.2% and units fell 3.1% for Pepperidge; while Sara Lee’s dollar sales dropped 9.6% and units fell 10.9%.

To read more on what’s happening with frozen desserts, check out “It’s a flavor game” on page 56.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!