Natural cheese products still winning against processed

Refrigerated grated, crumbled and shredded cheeses are still winners for the natural cheese category, while imitation cheese loaf and shreds show promise in the processed cheese category.

Convenience is the key. Shred it, grate it, crumble it. Consumers like their cheese ready-to-go, whether it’s natural or processed, though natural is still winning the game.

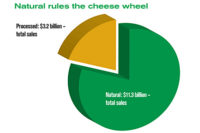

In the 52 weeks ended Jan. 26, 2014, the natural cheese category’s dollar sales went up 2.9% to $11.7 billion, and units were up 2.5% to 3.5 billion, according to data from Information Resources Inc. (IRI), Chicago. The increase is not as great as the previous period, but still beating the processed cheese category in almost all segments. In the same time period, the processed cheese category saw dollar sales drop 1.5% to $3.1 billion, and units fell 3.3% to 902.7 million.

The natural cheese category includes these segments:

- Natural shredded cheese ($4.2 billion sales, units up 3.3%)

- Natural slices ($1.6 billion sales, units up 6%)

- Natural crumbled ($354.6 million sales, units up 3.8%)

- The processed cheese category includes these segments:

- Processed/Imitation cheese-slices ($1.9 billion sales, units down 4.1%)

- Processed/Imitation cheese-loaf ($406.6 million sales, units up 8%)

- Processed/Imitation cheese-shredded ($66.7 million sales, units up 24.2%)

Though not a big segment within the natural cheese category, the “natural all other forms” segment saw the biggest increases with dollar sales up 13.2% and units up 13.8%. Another small segment that did well was refrigerated grated cheese; dollar sales jumped 9.3% and units went up 8.4%.

The largest segment in the category, natural shredded cheese, saw dollar sales go up 4% to $4.2 billion, with units up 3.3% to 1.3 billion. Among the top 10, Kraftand Kraft Philadelphia’s dollar sales went up 9.8% and 8%, and units were up 11.1% and 7%, respectively. Borden (Dairy Farmers of America) saw dollar sales and units jump 18.3% and 19.4%, respectively. Crystal Farms was the only company in the top five to see numbers drop: dollar sales fell 5.9% and units dropped 4.1%.

The natural slices segment also saw increases, with dollar sales up 6.3% to $1.6 billion, and units up 6%. Among the top five, Kraft had the biggest dollar increase, up 48.1%, and units jumped 62.5%. Sargento also saw numbers go up, with dollar sales increasing 6.1% and units up 5.7%. Tillamook (Tillamook County Creamery) struggled, with dollar sales down 1.2% and units down 4.4%.

Numbers looked good in the natural crumbled segment with dollar sales up 5.5% to $354.6 million, and units up 3.8%. Among the top five, Athenos (Kraft Foods) saw dollar sales go up 12.9% and units up 6.4%. President (Lactalis USA) struggled; dollar sales went down 15% and units dropped 17.7%. Private Label dollar sales went up 6.9% and units were also up 4.6%. One segment not doing as well as last year was natural string/stick cheese. Dollar sales dropped 1.3% to $1 billion, and units fell 2.3%.

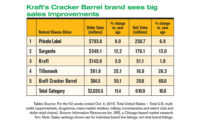

Though the overall processed cheese category struggled, two segments showed promise with increases. Dollar sales of processed shredded cheese jumped 24.7%, with units up 24.2%. Among the top five, Kraft Velveeta helped push these numbers up. Dollar sales jumped 68.6% and units were up 68.4%. The other segment doing well was processed cheese loaf, with dollar sales rising 9.8% and units up 8%. Kraft Velveeta led the way again with dollar sales up 13.1% and units up 12.5%.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!