Natural sliced and grated cheese sales rise

Health and wellness remains top of mind for many consumers, and the desire for clean labels continues to grow. It is trends like these that keep natural cheese sales at the top and processed cheese products scrambling to compete.

In the 52 weeks ended Oct. 6, 2013, the natural cheese category grew dollar sales 2.9% to $11.8 billion and units went up 2.6% to 3.5 billion, according to Information Resources Inc. (IRI), Chicago. But the downward trend continued for processed cheese; in the same time period the processed cheese category saw dollar sales drop 2.4% to $3.1 billion, while units dropped 3.1% to 915.8 million.

The natural cheese category includes:

- Natural shredded cheese ($4.2 billion, units up 3.5%)

- Natural chunks ($3.4 billion, units up 1.7%)

- Natural slices ($1.6 billion, units up 5.8%)

- The processed cheese category includes:

- Processed/imitation cheese-slices ($1.9 billion, units down 3.9%)

- Cheese spreads/balls ($464.4 million, units down 8%)

Though not the biggest in overall sales, two segments within the natural cheese category saw the biggest increases in sales and units — natural/all other forms and refrigerated grated. The refrigerated grated cheese segment had the biggest jump in numbers, with dollar sales up 16.5% and units up 17.2%. The natural/all other forms segment saw dollar sales jump 15% and units go up 15.4%.

Dominating in overall sales for the category was natural shredded cheese, with $4.2 billion. This segment’s dollar sales went up 3.9% and units rose 3.5%. Among the top five, private label dominated with $2.4 billion, dollar sales were up 2.1% and units up 1.3%. Kraft saw its dollar sales go up 9.8% and units jump 12%. Kraft Philadelphia had the best increases with dollar sales up 13.2% and units up 12.4%.

The natural slices segment also showed promising numbers, with dollar sales up 6.1% to $1.6 billion and units were up 5.8%. Two companies really stood out among the top 5: Kraft once again saw success with dollar sales up 19.3% and units skyrocketed 30.2%; Sargento kept pace with dollar sales up 11.6% and units up 10.9%.

The natural string/stick segment was the only one in the natural category to struggle slightly. The overall dollar sales were good at $1.1 billion, but dollar sales barely went up 0.5% and units dropped 1.1%. Kraft still won the segment with dollars and units up 10.6%. Sargento’s dollar sales were up 4.1% and units up 3.5%, Polly-O (a Kraft Foods brand) wasn’t far behind with dollar sales up 2.7%, and units rising 1.5%.

The woes of processed cheese

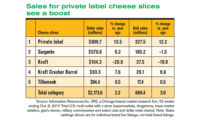

On the flip side, the processed cheese category saw several segments struggle to compete. The processed/imitation cheese-slices segment had dollar sales falling 3.4% and units dropping 3.9%. Among the top five, private label’s numbers hurt the most with dollar sales down 8.8% and units down 10%. Though Kraft struggled to see numbers out of the negative with its Singles and Deli Deluxe brands (units down 4.7% and 6.8%, respectively) it did see some success within the overall brand. Kraft regular slices rose above the rest with dollar sales up 20.4% and units up 10.7%.

The cheese spreads/balls segment also took a hit, with dollar sales down 6.8% to $464.4 million, and units fell 8%. Among the top five, both Laughing Cow and Boursin (part of Bel Brands) struggled with dollars sales down 17.6% and 17.1%, respectively, and units also down 17% and 18.5%, respectively.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!