Ice cream sales are up, novelties are melting

The ice cream category shows sales up slightly, but frozen novelties are struggling.

Summertime is the ultimate season for ice cream companies and some showed positive sales numbers heading into summer. But still many struggled, and with the exception of a couple bright stars, the frozen novelties segment showed sales numbers dropping across the board.

In the 52 weeks ended May 19, 2013, the Ice Cream/Sherbet category showed dollar sales up 1.8% to $6 billion, and unit sales up 2.3% to 1.6 billion, according to data from Information Resources Inc. (IRI), Chicago. On the flip side, in the Frozen Novelties category, dollar sales were down 1.7% to $4.6 billion, and units dropped 4.6% to 1.6 billion.

Here are the segments that make up IRI’s ice cream/sherbet category:

- Ice cream ($5.5 billion sales, units up 0.9% )

- Frozen yogurt/tofu ($341.5 million sales, units up 37.9%)

- Sherbet/sorbet/ices ($218.4 million sales, units down 2.5%)

Here are the segments that make up the frozen novelties category:

- Frozen novelties ($4.2 billion sales, units down 3.8%)

- Frozen ice cream/ice milk desserts ($221.5 million sales, units down 38.3%)

- Ice pop novelties ($155.9 million sales, units down 10.1%)

In the ice cream segment, dollar sales rose 0.7% to $5.5 billion and units went up 0.9% to 1.5 billion. Among the top 10 in the segment, Friendly Ice Cream saw the most success; its sales rose 13.8% and units jumped 20.1%. Also seeing an increase, Kroger’s Turkey Hill Dairy’s sales went up 4.6%, and units rose 6.7%.

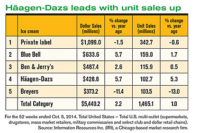

Though private label led the segment in overall dollar sales with $1.1 billion, Dreyers Grand Ice Cream was close behind with $1 billion. Dreyers’ dollar sales were up 2.7% and units rose 3.5%. Blue Bell Creameries’ dollar sales were also up 5.1% and units rose 3.7%. Mayfield Dairy Farms (a unit of Dean Foods) saw the worst sales numbers — dollar sales dropped 7.8% and units fell 8.1%. (See table.)

Over in the frozen novelties segment, two companies achieved significant increases. Unilever Bestfoods North America saw dollar sales jump 22.2% and units went up 20.8%. Ziegenfelder Ice Cream Co.’s dollar sales went up 12.1% and units jumped 12.2%. Blue Bell Creameries saw dollar sales increase 6.7%, but the units dropped 0.8%. Dreyers Grand Ice Cream led the segment in overall dollar sales, but sales were down 3.2% and units dropped 7.4%. Also struggling was Good Humor/Breyers. Its dollar sales fell 6.8% and units were down 6.1%. Mars Inc.’s dollar sales went down 3.5% and units fell 6.2%.

The frozen ice cream/ice milk segment overall struggled significantly (dollar sales were down 8.5%, units dropped 38.3%), but there were a couple of companies that saw huge sales increases. Arctic Zero's (formerly California Soft Serve Concepts) dollar sales skyrocketed 143.4% and units jumped 132.4%. Also rising above the rest was Turkey Hill Dairy, with sales up 119.9% and units up 86.8%. Among the top 10, Heinz Frozen Foods’ sales were the worst — dollar sales fell 80.8% and units dropped 86.4%. Celebration Foods led the overall segment in dollar sales, but sales were down 3.6% and units dropped 6.8%.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!