Market Trends

Sales of cultured dairy foods have been flat in the past year

Yogurt is a $6.6 billion category, but unit sales did not grow. It’s the same story for cream cheese, cottage cheese and sour cream.

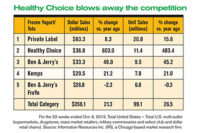

For the 52 weeks ended Feb. 24, 2013. Total United States — Total U.S. multi-outlet (supermarkets, drugstores, mass market retailers, military commissaries and select club and dollar retail chains). Source: IRI (formerly SymphonyIRI Group), a Chicago-based market research firm.

Data provided by IRI (formerly SymphonyIRI Group), Chicago, show that dollar sales in the yogurt category rose 6.1% to $6.6 billion, while units were down slightly by 0.06% to 4.9 billion in the 52 weeks ended Feb. 24, 2013. Doing their best to compete, both the cream cheese and sour cream categories saw unit increases. In the same time period, the cream cheese category’s dollar sales went down slightly by 0.1% to $1.4 billion, but units rose 0.2% to 674.7 million. Also showing promise, the sour cream category saw units rise 0.4% to 588 million, though its dollar sales dropped 0.8% to $1 billion. Struggling to keep up with the pack, the cottage cheese category saw dollar sales drop 2.7% to $1 billion, and units were also down 1.2% to 425 million.

The cream cheese/cream cheese spread category consists of the following segments:

- Brick ($666.9 million sales, units down 3.8%)

- Soft ($620.8 million sales, units up 8.4%)

- Whipped ($136.9 million sales, units down 3.7%)

- Balls ($1.9 million sales, units down 23.4%)

- All other forms ($1.5 million sales, units down 21.7%)

Within the cream cheese category, the soft segment surged ahead of the rest with dollar sales up 5.6% and units jumping 8.4%. Among the top five in the segment, Bel Brands USA dominated with a 1,260.3% jump in dollar sales, and units skyrocketed 2,225.7%. The average price per unit for Bel Brands in this segment was $2.98, which went down 2.1%. Private label saw dollar sales rise 11.2% and units go up 16.1%. Leading the segment in overall sales was Kraft Foods with $427.8 million. Its sales were up 0.5%, with units up 2.2%.

Though overall sales for the whipped segment struggled (dollar sales dropped 5% and units were down 3.7%), one company found success among the top five. Weight Watchers International saw dollar sales jump 271%, while units rose 236.6%. Kraft Foods led the segment in overall sales at $80.1 million, but sales were down 5.2%. The units were also down 2.2%.

In another dairy aisle, unit sales in the sour cream category rose slightly. Among the top five, Dean Foods Co. saw the most success with dollar sales up 29.5% and units rose 40%. Leading the segment in overall sales was Daisy Brand with $436.1 million. Its dollar sales were up 5%, with units also up 5.7%. Kraft Foods also tried to compete with unit sales up 3.8%, but dollar sales were down 1.3%.

Though the cottage cheese category struggled overall, a couple of companies showed promise. Daisy Brand’s dollar sales were up 23% and units jumped 29.4%. HP Hood Inc. also saw success, its dollar sales rose 7.5% and units were up 8.7%.

Processors of cottage cheese should take a look at what’s happening with the market leaders to help compete in the cultured market.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!