Tighter dairy supplies forecast for 2013

Drought in the United States, less favorable conditions in Europe, an uncertain El Niño and a decrease in New Zealand pay prices have increased supply challenges in the year ahead.

This represents a reversal from the first half of 2012, when surging milk production among leading dairy exporters overshot consumption. Lower prices were necessary to clear markets, especially large New Zealand inventories. However, severe drought in the United States, less favorable conditions in Europe, an uncertain El Niño and a decrease in New Zealand pay prices have increased supply challenges headed into 2013.

Macroeconomic, political and social conditions — especially among euro-zone economies — are contributing to global demand uncertainty. Nonetheless, developing Asia remains the primary driver of dairy import demand growth, along with solid demand from energy-exporting economies. However, Asian economic growth is expected to slow as exports to recessionary Europe decrease. Moreover, tight supply situations for food grains, feed grains and oilseeds create the potential for increased food price inflation that could offset income gains.

Sluggish growth prospects and uncertain macroeconomic conditions among the Organization for Economic Co-operation and Development (OECD) countries continue to contrast with growth — albeit slowing — in Asia, Russia, India, Brazil and other emerging economies. Robust dairy consumption growth outside the United States and Europe is expected to continue as increasing numbers of middle-class consumers in developing and emerging economies develop a consistent demand for dairy. This will put pressure on global dairy supplies for the foreseeable future, requiring the United States to play a key role in fulfilling world market needs.

From a competitive supply standpoint, the euro has trended lower since May 2011 and is likely to remain weak, though volatile, as the euro-zone struggles with recessionary and sovereign debt issues. While slower milk production growth may decrease exportable surpluses, a weaker euro enhances export market returns relative to domestic sales, increasing pressure to divert European dairy supplies to export markets. On the other hand, expected strength in the New Zealand dollar has offset some of the recent increases in dairy commodity prices, causing New Zealand exporters to decrease initial milk payout forecasts for the 2012/13 season to levels barely above increased costs of production, thereby curbing the incentive of farmers to maximize production.

On the demand side, though exhibiting recent strength, the U.S. dollar appears likely to trade in relatively narrow ranges vis-à-vis the currencies of major dairy importers — including the Mexican peso, Japanese yen, Korean won and Southeast Asian currencies — stabilizing exchange rate effects on dairy demand, regardless of source. However, given macroeconomic uncertainty and the U.S. dollar’s position as a safe haven relative to other currencies, it is conceivable that the U.S. dollar could strengthen more relative to these currencies.

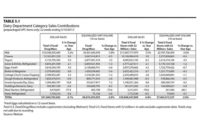

Consumption and demand

China continues to sop up increasing quantities of dairy products, despite slower economic growth. Total imports for the 12 months ended July 2012 exceeded 1.22 million tons, up 21% compared with the previous 12-month period. For the 12 months ended July 2012, Chinese imports from New Zealand and Australia were up 8% and 3%, respectively. Meanwhile, imports from the United States, EU, and Argentina were up 20%, 55% and 130%, respectively. Increased imports from the United States and EU primarily focused on whey and skim milk powder.

Dairy import demand in Southeast Asia also remains a growth engine; the total value of imports for the 12 months through May 2012 was more than $5.2 billion, a 15.6% increase over the previous 12 months.

Most important for U.S. suppliers is the growth of Mexican dairy imports, where the United States holds a 64% value share and a 70% quantity share. In the 12 months through May 2012, Mexican imports topped 632,000 tons, up 11% from the prior year, worth nearly $2 billion, up 21%.

Severe drought, high heat and low margins in the United States have taken a toll on U.S. milk production, which showed year-over-year declines beginning in August 2012 with contraction expected to last into 2013. Reduced milk production is most likely to restrict milk powder production, requiring international buyers to compete with domestic users for the available supply. While some might consider it likely that U.S. buyers will pay a better price, it’s worth pointing out that China and Mexico are examples of global milk buyers who have shown a willingness to pay what might be considered strong prices for SMP; from January-July 2012, average U.S. export unit values to Mexico and China averaged $1.33/lb. and $1.31/lb. compared with the West Coast average NDM price of $1.24/lb.

New Zealand production finished the 2011-12 season 11.2% greater than the previous season on a milk solids basis. Record exports in July are, however, believed to have cleared inventories to normal seasonal levels. Early season conditions have spurred an excellent start to the new season, supporting expectations for 2012-13 production growth in the historically average range of 3-4%. Australian milk production exceeded expectations and finished the past season 4.3% ahead of the previous season. Based on herd growth and normal weather conditions, Australian production is expected to increase 2% in the 2012-13 season.

Conditions in Argentina continue to stimulate milk production growth, boosting Argentina’s exportable surplus to more than 448,000 tons on a product weight basis, a 13% increase for the 12 months ended July 2012. However, constrained milk powder processing capacity and lower returns to dairy production relative to corn and soybeans could slow milk production growth prospects into 2013.

EU milk collections have moderated early in the 2012-13 quota year. After robust growth of 2.1% during the 2011-12 quota year (April-March), collections were up less than 1% during the first three months of the 2012-13 quota year (April-June), and slipped below year-earlier levels in July.

While weather conditions are contributing to decreased production, lower milk prices and higher feed costs also are likely to moderate EU milk production growth into 2013. Much of the increased milk production over the past 24 months was directed to skim milk powder (SMP) for export, which totaled more than 568,000 tons for the 12 months ended June 2012, up nearly 30% from the previous period and an 81% increase over the past 24 months. Recent strength in global SMP markets is likely to continue this trend, especially in light of expected shortfalls in U.S. milk powder production.

U.S. production growth will increasingly depend upon its contribution to the global supply picture. Growth by Southern Hemisphere exporters is expected to fall short of consumption because, despite the recent surge in milk production among these lower-cost producers, new milk in these regions faces many structural constraints. Conversely, various EU processors are likely to emerge as formidable international competitors.

Conclusions

The opportunity for the U.S. dairy industry to be a beneficiary of growing global dairy demand remains positive. Gaps between domestic production and domestic consumption will persist in China, Mexico, Southeast Asia and the Middle East, as well as other emerging economies. Milk production costs have moved to a higher level for the foreseeable future. Over time dairy commodity prices need to reflect those higher costs to ensure an adequate supply.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!