For a brand that uses a rabbit as a mascot, Nesquik wasn’t too mobile. Nestlé USA’s popular flavored-milk brand had been pretty much tied to grocery stores and other retail outlets with refrigerated cases. But since the Nestlé Beverage Division created shelf-stable products that do not require refrigeration, new channels of distribution opened up, including mom-and-pop convenience stores, amusement parks, minor league baseball parks, campgrounds, bowling alleys and movie theaters. Nestlé’s shelf-stable milk is making inroads into those outlets with limited refrigerated storage space or display space.

The Glendale, Calif.-based dairy and food processor believes so strongly in the growth potential of shelf-stable milks that it built its own $670 million plant in Anderson, Ind. (see “Nestlé LEEDs the Way,” page 104.) Nestlé had been using co-packing arrangements with other dairy processors.

“Our biggest challenge is producing high-quality dairy-based beverages within a highly regulated industry that dictates clear standards for processing and labeling,” says Kim Peddle-Rguem, director of marketing, immediate consumption beverages. “Our investment in Nestlé Anderson and our state-of-the-art aseptic technology have opened up a route to market that will enable us to make our ready-to-drink dairy-based beverages available whenever and wherever consumers want them, vastly increasing our ability to influence consumption outside of the home.”

The company sees “a tremendous opportunity for growth” in impulse (or “point of thirst”) channels, especially when it comes to getting its brands recognized, Peddle-Rguem says.

In response to the production of shelf-stable Nesquik at the Anderson plant, Nestlé reshaped its chilled-beverage sales force to focus on direct-store-distribution (DSD) accounts. The expanded sales force has taken the lead and broadened distribution into new accounts, says Joe Melone, sales director for Nestlé’s DSD beverage sales force.

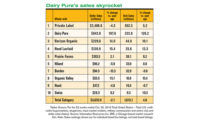

The strategy seems to be paying off. Unit sales of Nesquik shot up 394% in the 52-week period ending Oct. 31, 2010, according to SymphonyIRI Group, a Chicago-based research firm.

In addition, the DSD partnerships have led to new innovations, not just for the brands produced in Anderson, but across Nestlé’s entire beverage portfolio, the company says. Nestlé has seen increasing popularity for its 8-ounce bottles of Nesquik flavored milk and 8-ounce 100 Calorie Nesquik flavored milk. In June 2010, the company introduced Juicy Juice Sparkling in apple, berry and orange varieties.

The juice and the 100-calorie chocolate milk address consumers’ desires for lower-fat and lower-calorie options. Juicy Juice Sparkling, which comes in 8.4-ounce slim cans, contains 70% real fruit juice, 30% sparkling water and no artificial flavors, colors or added sugars. One can (90 calories) is considered a full serving of fruit.

The expansion of the sales force has helped Nestlé’s recent beverage launches, including a 10-ounce Juicy Juice PET bottle and Juicy Juice Sparkling. The juice products, Nesquik milks and Coffee-mate non-dairy creamers have become popular options for foodservice, education, hospitality and hospital accounts, Melone says. In the foodservice industry, Wendy’s restaurants, a division of Wendy’s/Arby’s Group, sells 8-ounce fortified low-fat white milk and chocolate milk.

Within convenience and drug store accounts, the DSD partnerships increased placement of point-of-sale items, Melone says. A marked improvement in the placement of static clings, pricing stickers and additional point-of-sale items has been seen in retail accounts, he says. The new route-to-market also opens more opportunities for sampling and interaction with local accounts, including in-market appearances by the Nesquik bunny.

The partnerships also have yielded product expansion in existing outlets, Melone says.

“Our DSD distributors and partners control a lot of the shelf space not only in the dairy door, but in the tea door and the water door, and everywhere else, so they look at the whole beverage set, rather than just the dairy set,” he says. “We also have the opportunity for secondary placements, too, both with Nesquik, with the Juicy Juice brands, and so on. They’ve done a really nice job with secondary placements on kids’ shelves.”

But it is adults, not children, who drink the most Nesquik. Adults age 25 years and more account for 70% of Nesquik consumption, Peddle-Rguem says.

The portion-control and better-for-you positionings of the milks and juices appeals to shopper moms, an important demographic segment. Nestlé markets Nesquik and Juicy to address emerging consumer trends.

“From our perspective, consumers are looking for better-for-you products that are natural and deliver great taste,” says Peddle-Rguem. “Additionally, we are seeing an increase in on-the-go beverage consumption. Nestlé is committed to continuous product innovation.”

One such innovation is a new energy drink, although the company decided it was better to link arms with an existing player than to develop its own product from the ground up. Nestlé has a licensing partnership with Jamba Juice Co. to develop a new line of ready-to-drink energy beverages. They will be available for retail sale in the northeastern United States in early 2011. The goal is to take the product nationwide in 2012.

Nestlé Jamba All-Natural Energy Drinks will feature real fruit juice boosted with natural caffeine.

“The line of energy drinks will provide a meaningful point of difference to consumers within the $8.5 billion energy drink category,” says Peddle-Rguem. The Jamba energy drinks will be available in flavors such as pomegranate blueberry, strawberry banana and crisp apple flavors.

Meanwhile, Coffee-mate continues to succeed. Dollar sales of its refrigerated coffee creamers rose 2% and unit sales were up 4.6%, in a 52-week-period ending October 2010, according to Symphony IRI Group.

The new Café Collections line, going after the coffee-house consumer, consists of three flavors: Caramel Macchiato, White Chocolate Caramel Latte and Café Latte. The company reports its seasonal flavors continue to perform “extremely well.” Nestlé introduced three flavors in 2010: Sugar and Spice, Eggnog Latte and Gingerbread Latte.

Despite the success of Nesquik in 2010, Chicago-based market research firm Mintel pointed out a weakness in Nestlé. “With its Nesquik brand its lone entry in [refrigerated flavored milk], Nestlé lacks the product diversification of other manufacturers. This puts the company’s fortunes on the performance of a single brand, where others have multiple brands to pick up the slack if one should falter.” Mintel’s analysis came in the wake of a drop in share of 2.7 points in early 2010.

In looking at Nestlé’s juice sales, Mintel blamed the decline in sales on the recession. “The company had kept the brand invigorated by rebranding it from Libby’s to Nestlé and introducing Harvest Surprise-a vegetable and juice blend targeted at kids. However, Harvest Surprise, a premium-priced juice, declined considerably as recession-torn consumers stayed with staple (cheaper) flavors such as apple and lemonade, as these are the favorite of kids-the main consumer of Nestlé’s fruit juice products,” according to a Mintel analysis.

Peddle-Rguem concedes that timing was an issue. One of the shopper insights Nestlé gained from Harvest Surprise is that moms struggle to deliver vegetable nutrition to their children. Harvest Surprise was seen as a solution because it “disguised vegetables,” Peddle-Rguem says, venturing that the brand was “before its time.”

Nestlé uses a broad mix of marketing strategies, all emphasizing to consumers the benefits of its products. Its Juicy Juice brand has participated in Box Tops For Education for three years. This is a way to reach a key demographic: mothers of school-age children.

Box Tops has been “enormously successful. It drives brand loyalty and shows we’re moms’ allies in raising happy, healthy kids,” says Joanne Crawford-Dunér, director, integrated marketing communications.

In 2010, Nestlé once again used the Copita Juicy Juice program to appeal to the Hispanic market. The program tied into the World Cup with events in Chicago, New York and Los Angeles in which 1,600 children in 104 youth soccer teams participated. Bilingual spokesperson Claudia Gonzalez, a registered dietitian and author, led nutrition workshops for parents and children, while past World Cup soccer players participated in soccer clinics with the kids. “The program generated positive media coverage in Hispanic outlets such as El Clasificado, Entre Familia and MegaTV,” Crawford-Dunér says.

On the web, Nestlé developed an interactive, “augmented reality game” for the Nesquik brand. A webcam (required to play) puts the player in the factory and players score points by filling milk bottles in a set amount of time.

With the No. 1 flavored milk brand in Nesquik and the No. 1 juice brand for children in Juicy Juice, Peddle-Rguem says Nestlé will continue to “provide consumers with product choices that meet their needs in the locations where they are shopping. We continue to evolve our brands to address the changing preferences of consumers who are looking for products positioned around health and wellness, value and on-the-go consumption.”

“We want to delight consumers with our beverage brands every day and wherever they enjoy beverages. That means continued innovation/renovation to drive to new and unique beverages and a robust route-to-market that makes our brands available whenever and wherever consumers want to consume,” Peddle-Rguem says.

Jennifer Zegler, managing editor of Beverage Industry, contributed to this article. The interview with Joe Melone first appeared in the August 2010 issue of Beverage Industry (like Dairy Foods, a BNP Media publication).

History

Headquartered in Vevey, Switzerland, Nestlé S.A. was founded in 1866 by Henri Nestlé. It calls itself “the world’s leading nutrition, health and wellness company.” The company employs about 280,000 worldwide, and has factories and operations around the globe. Nestlé’s United States headquarters is in Glendale, Calif.

Its dairy brands include Carnation Milks, Edy’s, Nesquik, Häagen-Dazs and The Skinny Cow. Other packaged food brands include Baby Ruth, Buitoni, Nescafe, Raisinets and Stouffer’s. Nestlé S.A. reported 2009 sales of $99 billion, with Nestlé USA accounting for $10.4 billion.