Dairy Market Trends

Natural cheese sales are growing again, and natural slices appears to be leading the pack.

The last time we focused specifically on cheese, July 2006, quarterly retail sales of natural cheese were losing steam, based on numbers from Information Resources Inc.

Natural cheese sales are growing again, and natural slices appears to be leading the pack.

The last time we focused specifically on cheese, July 2006, quarterly retail sales of natural cheese were losing steam, based on numbers from Information Resources Inc.

First let’s look at natural slices, which has been the hottest sub-segment in retail cheese for some time now.

For the 52 weeks ended Dec. 31, sales of natural slices were up 9.8% by dollar measure and 14.1% by units. In the most recent three quarters, the rate of growth has accelerated into double digits, reaching 16.3% by units in the 13 weeks ended Dec. 24. The IRI numbers are for supermarkets, drug stores and mass merchandisers, but do not include Wal-Mart.

Not surprisingly, the top brands in this category are doing well, and private label, which has about four times the market share of the top name brand, Sargento. Both Sargento and No. 3 Kraft had significant sales growth during the period, but lost some market share to private label and to other top-10 brands. These include Tillamook cheese (a relative newcomer to the category on the national stage), Kraft Deli Deluxe and Sargento Deli Style slices.

Not surprisingly, the top brands in this category are doing well, and private label, which has about four times the market share of the top name brand, Sargento. Both Sargento and No. 3 Kraft had significant sales growth during the period, but lost some market share to private label and to other top-10 brands. These include Tillamook cheese (a relative newcomer to the category on the national stage), Kraft Deli Deluxe and Sargento Deli Style slices.

Another strong subcategory of late has been natural string cheese, which experienced double-digit dollar sales growth in the most recent two periods. Meanwhile, natural chunks have shown little growth as more cheese is going into convenience forms.

Looking at the broader picture of natural cheese, overall growth rebounded in the most recent three quarters after there had been some shrinkage in the three quarters prior.

Looking at the broader picture of natural cheese, overall growth rebounded in the most recent three quarters after there had been some shrinkage in the three quarters prior.

Unit sales of natural cheese topped 600 million for the final 13-week period, a high mark for the year.

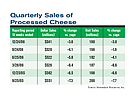

Processed cheese on the other hand is headed in the opposite direction, but declines were slower in the most recent three quarters than in the previous three. Some of the worst attrition is in the area of natural shredded cheese, which lost more than 20% in some periods. Sales hovered under a million units in the most recent quarters.

To find out more about what’s driving cheese sales, and to read about some of the latest products and promotions in cheese, watch for the March issue of Dairy Foods and see our Cheese Trends special section. March will also include the annual Ice Cream Outlook.

The last time we focused specifically on cheese, July 2006, quarterly retail sales of natural cheese were losing steam, based on numbers from Information Resources Inc.

Natural cheese sales are growing again, and natural slices appears to be leading the pack.

The last time we focused specifically on cheese, July 2006, quarterly retail sales of natural cheese were losing steam, based on numbers from Information Resources Inc.

First let’s look at natural slices, which has been the hottest sub-segment in retail cheese for some time now.

For the 52 weeks ended Dec. 31, sales of natural slices were up 9.8% by dollar measure and 14.1% by units. In the most recent three quarters, the rate of growth has accelerated into double digits, reaching 16.3% by units in the 13 weeks ended Dec. 24. The IRI numbers are for supermarkets, drug stores and mass merchandisers, but do not include Wal-Mart.

Another strong subcategory of late has been natural string cheese, which experienced double-digit dollar sales growth in the most recent two periods. Meanwhile, natural chunks have shown little growth as more cheese is going into convenience forms.

Unit sales of natural cheese topped 600 million for the final 13-week period, a high mark for the year.

Processed cheese on the other hand is headed in the opposite direction, but declines were slower in the most recent three quarters than in the previous three. Some of the worst attrition is in the area of natural shredded cheese, which lost more than 20% in some periods. Sales hovered under a million units in the most recent quarters.

To find out more about what’s driving cheese sales, and to read about some of the latest products and promotions in cheese, watch for the March issue of Dairy Foods and see our Cheese Trends special section. March will also include the annual Ice Cream Outlook.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!