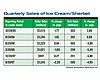

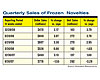

From September to the end of the fourth quarter of 2008, ice cream and sherbet sales dropped about $249 million, according to Information Resources Inc. (IRI), a Chicago-based market research firm. Meanwhile, IRI reported that frozen novelties such as Nestlé Drumsticks, Good Humor, Dove and Klondike bars plummeted nearly $336 million in sales since Sept. 28, 2008.

Tough economy? Or a just a case of the wintertime blues?

Private label frozen yogurt actually comes in second behind Dreyer’s/Edy’s at $44 million, a brand that takes a third-place showing among ice cream brands behind private label ($993 million) and Unilever-owned Breyers ($549 million).

Private label also trumps the frozen novelties segment with a $171.4 million lead over Weight Watchers, a $210.5 million lead over Nestlé Drumstick and a $329.3 million lead over Eskimo Pie bars. Private label further stealing the show in the sorbet arena, with sales of $32.4 million.

The longevity of ice cream and frozen yogurt may lie in the freezers of its consumers, but here’s hoping for a sweaty summer and no more food safety emergencies. Ice cream manufacturers could use the helping hand.