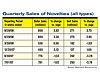

Private label accounts for more and more market share in ice cream (nearly 24% in dollar share according to the most recent data) while for novelties, many of the top brands are growing much faster than private label. This data comes from Information Resources Inc., the Chicago-based market research firm. IRI’s FDMx index measures sales in food, drugstore, and mass merchandiser channels, excluding Wal-Mart.

For the most recent quarter both novelties and ice cream showed some growth in terms of both dollar and unit sales. Ice cream just eked out of the red in the unit sales column, while novelties have shown measureable dollar and unit sales growth for some time.

Among the top brands in the ice cream novelties (the major sub-segment that IRI defines, which does not include water-ice products) there have been some big gainers in the last year. Weight Watchers, which now has about 7.5% of the market share, saw a 15.3% spike in dollar sales for the 52 weeks ended Nov. 2. Dreyer’s/Edy’s a relatively new entrant into this category grew dollar sales by more than 61% and the Skinny Cow Brand jumped about 25% for the period.

Overall, this sub-segment saw dollar sales grow about 2% and unit were up about 1.4% for the reporting period.

Looking at ice cream brands, it’s that leap in private label dollar sales that really stands out-up nearly 12% for the 52-week period ending in November. Better private label, consumer price sensitivity, chalk it up to what you will, but if you go back a few years to a similar period, the 52-weeks ended Dec. 25, 2005, private label ice cream had just a 17.7% dollar market share, compared with the current 23.66% share it now enjoys. At that time, private label was actually loosing ground, while the major brands were gaining.

Overall, dollar sales across the main ice cream sub-category was virtually flat through Nov. 2, while unit sales receded about 3%.

Further explanation of ice cream’s sluggishness might be found in the rejuvenated frozen yogurt sub-category, which was up 7% in terms of dollar sales and 3.3% by units for the same period. Again, this is a reversal of what was seen a couple years ago. It might be that the largest manufacturers are putting more of their capacity and shelf space into this more healthful product line. We’ll look more closely at frozen yogurt and other frozen desserts in this space in March.