Sales Data

Sales jump in the energy drink segment

Though the overall category is shaping up, energy shots continue to struggle.

March 7, 2019

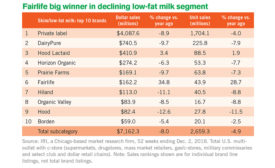

Milk sales take a dive

Even flavored milk and whole milk have been struggling

February 5, 2019

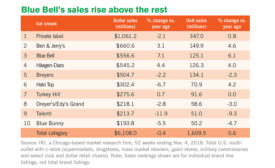

Ice cream sales try to stay afloat

Some brands showed decent gains, while others struggled.

January 4, 2019

Only modest growth for natural cheese

But refrigerated grated cheese, cheese cubes and cheese slices are outperforming the total category.

December 5, 2018

2018 State of the Industry report: Dairy exports are stepping on the gas

On a global scale, the track looks ready for dairy-export growth in 2019

November 19, 2018

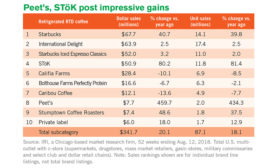

No slowdown in sight for ready-to-drink coffee and tea

Most subcategories make strong dollar and unit sales gains

October 9, 2018

Frozen dessert sales are falling

Sales of frozen puddings, whip toppings and pies are struggling.

September 6, 2018

Global dairy prices take a hit

U.S. dairy prices have dropped since the announcement of retaliatory tariffs, but are the tariffs to blame?

September 6, 2018

The indulgence factor: trends in frozen and refrigerated dairy desserts

To appeal to today’s consumers, producers of refrigerated and frozen desserts are creating products with premium and simple ingredients, often in convenient and single-serve formats. But they also need to meet consumers’ desire for indulgence

September 4, 2018

Stay ahead of the curve. Unlock a dose of cutting-edge insights.

Receive our premium content directly to your inbox.

SIGN-UP TODAYCopyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing